Chartered Accountants Association of Surat Represents Anomalies in Income Tax Law and Practice before Prime Minister and Finance Minister

The Chartered Accountants Association of Surat represented the anomalies in Income Tax Law and Practice before the Prime Minister and Finance Minister on 22nd August 2023. The association has quoted 2 issues vide Late release of essential return filing utilities and Insufficient time available for EVC Verification

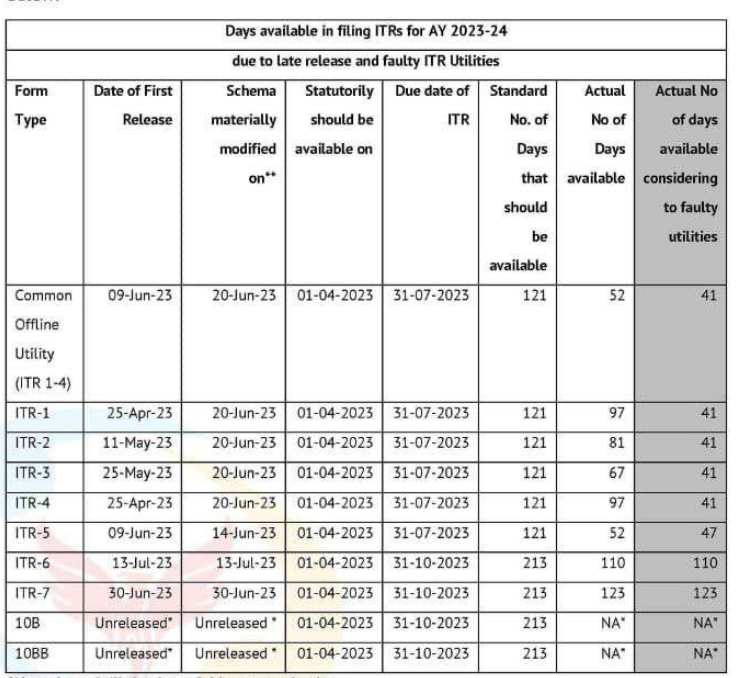

According to the representation, Delays in release of utilities (softwares) by the department has become a regular feature and this year due to faulty utilities a substantial time of taxpayers was wasted as can be seen from the table below:

Regarding the 10B and 10BB, the utility is not released till the date of the representation date that is 22nd August 2023.

Further stated that it is pertinent to note that when any person or organisation is prevented from discharging their statutory liability, the said person cannot be held responsible for any legal and financial consequences entailing therefrom.

However, the Central Board of Direct Taxes (CBDT) time and again has been illegally levying interest under Section 234A and late fees under Section 234F which is linked with filing of returns, and the filing facilities are non-existent till the last moment on the Income Tax Website.

The association also stated that frequently the website is down due to denial of service not on account of external factors like hacking but due to inefficiencies and piling of work by users resulting from late release of utilities by the CBDT itself.

Regarding EVC verification, the organization has observed that the Income Tax Return process involves an OTP requirement. However, there are instances when these OTPs are not delivered due to high server loads. In such situations, the requirement for taxpayers to verify the information within 30 days seems unduly strict. It would be more reasonable to extend this timeframe to a minimum of 60 days.

Demands of Chartered Accountants Association of Surat

- Utilities for ITRs and Audit Reports for each Assessment Year should be released well before the start of the Assessment Year.

- While the Utilities are not released this year, interest under Section 234A and Late Fees under Section 234F should not be charged irrespective of the quantum of taxes payable up to 31st December 2023 considering the loss of time of assessees statutorily available to the assessees under the law.

- Time for verification of ITR through EVC should be increased to at least 60 days in the light of the technological glitches of receiving OTP on time.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates