- Home

- »

- Avinash Kurungot

Avinash Kurungot

Avinash Kurungot is a B.B.A. LL.B (Hons.) Graduate from Christ University, Bangalore. Following a stint in Civil Litigation, marking appearances across the High Court of Kerala and various sub-courts, he has channelled his skills towards developing engaging tax, finance and news content.

![AICMAA: Official Communication to Govt. Bodies Shall be Issued by President, Secretary or Authorized Spokesperson Only [Read Notice] AICMAA: Official Communication to Govt. Bodies Shall be Issued by President, Secretary or Authorized Spokesperson Only [Read Notice]](https://www.taxscan.in/wp-content/uploads/2025/03/All-India-Cost-Management-Accountants-Association-AICMAA.jpg)

AICMAA: Official Communication to Govt. Bodies Shall be Issued by President, Secretary or Authorized Spokesperson Only [Read Notice]

The All India Cost & Management Accountants Association (AICMAA) has issued a formal notice to its members, emphasizing that any official...

Sale of Assets of Liquidating Company done by Liquidator is Supply of Goods/Services under S.7 CGST Act: AAR [Read Order]

In a recent ruling, the West Bengal Authority for Advance Ruling (AAR) has held that any sale of assets of a company in liquidation conducted by its liquidator qualifies as a supply of goods or...

