- Home

- »

- Kalyani B. Nair

Kalyani B. Nair

Kalyani is graduated from Government Law College Thiruvananthapuram on BA, LLB and is currently pursuing LLM in Criminal Law, Criminology and Penology. She always believes that Fear kills more dreams, than failure ever will. Her area of interest are Criminal law and Constitutional Law. She is also into baking, reading and gardening.

![Sufficient evidence to establish that brand name belonged to third person: CESTAT upholds excise duty demand [Read Order] Sufficient evidence to establish that brand name belonged to third person: CESTAT upholds excise duty demand [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/01/excise-duty-demand-site-img.jpg)

Sufficient evidence to establish that brand name belonged to third person: CESTAT upholds excise duty demand [Read Order]

The Hyderabad Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) upheld the excise duty demand as there was sufficient evidence...

No Interference by Writ Court for notice u/s 73 of UPGST Act unless there is Inherent Lack of Jurisdiction or Complete Absence of Relevant Material: Allahabad HC [Read Order]

In a significant ruling the Allahabad High Court observed that there cannot be any interference by the Writ Court for notice under Section 73 of the Uttar Pradesh Goods and Services Tax Act, 2017...

Deduction u/s 80IA(4) of Income Tax Act available to Company engaged in Developing Infrastructure Projects like Roads, Canals: Gujarat HC [Read Order]

In a significant ruling the Gujarat High Court observed that the deduction under Section 80IA(4) of the Income Tax Act, 1961 is available to a company engaged in developing infrastructure projects...

Setback to Amway: Delhi HC rules Coconut Oil Sold as Hair Oil, not classifiable as Edible Oil under DVAT Act [Read Order]

In a major setback to Amway India Enterprises Private Limited, the Delhi High Court ruled that the coconut oil sold as hair oil, not classifiable as edible oil under the Delhi Value Added Tax Act,...

Delay of 781 days in filing Appeal against Assessment Order due to Covid Pandemic: SC stays Order of AP HC

The Supreme Court stayed the application of the order passed by the Andhra Pradesh High Court in the matter regarding the Delay of 781 days in filing appeal against Assessment order due to Covid...

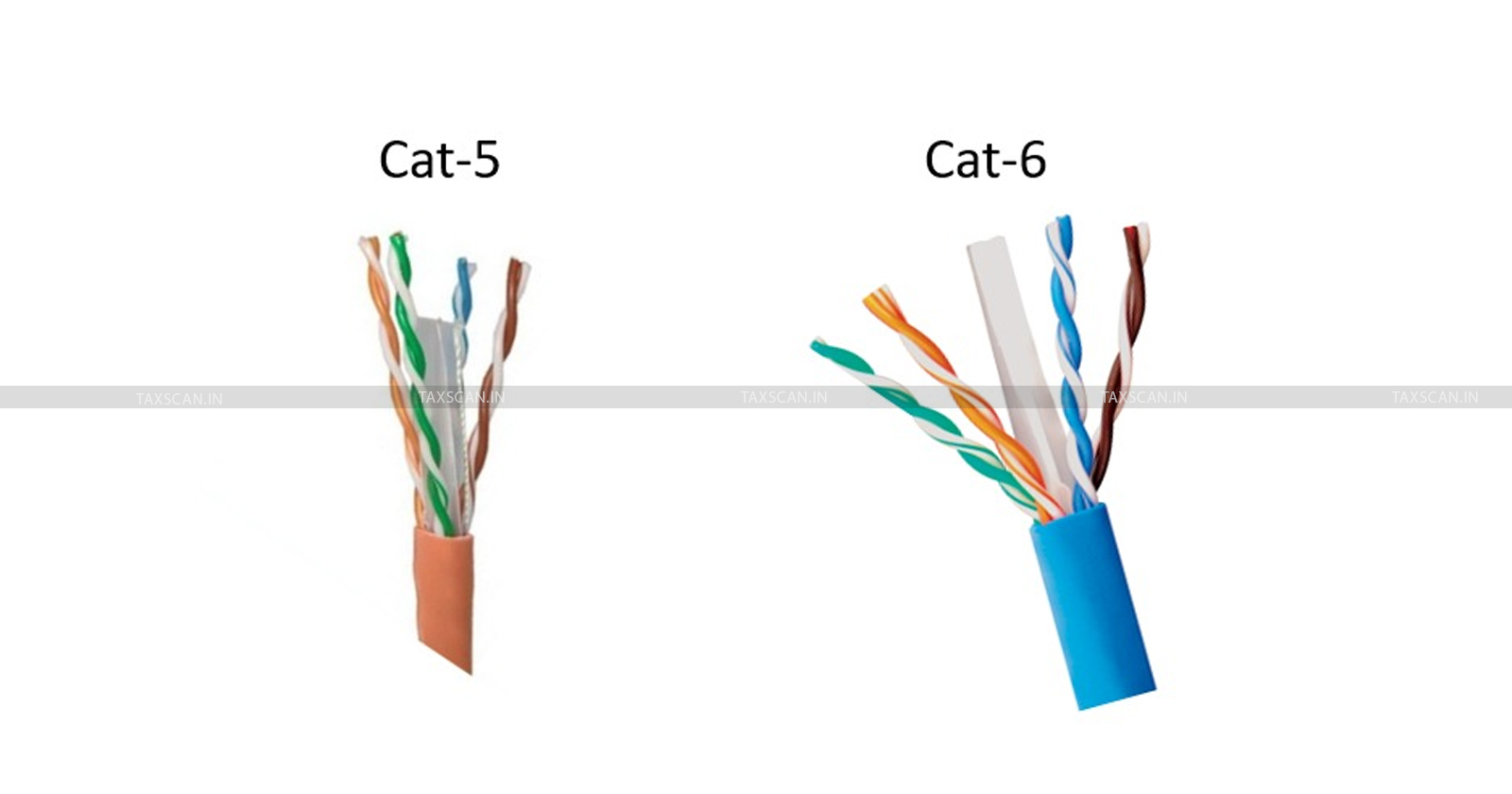

CAT-5/CAT-6 Cables falls in Category of “Computer System and Peripherals”: SC dismisses SLP filed by Commercial Tax Officer

In a recent decision the Supreme Court of India ruled that CAT-5/CAT-6 cables falls in Category of “Computer System and peripherals” and thereby dismissed the Special Leave Petition (SLP) filed by...

![Notice u/s 274 of Income Tax Act should be issued before period of limitation: Delhi HC [Read Order] Notice u/s 274 of Income Tax Act should be issued before period of limitation: Delhi HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/01/Notice-Income-Tax-Act-before-period-limitation-Delhi-HC-TAXSCAN.jpg)

![GST Registration can be Cancelled with Retrospective Effect only where such Consequences are Intended and Warranted: Delhi HC [Read Order] GST Registration can be Cancelled with Retrospective Effect only where such Consequences are Intended and Warranted: Delhi HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/01/GST-Registration-Cancelled-Retrospective-Effect-Consequences-Warranted-Delhi-HC-TAXSCAN.jpg)

![Imposition of Excise Duty on Incineration of Lean Gas used in Generation of Electricity: Calcutta HC Quashes Ex Parte Order [Read Order] Imposition of Excise Duty on Incineration of Lean Gas used in Generation of Electricity: Calcutta HC Quashes Ex Parte Order [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/01/Imposition-of-Excise-Duty-Incineration-Lean-Gas-used-Generation-of-Electricity-Calcutta-HC-Ex-Parte-TAXSCAN.jpg)

![Investment in Shares of Indian Subsidiary Capital Account Transaction is not Income: Delhi HC [Read Order] Investment in Shares of Indian Subsidiary Capital Account Transaction is not Income: Delhi HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/01/Investment-in-Shares-site-img.jpg)

![Deduction u/s 80IA(4) of Income Tax Act available to Company engaged in Developing Infrastructure Projects like Roads, Canals: Gujarat HC [Read Order] Deduction u/s 80IA(4) of Income Tax Act available to Company engaged in Developing Infrastructure Projects like Roads, Canals: Gujarat HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/01/Gujarat-High-Court-Income-Tax-Act-Infrastructure-Projects-TAXSCAN.jpg)

![Setback to Amway: Delhi HC rules Coconut Oil Sold as Hair Oil, not classifiable as Edible Oil under DVAT Act [Read Order] Setback to Amway: Delhi HC rules Coconut Oil Sold as Hair Oil, not classifiable as Edible Oil under DVAT Act [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/01/Setback-to-Amway-Delhi-HC-rules-Coconut-Oil-Sold-as-Hair-Oil-Edible-Oil-under-DVAT-Act-TAXSCAN.jpg)

![Delay of More than 4 years: SC dismisses SLP filed by Income Tax Dept [Read Judgement] Delay of More than 4 years: SC dismisses SLP filed by Income Tax Dept [Read Judgement]](https://www.taxscan.in/wp-content/uploads/2024/01/Supreme-Court-Dismisses-SLP-Supreme-Court-SLP-Income-Tax-Dept-taxscan.jpg)