COVID-19: MCA issues Office Memorandum to clarify contribution to PM-CARES Funds as eligible CSR activity

In the wake of Coronavirus (COVID-19), the Ministry of Corporate Affairs (MCA) issued an Office Memorandum to clarify contribution to Prime Minister’s Citizen Assistance and Relief in Emergency Situation PM-CARES Funds as eligible Corporate Social Responsibility (CSR) Activity.

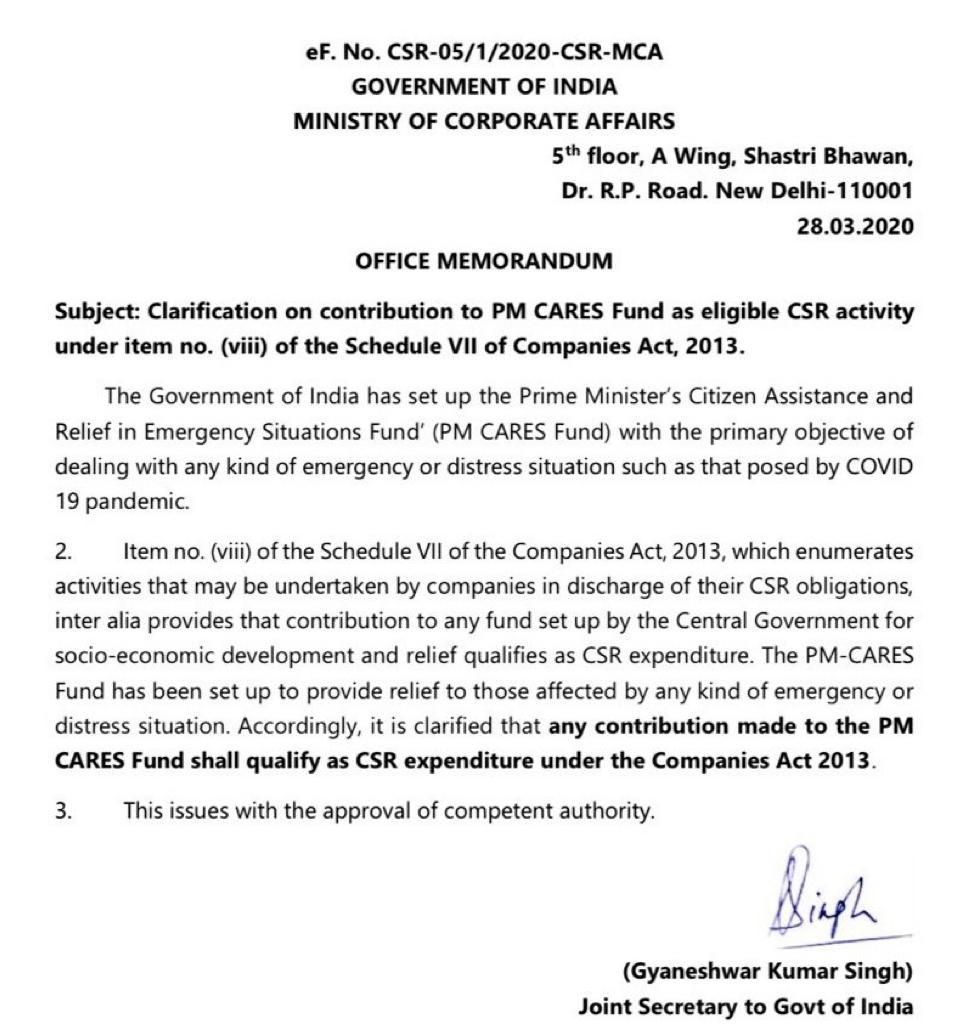

The Ministry of Corporate Affairs (MCA) under the Government of India issued an Office Memorandum on March 28, 2020 in the name of Joint Secretary of the Government of India, Mr. Ganeshwar Kumar Singh.

The subject-matter of the memorandum pertained to the clarification on contribution to Prime Minister’s Citizen Assistance and Relief in Emergency Situation (PM-CARES) Funds as eligible Corporate Social Responsibility (CSR) Activity under Item No. (viii) of the Schedule VII of the Companies Act, 2013.

The notification issued by the Ministry of Corporate Affairs (MCA) keeping in view of the spread of novel Coronavirus (COVID-19) in India, its declaration as a pandemic by the World Health Organisation (WHO), and, decision of the Government of India to treat this as a notified disaster, it is hereby clarified that spending of CSR funds for COVID-19 is eligible CSR activity.

After the assent of the competent authority the Item No. (viii) of the Schedule VII of the Companies Act, 2013 pertains to “the activities that may be undertaken by companies in discharge of their Corporate Social Responsibility (CSR) obligation, inter alia provides for the contribution to any fund set up by the central government for the socio-economic development and relief qualifies as Corporate Social Responsibility (CSR) expenditure.”

The preliminary objective of the Prime Minister’s Citizen Assistance and Relief in Emergency Situation (PM-CARES) Funds has been set up to provide relief to all the affected citizens of India by any kind of emergency or distress situation which is posed by the pandemic called Coronavirus (COVID-19).

Therefore, it is clarified that any contribution made to Prime Minister’s Citizen Assistance and Relief in Emergency Situation (PM-CARES) Fund will qualify as Corporate Social Responsibility (CSR) expenditure under the Companies Act, 2013.