- Home

- »

- Navasree A.M

Navasree A.M

Navasree A M, B.B.A., LL.B. (Hons), a lawyer with over 2.5 years of experience as a researcher and content writer at Taxscan, specializing in Indirect Taxes and Corporate Laws.

Only 30% Annual Filings Completed Despite Extension: ICSI Warns Professionals against Last-Minute Rush

Less than 30% of annual files for FY 2024-2025 have been completed despite the extended deadline, according to an advisory from the Institute of...

Bombay CA Society Seeks 3-Month Extension for GSTR-9 & 9C Due Date, Raises Compliance Complexity [Read Representation Copy]

The Bombay Chartered Accountants’ Society ( BCAS ) has requested the Union Finance Ministry, the Central Board of Indirect Taxes and Customs ( CBIC ), and the GST Council to grant a minimum...

Taxpayer Cannot be Penalised for ‘Invisible’ GST Notices: Calcutta HC Restores Right to Reply for Birla Brothers [Read Order]

The Calcutta High Court has ruled that a taxpayer cannot be penalised for failing to respond to GST ( Good and Services Tax ) proceedings when statutory notices are “invisible” on the GST portal,...

GST Orders without ‘Application of Mind’ Violates Article 14: Allahabad HC Sets Aside Ex-Parte Order, Directs to Deposit Rs. 2L [Read Order]

The Allahabad High Court has set aside an ex-parte GST ( Goods and Services Tax ) demand order, holding that orders passed without proper application of mind and without granting an effective...

What You See isn’t What You Pay: ITAT Rules High Tag Prices in Jewellery is Sales Strategy, Not Tax Evasion, Deletes Addition [Read Order]

The Mumbai Bench of the Income Tax Appellate Tribunal ( ITAT ) has held that high/inflated “tag prices” displayed on jewellery items are part of a common sales and marketing strategy in the...

ED Summons Missed Due to Distance, Not Ignored: Gauhati HC directs ED to grant Bail to GST Accused with Aadhar, PAN and Voter ID Surrender [Read Order]

The Gauhati High Court has granted anticipatory bail to a GST ( Goods and Services Tax ) -linked accused after noting that his failure to appear before the Enforcement Directorate (ED) in...

![Cash Deposit used for Creating FD cannot Be Clubbed to Cross ₹50 Lakh Threshold: Madras HC Quashes Section 148A Action [Read Order] Cash Deposit used for Creating FD cannot Be Clubbed to Cross ₹50 Lakh Threshold: Madras HC Quashes Section 148A Action [Read Order]](https://images.taxscan.in/h-upload/2025/12/17/250x150_2112744-cash-deposit-creating-fd-clubbed-threshold-madras-hc-section148a-action-taxscan.webp)

![State Cannot ‘Carve Out Its Own Limitation Period’: Supreme Court Dismisses Income Tax Dept’s Time-Barred SLP against Shriram Finance [Read Judgement] State Cannot ‘Carve Out Its Own Limitation Period’: Supreme Court Dismisses Income Tax Dept’s Time-Barred SLP against Shriram Finance [Read Judgement]](https://images.taxscan.in/h-upload/2025/12/16/250x150_2112651-state-carve-out-limitation-period-supreme-court-dismisses-income-tax-depts-slp-shriram-finance-taxscan.webp)

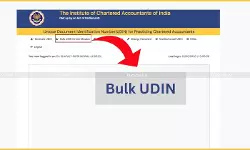

![No Silent Auditor Changes: ICAI Releases UDIN Portal Manual with Mandates [Get Full Manual Here] No Silent Auditor Changes: ICAI Releases UDIN Portal Manual with Mandates [Get Full Manual Here]](https://images.taxscan.in/h-upload/2025/12/16/250x150_2112620-icai-releases-udin-portal-manual-mandates-taxscan.webp)

![Bombay CA Society Seeks 3-Month Extension for GSTR-9 & 9C Due Date, Raises Compliance Complexity [Read Representation Copy] Bombay CA Society Seeks 3-Month Extension for GSTR-9 & 9C Due Date, Raises Compliance Complexity [Read Representation Copy]](https://images.taxscan.in/h-upload/2025/12/16/500x300_2112539-bombay-ca-gstr-9-taxscan.jfif)

![Taxpayer Cannot be Penalised for ‘Invisible’ GST Notices: Calcutta HC Restores Right to Reply for Birla Brothers [Read Order] Taxpayer Cannot be Penalised for ‘Invisible’ GST Notices: Calcutta HC Restores Right to Reply for Birla Brothers [Read Order]](https://images.taxscan.in/h-upload/2025/12/16/500x300_2112551-taxpayer-penalised-invisible-gst-notices-calcutta-hc-restores-right-reply-birla-brothers-taxscan.webp)

![Issuing GST MOV-07 and MOV-09 on Same Date is Unsustainable: Punjab & Haryana HC [Read Order] Issuing GST MOV-07 and MOV-09 on Same Date is Unsustainable: Punjab & Haryana HC [Read Order]](https://images.taxscan.in/h-upload/2025/12/15/500x300_2112383-punjab-haryana-hc-taxscan.jfif)

![Once GST Demand Quashed and Remanded, Provisional Attachment cannot Survive: Delhi HC [Read Order] Once GST Demand Quashed and Remanded, Provisional Attachment cannot Survive: Delhi HC [Read Order]](https://images.taxscan.in/h-upload/2025/12/15/500x300_2112316-gst-demand-quashed-remanded-provisional-attachment-survive-delhi-hc-taxscan.webp)

![GST Orders without ‘Application of Mind’ Violates Article 14: Allahabad HC Sets Aside Ex-Parte Order, Directs to Deposit Rs. 2L [Read Order] GST Orders without ‘Application of Mind’ Violates Article 14: Allahabad HC Sets Aside Ex-Parte Order, Directs to Deposit Rs. 2L [Read Order]](https://images.taxscan.in/h-upload/2025/12/15/500x300_2112295-10c86fc1-892b-413b-b9b7-ba6950bdc83a.webp)

![What You See isn’t What You Pay: ITAT Rules High Tag Prices in Jewellery is Sales Strategy, Not Tax Evasion, Deletes Addition [Read Order] What You See isn’t What You Pay: ITAT Rules High Tag Prices in Jewellery is Sales Strategy, Not Tax Evasion, Deletes Addition [Read Order]](https://images.taxscan.in/h-upload/2025/12/15/500x300_2112322-itat-quashes-assessment-order-and-penalty-taxscan.webp)

![ED Summons Missed Due to Distance, Not Ignored: Gauhati HC directs ED to grant Bail to GST Accused with Aadhar, PAN and Voter ID Surrender [Read Order] ED Summons Missed Due to Distance, Not Ignored: Gauhati HC directs ED to grant Bail to GST Accused with Aadhar, PAN and Voter ID Surrender [Read Order]](https://images.taxscan.in/h-upload/2025/12/15/500x300_2112307-gauhati-hc-ed-grant-bail-gst-accused-with-aadhar-pan-voter-id-taxscan.jfif)