- Home

- »

- Manu Sharma

Manu Sharma

Manu Sharma is a tax-law enthusiast who is also a Physics Graduate deeply passionate about gaming, puzzles, technology and movies. With an eye for detail and knack for legal research, Manu plays a crucial role in curating and editing content to ensure accuracy, clarity, and relevance.

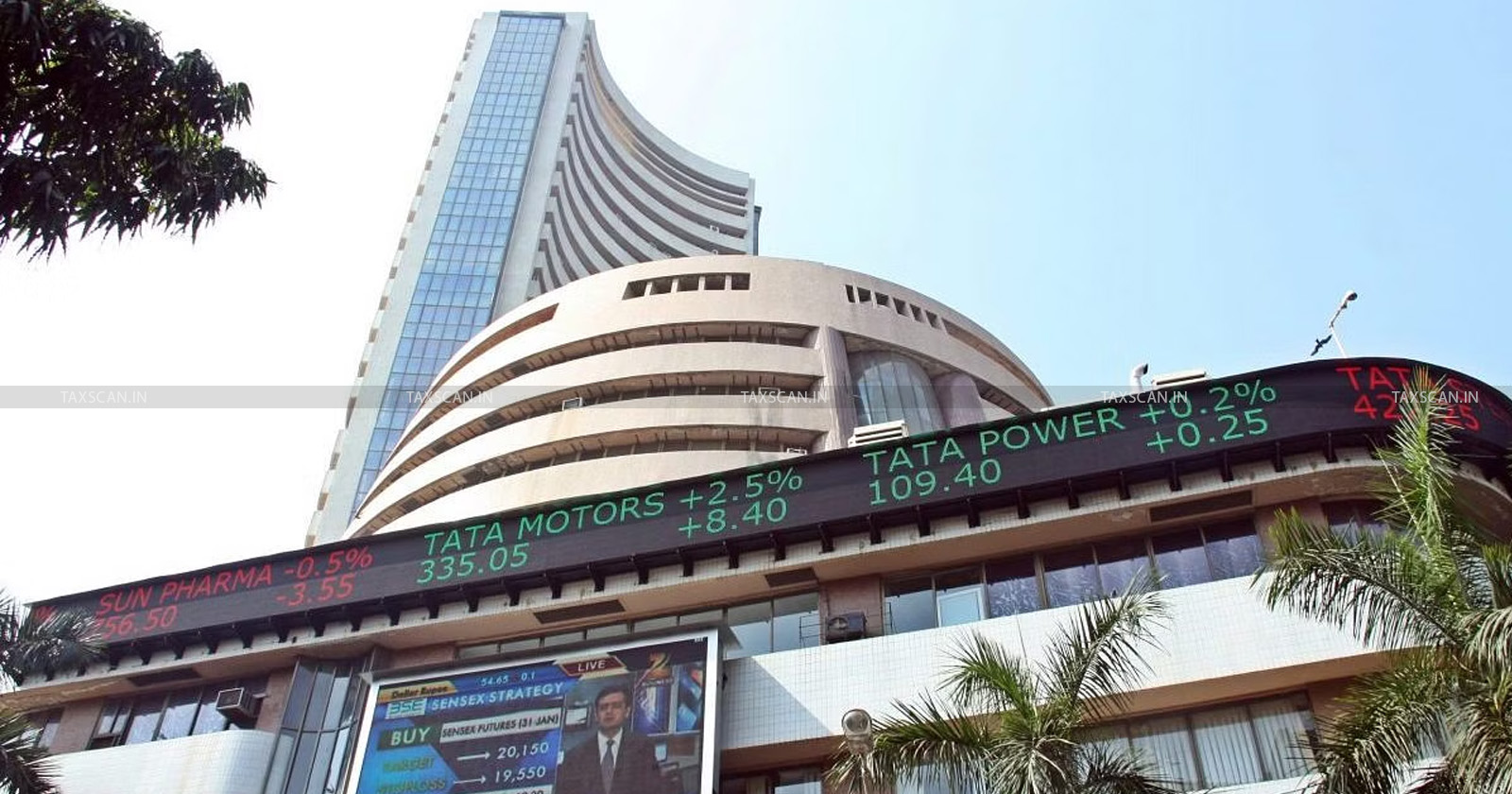

Tracking the Charts: Budget Impacts on India's Share Markets

Amidst higher valuations, analysts suggest that the upward momentum in the Indian stock markets may not wane leading up to the interim budget next...

CBIC notifies Extension of Additional Duty Levy Commencement on Unblended Diesel to April 1, 2025 [Read Notification]

The Central Board of Indirect Taxes and Customs ( CBIC ) has extended the imposition of Additional Excise Duty on unblended diesel to April 1, 2025. The CBIC, through Notification No....

No Property Tax as Business on Advocates Office at Residence: Supreme Court upholds Delhi HC Ruling

The Supreme Court has upheld a Delhi High Court ruling, maintaining that an advocate's office situated in a residential building is exempt from property tax under the Delhi Municipal Corporation Act,...

IGST Refund on Export of Zero Rated Supplies: Madras HC allows Clubbing of unutilised GST ITC Refund Claims beyond Calendar Month, remands Matter [Read Order]

A Single Bench of the Madras High Court has allowed clubbing of Integrated Goods and Services Tax ( IGST ) refund claims on export of zero rated supplies, beyond a calendar month, while remanding the...

Non-Consideration of Employer-Employee Relation as per CBIC Circular: Madras HC quashes GST Demand on Directors Incentives [Read Order]

The Madras High Court has quashed the Goods and Services Tax ( GST ) Demand on incentives paid to directors in ignorance of employer-employee relation as per Central Board of Indirect Taxes and...

![CBIC notifies Extension of Additional Duty Levy Commencement on Unblended Diesel to April 1, 2025 [Read Notification] CBIC notifies Extension of Additional Duty Levy Commencement on Unblended Diesel to April 1, 2025 [Read Notification]](https://www.taxscan.in/wp-content/uploads/2024/01/CBIC-Unblended-diesel-Excise-Duty-Central-Board-of-Indirect-Taxes-Diesel-taxation-Taxation-extension-announcement-taxscan.jpg)

![IGST Refund on Export of Zero Rated Supplies: Madras HC allows Clubbing of unutilised GST ITC Refund Claims beyond Calendar Month, remands Matter [Read Order] IGST Refund on Export of Zero Rated Supplies: Madras HC allows Clubbing of unutilised GST ITC Refund Claims beyond Calendar Month, remands Matter [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/01/IGST-Refund-Madras-High-Court-GST-TAXSCAN.png)

![Non-Consideration of Employer-Employee Relation as per CBIC Circular: Madras HC quashes GST Demand on Directors Incentives [Read Order] Non-Consideration of Employer-Employee Relation as per CBIC Circular: Madras HC quashes GST Demand on Directors Incentives [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/01/Employer-Employee-Relation-CBIC-Circular-Madras-HC-GST-Demand-Directors-Incentives-taxscan.jpg)