Central Govt notifies amendment of GST exemption to Cancer medicines and Customs Duty Exemption to Re-imported Goods in Respective Notifications [Read Notification]

![Central Govt notifies amendment of GST exemption to Cancer medicines and Customs Duty Exemption to Re-imported Goods in Respective Notifications [Read Notification] Central Govt notifies amendment of GST exemption to Cancer medicines and Customs Duty Exemption to Re-imported Goods in Respective Notifications [Read Notification]](https://www.taxscan.in/wp-content/uploads/2023/07/Central-Govt-notifies-amendment-GST-exemption-to-Cancer-medicines-Customs-Duty-Exemption-Re-imported-Goods-in-Respective-Notifications-Central-Govt-notifies-amendment-of-GST-exemptions-taxscan.jpg)

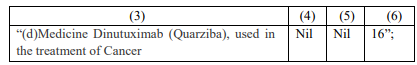

The Central Board of Indirect Taxes and Customs (CBIC) under the Ministry of Finance vide notification no. No. 46/2023-Customs, G.S.R. 557(E) issued on 26th July 2023 has notified the amendments of Goods and Services Tax (GST) exemption to cancer medicines and customs duty exemption to re-imported goods in the respective notifications.

The 50th GST Council meeting held on 11th July 2023, presided by the Union Finance Minister Nirmala Sitharaman announced the GST exemption of the cancer medicines. And the same has come into effect from 27th July 2023.

By virtue of the authority granted under sub-section (1) of section 25 of the Customs Act, 1962,the Central Government, upon determining that it is essential in the public interest, introduced additional modifications to the notifications issued by the Government of India in the Ministry of Finance (Department of Revenue).

In Notification No. 45/2017-Customs, dated the 30th June, 2017, G.S.R. 780(E), dated the 30th June, 2017:

In the said notification, in the TABLE, - (i) against Sl. No. l, (I) in column (2), after item (e), the following items shall be inserted, namely: -

"(f) under claim for RoDTEP

(g) under claim for RoSCTL";

(II) in column (3), after the words "amount of integrated tax and compensation cess leviable at the time and place of importation of goods" the words amount “;of Remission of Duties and Taxes on Exported Products (RoDTEP) allowed at the time of export; amount of Rebate of State and Central Taxes and Levies (RoSCTL) allowed a the time of export" shall be inserted;

(ii) against Sl. No. 3, in column (2), for the figures and letter "4A.20.l", the figure "4.51 " shall be substituted;

(B.)in the first proviso for the words "any reward scheme of Chapter 3", wherever the occur, the words "any scheme of Chapter 4" shall be substituted;

(C.) in the Explanation, -

(i) for clause (b), the following clause shall be substituted, namely:

(b) “Foreign Trade Policy" means the Foreign Trade Policy, 2023, notified by the Government of India in the Ministry of Commerce and Industry vide notification No. 1/2023 dated the March, 2023, published in the Gazette of India, Extraordinary, Part-11, Section 3, Sub-Section (ii) vide S.O. 1565 dated the 31st March, 2023;"

(ii) in clause (c),

(I) the items (i) , (iii), (iv), (v) and (viii) shall bc omitted;

(II) for the item (ii), the item ' 'The Handicraft and Handlooms Exports Corporation of India Ltd" shall be substituted;

(iii) after clause (d), the following clauses shall be inserted namely: -

(e) "RoDTEP" means the Scheme for Remission of Duties and Taxes on Products as per chapter 4 of Foreign Trade Policy.

(f) "RoSCTL" means the Scheme for Rebate of State and Central Taxes and Levie

as notified by the Ministry of Textiles."

In Notification No. 47/2017-Customs, dated the 30th June, 2017 G.S.R. 782(E), dated the 30th June, 2017

In the said notification, (A.) in the TABLE, against Sl. No. 1, (i) in column (2), after item (e), the following items shall be inserted, namely: -

“(f) under claim for RoDTEP

(g) under claim for RoSCTL”;

(ii) in column (3), after the words “amount of excise duty leviable at the time and place of importation of goods”, the words “; amount of Remission of Duties and Taxes on Exported Products (RoDTEP) allowed at the time of export; amount of Rebate of State and Central Taxes and Levies (RoSCTL) allowed at the time of export” shall be inserted;

(B.) in the first proviso, for the words “any reward scheme of Chapter 3”, at both places where they occur, the words “any scheme of Chapter 4” shall be substituted;

(C.) in the Explanation,

(i) for clause (b), the following clause shall be substituted, namely: —

“(b) “Foreign Trade Policy” means the Foreign Trade Policy, 2023, notified by the Government of India in the Ministry of Commerce and Industry vide notification No. 1/2023 dated the 31st March, 2023, published in the Gazette of India, Extraordinary, Part-II, Section 3, Sub-Section (ii) vide S.O. 1565 (E). dated the 31st March, 2023;”

(ii) after clause (b), the following clauses shall be inserted namely: -

“(c) “RoDTEP” means the Scheme for Remission of Duties and Taxes on Exported Products as per chapter 4 of Foreign Trade Policy. (d) “RoSCTL” means the Scheme for Rebate of State and Central Taxes and Levies as notified by the Ministry of Textiles.”

In Notification No. 50/2017-Customs, dated the 30th June, 2017 [G.S.R. 785 (E), dated the 30th June, 2017]

In the said notification, - (A.) In the Table, (i) against S. No. 167A, in column (5), for the entry, the entry “Nil” shall be substituted;

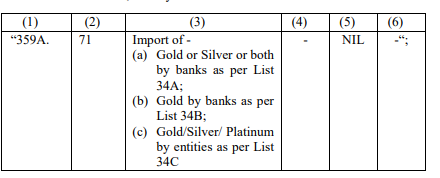

(ii) for S. No. 359A and the entries relating thereto, the following S. No. and entries shall be substituted, namely: -

(iii) against S. No. 607, after clause (c) and the entries relating thereto, the following clause and entries shall be inserted, namely: -

(iv) against S. No. 607B, in column (5), for the entry, the entry “Nil” shall be substituted;

(B.) In the Annexure, for List 34 and the entries relating thereto, the following lists and entries shall be substituted, namely:

“List 34A (See S. No. 359A of the Table)

1. Bank of India

2. Bank of Nova Scotia

3. Corporation Bank

4. The HDFC Bank Ltd

5. ICICI Bank Ltd

6. Indian Overseas Bank

7. Induslnd Bank Ltd

8. Kotak Mahindra Bank Ltd

9. Punjab National Bank

10. State Bank of India

11. Union Bank of India

12. Yes Bank Limited

13. RBL Bank

14. Industrial and Commercial Bank of China

List 34B (See S. No. 359A of the Table)

1. Bank of Baroda

2. The Federal Bank Ltd

List 34C (See S. No. 359A of the Table)

1. The Handicraft and Handlooms Exports Corporation of India Ltd

2. MSTC Ltd 3. Diamond India Limited ”

The notification shall come into effect on the 27th July, 2023.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Notification No : 46/2023 , 26 July, 2023