Curbing Fraud: RBI Introduces Beneficiary Name Verification for RTGS & NEFT from April 2025

Participating banks, including both direct and sub-members of RTGS and NEFT systems, were directed to provide this feature to their customers through internet and mobile banking platforms, as well as for in-branch transactions, by April 1, 2025

RBI Introduces Beneficiary Name Verification – RBI – Beneficiary Name Verification – Curbing Fraud – RTGS – NEFT – taxscan

RBI Introduces Beneficiary Name Verification – RBI – Beneficiary Name Verification – Curbing Fraud – RTGS – NEFT – taxscan

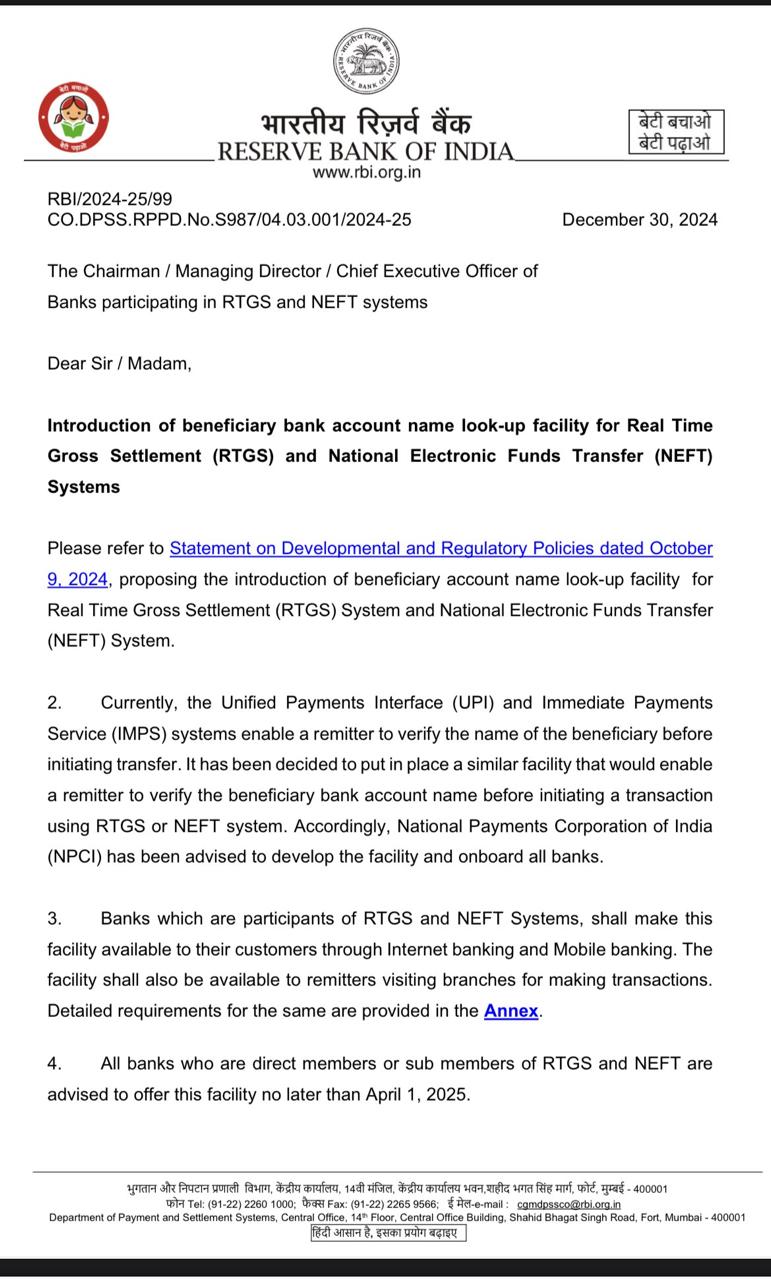

The Reserve Bank of India ( RBI ) has introduced a beneficiary name look-up facility for Real Time Gross Settlement ( RTGS ) and National Electronic Funds Transfer ( NEFT ) systems to curb fraud.

As per the Statement on Developmental and Regulatory Policies dated October 9, 2024, this facility will enable remitters to verify the name of the beneficiary’s bank account before initiating a transaction, concurring RTGS and NEFT with the existing functionality of Unified Payments Interface (UPI) and Immediate Payments Service (IMPS).

The RBI has directed the National Payments Corporation of India (NPCI) to develop and implement this facility across all banks.

Take Your SME to the Next Level with IPO Insights - Click here to Register

The participating banks, including both direct and sub-members of RTGS and NEFT systems, were directed to provide this feature to their customers through internet and mobile banking platforms, as well as for in-branch transactions, by April 1, 2025.

The beneficiary name verification system will work by fetching the beneficiary’s account name from the bank’s Core Banking Solution (CBS) based on the account number and IFSC provided by the remitter.

Customers will have the option to verify the beneficiary name while registering a new payee, making one-time fund transfers, or re-verifying existing beneficiaries. If the name cannot be displayed, remitters may proceed with the transaction at their discretion, supported by specific alert messages provided by NPCI.

Take Your SME to the Next Level with IPO Insights - Click here to Register

The RBI has advised the banks to maintain detailed logs of all queries and responses associated with this facility while ensuring compliance with data privacy laws.

NPCI will not store any related data, and disputes will be resolved using unique lookup reference numbers and corresponding logs maintained by the banks. Importantly, this service will be offered to customers free of charge.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates