Central Govt introduces New Form GST DRC-01C for Intimation of difference in ITC available in GSTR-2B and GSTR-3B [Read Notification]

![Central Govt introduces New Form GST DRC-01C for Intimation of difference in ITC available in GSTR-2B and GSTR-3B [Read Notification] Central Govt introduces New Form GST DRC-01C for Intimation of difference in ITC available in GSTR-2B and GSTR-3B [Read Notification]](https://www.taxscan.in/wp-content/uploads/2023/08/Central-Government-Central-Govt-introduces-New-Form-GST-DRC-01C-New-Form-GST-DRC-01C-ITC-GSTR-2B-and-GSTR-3B-GSTR-2B-GSTR-3B-taxscan.jpg)

The Central Government vide notification no. 38/2023 has notified the Central Goods and Services Tax Rules (CGST) Rules, 2023 on 4th August 2023. The new amendment has modified some rules and also inserted new ones.

A new rule 88D is inserted to the CGST rule via this amendment which details the Manner of dealing with difference in Input Tax Credit (ITC) available in Auto-Generated Statement containing details of ITC and that availed in Return, that is GSTR-2B and GSTR-3B.

The government has introduced a new Form GST DRC-01C, a system generated form for the Intimation of difference in input tax credit available in auto-generated statement containing the details of input tax credit and that availed in return with respect to newly inserted Rule 88D.

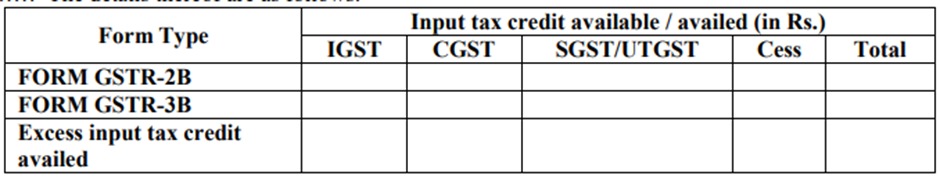

The Part A of the Form GST DRC-01C shall contain Reference number, Date, GSTIN and legal name. The Part A of the Form starts with

“1. It is noticed that the input tax credit availed by you in the return furnished in FORM GSTR-3B Exceeds the amount of input tax credit available to you in accordance with the auto-generated statement containing the details of input tax credit made available to you in FORM GSTR-2Bfor the period by an amount of Rs. …………… The details thereof are as follows:

2. In accordance with sub-rule (1) of rule 88D, you are hereby requested to either pay an amount equal to the said excess input tax credit, along with interest payable under section 50, through FORM GST DRC-03 and furnish the details thereof in Part-B of FORM GST DRC-01C, and/or furnish the reply in Part-B of FORM GST DRC01C incorporating reasons in respect of that part of the excess input tax credit that has remained to be paid, within a period of seven days.

3. It may be noted that where any amount of the excess input tax credit remains to be paid after completion of a period of seven days and where no explanation or reason for the same is furnished by you or where the explanation or reason furnished by you is not found to be acceptable by the proper officer, the said amount shall be liable to be demanded in accordance with the provisions of section 73 or section 74, as the case may be, of the Act.

4. This is a system generated notice and does not require signature.”

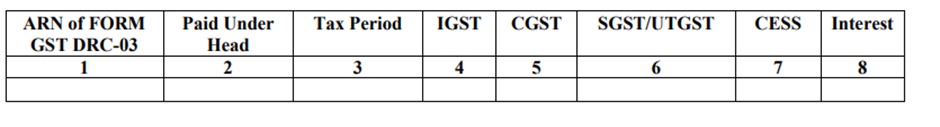

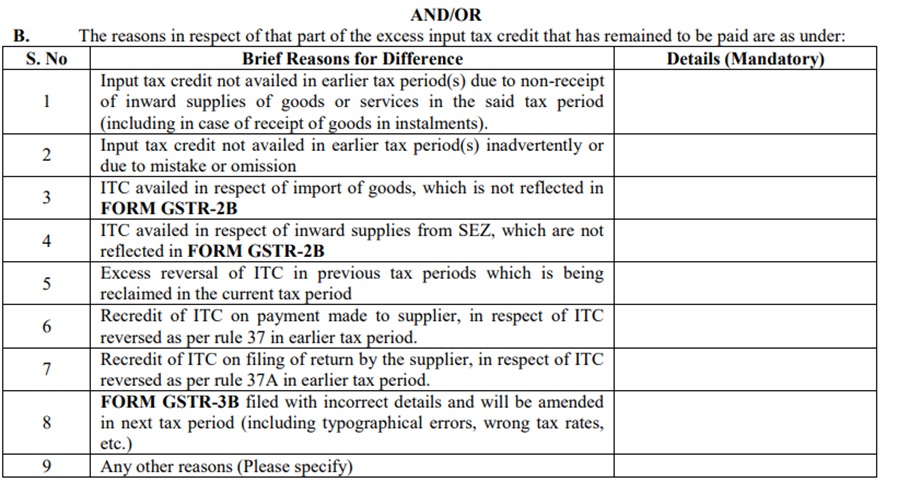

The Part B of the Form GST DRC 01C is dedicated to the Reply by Taxpayer in respect of the intimation of difference in ITC. It shall contain Reference number of intimation and date.

The form starts with

“

- I have paid the amount equal to the excess input tax credit, as specified in Part A of FORM GST DRC-01C, fully or partially, along with interest payable under section 50, through FORM GST DRC-03, and the details thereof are as below:

Verification

I ____ hereby solemnly affirm and declare that the information given hereinabove is true and correct to the best of my knowledge and belief and nothing has been concealed therefrom.

When responding to the form, the taxpayer is required to affix their authorised signature along with their name, designation, place, and date.

To Read the full text of the Notification CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick update

Notification No: 38/2023 , 4th August, 2023