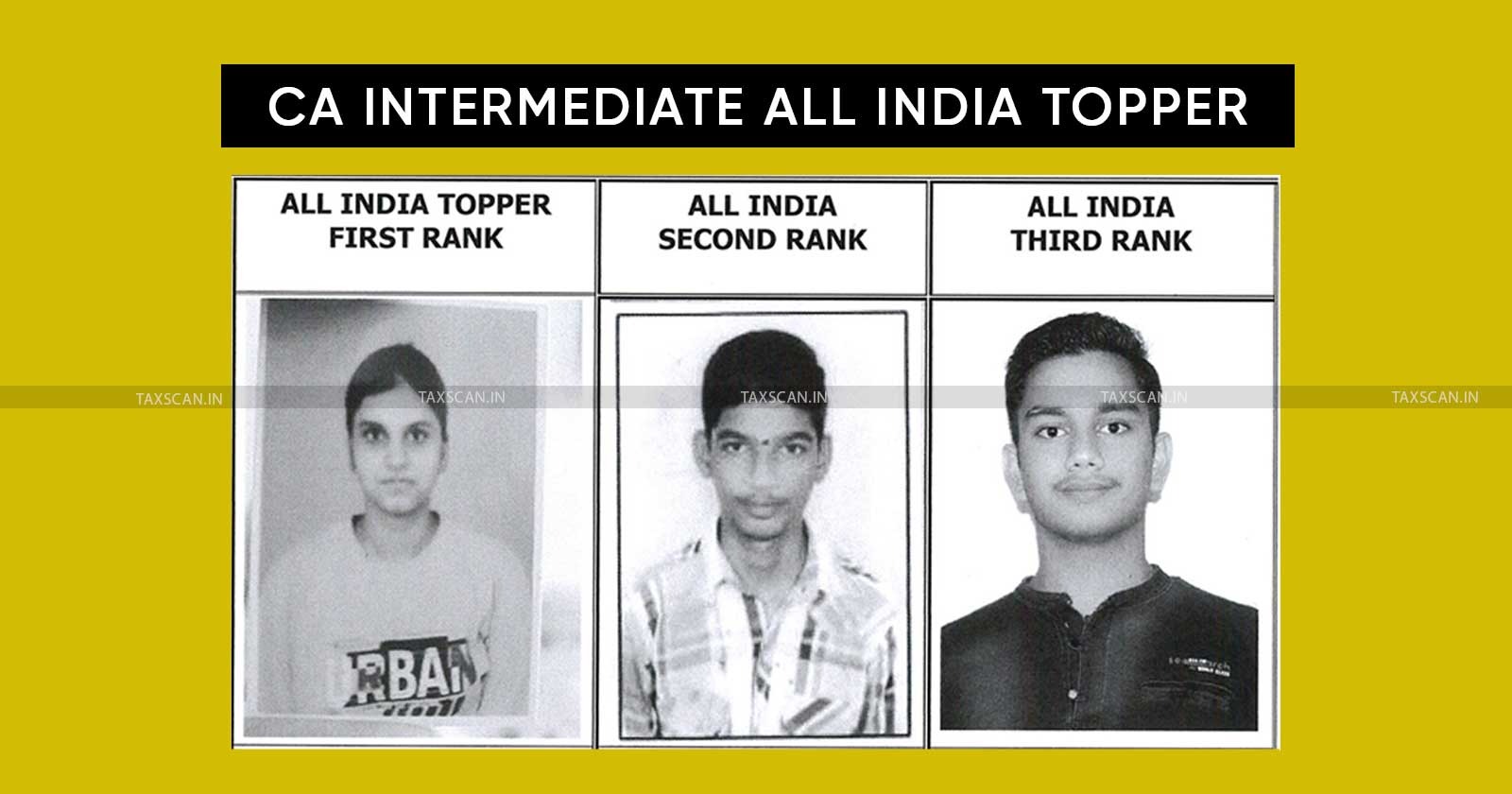

CA Exams January 2025 Results Out! ICAI Releases CA Foundation, Intermediate, Where and How to Check

The Institute of Chartered Accountants of India (ICAI) has officially declared the results for the CA Foundation and Intermediate exams held in January 2025. Aspiring Chartered Accountants who had...

Refund of Unutilized GST ITC: Gujarat HC upholds Priorly Granted Refund u/s.54(3) to Patanjali Foods [Read Order]

The Gujarat High Court recently ruled in favor of Patanjali Foods Ltd. (Patanjali), upholding the refund of unutilized Input Tax Credit ( ITC ) amounting to ₹1,70,07,091 which was initially granted...

GST Registration Mandatory for IRP Liquidator Conducting Sales for Liquidating Company: AAR [Read Order]

In a notable ruling, the West Bengal Authority for Advance Ruling (AAR) has declared that an Insolvency Resolution Professional (IRP) or liquidator appointed by the NCLT is required to obtain GST...

![Delhi HC quashes Order Levying TDS of 2% on Salesforce’s ₹633 Cr Revenue [Read Order] Delhi HC quashes Order Levying TDS of 2% on Salesforce’s ₹633 Cr Revenue [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/03/Delhi-High-Court-Delhi-High-Court-Quashes-Order-TDS-Salesforce-taxscan.jpg)

![18% GST on Service of Hiring of Fitted Assets such as A/C, Fire Sprinkler, DG Sets and Electric Installations: AAR [Read Order] 18% GST on Service of Hiring of Fitted Assets such as A/C, Fire Sprinkler, DG Sets and Electric Installations: AAR [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/03/GST-on-Service-Service-of-Hiring-Fitted-Assets-Fire-Sprinkler-DG-Sets-and-Electric-Installations-DG-Sets-Electric-Installation-AAR-taxscan.jpg)

![Sale of Assets of Liquidating Company done by Liquidator is Supply of Goods/Services under S.7 CGST Act: AAR [Read Order] Sale of Assets of Liquidating Company done by Liquidator is Supply of Goods/Services under S.7 CGST Act: AAR [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/03/AAR-CGST-CGST-Act-Goods-Services-taxscan.jpg)

![Refund of Unutilized GST ITC: Gujarat HC upholds Priorly Granted Refund u/s.54(3) to Patanjali Foods [Read Order] Refund of Unutilized GST ITC: Gujarat HC upholds Priorly Granted Refund u/s.54(3) to Patanjali Foods [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/03/Refund-Unutilized-GST-ITC-Gujarat-HC-Priorly-Granted-Refund-Patanjali-Foods-taxscan.webp)

![GST Registration Mandatory for IRP Liquidator Conducting Sales for Liquidating Company: AAR [Read Order] GST Registration Mandatory for IRP Liquidator Conducting Sales for Liquidating Company: AAR [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/03/GST-Registration-Mandatory-IRP-Liquidator-Conducting-Sales-Liquidating-Company-AAR-taxscan.jpg)

![18% GST on PVC Raincoat: AAR [Read Order] 18% GST on PVC Raincoat: AAR [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/03/GST-18-GST-on-PVC-Raincoat-AAR-Authority-for-Advance-Ruling-TAXSCAN.jpg)