Critical Oversight: State GST Departments Omit AA Details in DRC-07, makes GST Appeal filing Difficult

Professionals demand inclusion of Appellate Authority details in DRC-07

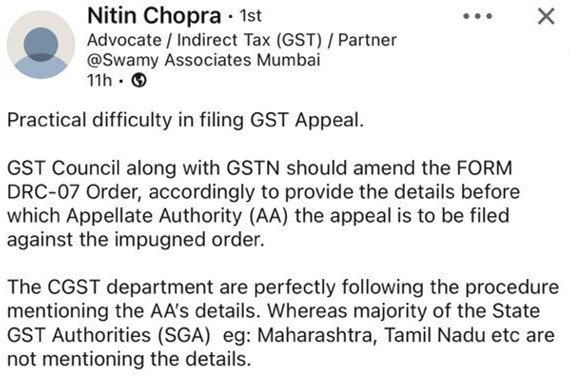

A critical oversight of the State Goods and Services Tax (SGST) Departments have made filing of Goods and Services Tax (GST) Appeals difficult. The Maharashtra, Tamil Nadu and GST Authorities are alleged to not have included the details of the Appellate Authorities in the GST Form DRC-07.

DRC-07 is the summary of all orders. Every order which ultimately ends up in demand creation, liability is created through DRC-07. By submitting DRC-07 to GSTN, liability against the taxpayer will be created in part B [other than return related liability] of the Liability Ledger. The same can be viewed from the GST back end by verifying the ‘’other than return liability’ of the taxpayer in the liability ledger.

To file an appeal against a demand order the steps given below are to be followed —

Access the www.gst.gov.in URL. The GST Portal Home page is displayed.

Login to the GST Portal with valid credentials i.e. your User Id and Password.

Creating Appeal to Appellate Authority

Upload Annexure to GST APL-01

Disputed Amount/ Payment Details

Pre-deposit % of disputed tax

Utilize Cash/ ITC

Add any Other Supporting Document

Preview the Application and Proceed to File

Further steps, as required:

Withdraw an Appeal Application

Re-file an Appeal Application.

It is crucial that the stakeholders know who the appellate authority is, in order to challenge the issuance or issues in GST DRC-07, Demand Order. The appeal process involves submitting Form DRC-08, detailing the grounds on which the appeal is based.

The proposal, directed towards the GST Council and GSTN, suggests incorporating a mandatory provision on the GST Portal. According to this proposed amendment, authorities passing orders would be obligated to provide comprehensive details of the Appellate Authority, including their address, within the FORM DRC-07. This information would become a prerequisite for the issuance of DRC-07 on the portal, so that the aggrieved parties know who is the appellate authority.

“GST Council and GSTN can make a way out in GST Portal where the authority passing the order should provide the details along with the Address of the Appellate Authority in FORM DRC-07 and the same shall be mandatory, without which the DRC-07 cannot be issued in the portal.”, Nitin Chopra, Partner at Swamy Associates told Taxscan.

Without the inclusion of AA details, the stakeholders and professionals are forced to manually look up the jurisdictional Appellate Authority, leading to unnecessary loss of time and resources.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates