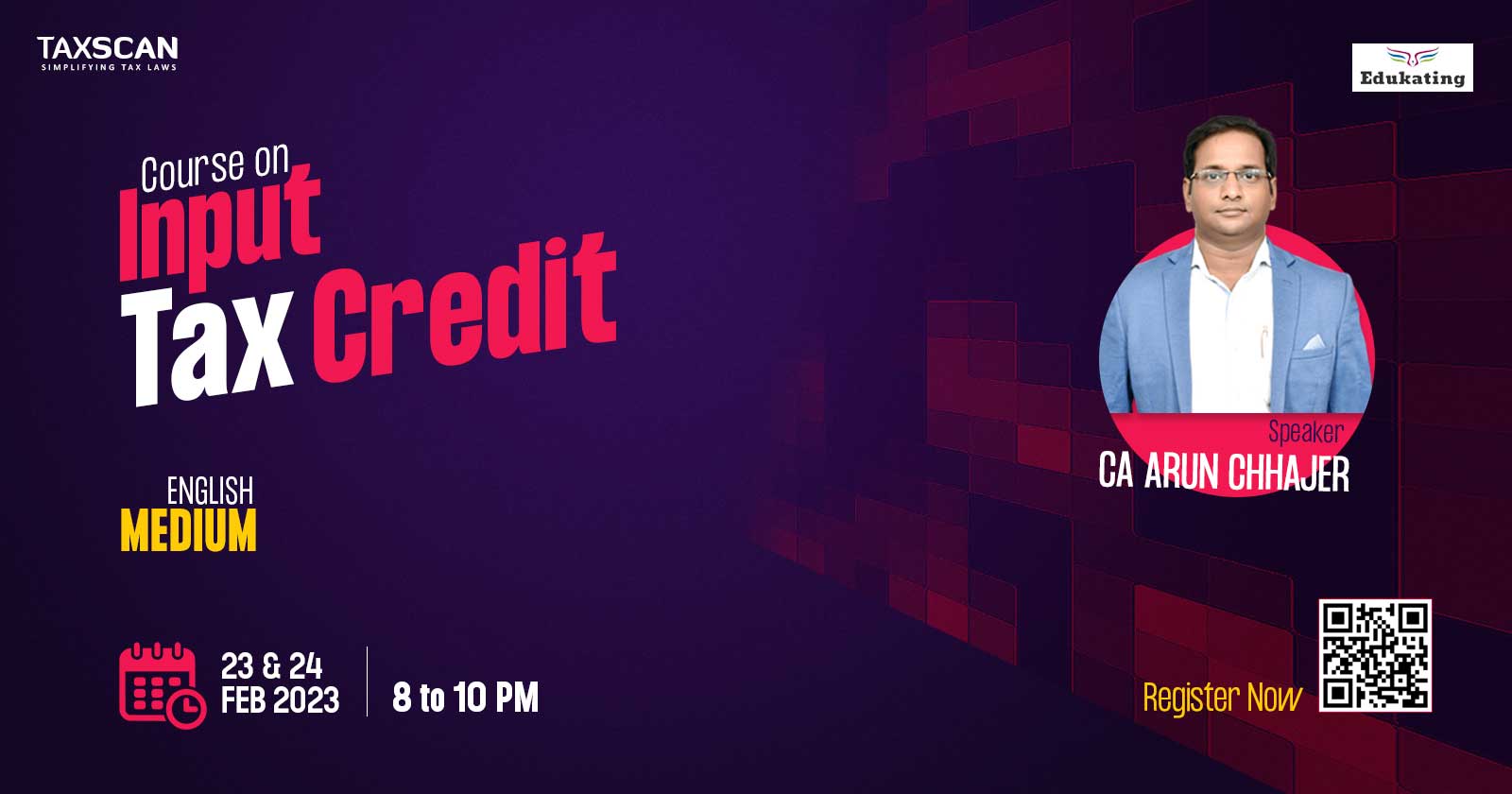

Course on Input Tax Credit

COURSE – INPUT TAX CREDIT – taxscanacademy – taxscan

COURSE – INPUT TAX CREDIT – taxscanacademy – taxscan

Faculty - CA Arun Chhajer

23 & 24 FEB 2023

8.00PM to 10.00PM

English Medium

E-notes available

The recorded sessions will be provided

Course Fees1599/-(Including GST)1259/-(Including GST

Click Here To Pay

What will be covered in the course

▪️What is the Eligibility and Condition for claiming ITC- Section 16 of CGST Act

▪️Requirement and reversal of ITC (rule 37)

▪️Schedule I vs Rule 37 Comparative Study

▪️Rules and Provision for Offset of ITC - Case Study

▪️Concept of Claim - Reversal – Reclaim

▪️Clarification on Non Filing of GSTR1 will not create ineligibility for taking ITC

▪️Block ITC as per Sec 17(5)

▪️Provision of Section 17 for reversal of common ITC and meaning of Exempt Supply

▪️Reversal as per Rule 42/43 for Input, Input Service & Capital Goods

▪️Special Provision for Banking, Financial Institutions, NBFC's

▪️ITC in case of special circumstances - Sec 18

▪️Other Provision - Payment of Tax, Interest, Block of ITC (Rule 86A)

For Queries - 8891 128 677, 89434 16272, info@rasheela