Depreciation Simplified: Your Guide to AY 2024-25 Rates and Deductions

This Article provides a comprehensive insight into the depreciation rates applicable for the Assessment Year 2024-25

Depreciation – Depreciation Simplified – AY 2024-25 Rates and Deductions – Taxscan

Depreciation – Depreciation Simplified – AY 2024-25 Rates and Deductions – Taxscan

Asset Depreciation is an important factor for consideration when it comes to finance and accounting. Accurately identifying and reflecting the depreciable value of tangible assets is key for businesses to formulate a faultless and comprehensive financial statement

Keep reading to get a comprehensive understanding of Depreciation, how it applies to your business and the overarching statutory permits and restrictions.

- Section 32 of the Income Tax Act, 1961

“Depreciation” refers to the loss of value accrued by a tangible asset over its usable life. Assets like buildings, machinery, vehicles depreciate in value over time owing to multiple factors such as wear and tear, usage and obsolescence.

In accounting and tax terms, depreciation is deducted annually to spread the asset’s cost across its life, reducing taxable income and reflecting the true value of the asset in financial records.

Depreciation under the Income Tax Regime is covered under Section 32 of the Income Tax Act, 1961. The components of Section 32 provides for taxpayers to claim deduction on the depreciation of tangible and intangible assets used in business or profession.

The Key Features of Section 32 of The Income Tax Act, 1961 include:

- Ownership - Depreciation is allowed only on capital assets owned, wholly or partly, by the taxpayer and used for the purpose of business or profession during the concerned Financial Year

- Kinds of Assets - Depreciation can be claimed on both tangible and intangible assets.

Become a PF & ESIC expert with our comprehensive course - Enroll Now

Alternatively, deductions are also available on intangible assets such as franchise, licenses, copyrights, trademarks and similar commercial or business rights.

- Block of Assets - Depreciation is calculable on blocks or groups of assets of similar nature.

- Multiple Methods of calculating Depreciation

- Unabsorbed Depreciation If depreciation exceeds profits, the unabsorbed depreciation can be carried forward and set off against future income.

- Block of Assets

A Block of Assets refers to a group of assets classified together for the purpose of calculating depreciation. These assets share a common depreciation rate and nature (e.g., machinery, building, furniture).

Blocks of Assets are classified on the basis of their nature, lifespan and usage. Instead of applying depreciation to individual assets, the deduction is applied collectively to the block.

When an asset within the block is sold, its sale value is deducted from the block's opening value.

In India, depreciation can be classified based on types of assets and methods of depreciation used to calculate it under the Income Tax Act. The types of assets typically include two main categories:

- Tangible Assets - Physical items like buildings, machinery, plants, and furniture, which wear out over time due to usage and environmental factors.

- Intangible Assets - Non-physical assets such as patents, trademarks, goodwill, copyrights, and other intellectual property, which depreciate due to market changes or limited legal lifespan.

Intangible Assets - Non-physical assets such as patents, trademarks, goodwill, copyrights, and other intellectual property, which depreciate due to market changes or limited legal lifespan.

Become a PF & ESIC expert with our comprehensive course - Enroll Now

- Methods of Depreciation

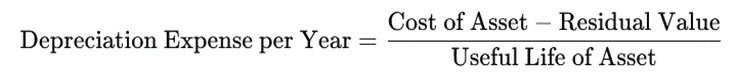

- Straight-Line Depreciation: This method allocates the asset’s cost evenly across its useful life.

The SLM applies a consistent percentage of the original cost of the asset as depreciation each year, spreading the cost equally across each year. It is calculated using the formula:

Here, The residual value is the estimated value of a fixed asset at the end of its lease term or useful life. This Method is usually applicable to industries where assets generate similar value each year.

- Written Down Value (WDV) Method: The WDV method calculates depreciation based on the reduced book value of an asset each year. Depreciation is applied as a percentage on the asset's opening WDV, which is then adjusted downward each subsequent year. Under this method, the asset value declines more rapidly in the initial years, providing a larger depreciation expense early on. This method is generally used for assets not related to power generation and is widely accepted under Indian tax laws.

Become a PF & ESIC expert with our comprehensive course - Enroll Now

4. Conditions for Claiming Depreciation

Depreciation under the Income Tax Ac, 1961 can be claimed by an entity provided that:

- The taxpayer owns the asset, fully or partially.

- The asset must be used for business or professional purposes during the previous year.

- Depreciation is based on the asset’s actual cost, including installation expenses, taxes, etc.

- Depreciation starts when the asset is put to use and is not applicable when the asset is held as an investment.

- Input Tax Credit (ITC) and Depreciation claim on the same Asset

According to Indian law, a taxpayer cannot claim both ITC under GST and depreciation on the same component of the asset’s cost under the Income Tax Act, 1961.

If ITC is claimed on the asset under GST, the cost of the asset for income tax purposes is reduced by the amount of ITC claimed. Thus, depreciation can only be claimed on the reduced cost.

Alternatively, if the taxpayer does not claim ITC on the capital asset, they can claim full depreciation on the asset’s cost under the Income Tax Act.

Example:

Suppose a taxpayer buys machinery for ₹1,00,000, and the GST component is ₹18,000 (18%). The treatment would be as follows:

Claiming ITC: If the taxpayer claims ITC, the effective cost for depreciation under the Income Tax Act will be reduced to ₹82,000 (i.e., ₹1,00,000 - ₹18,000). Depreciation will be claimed on ₹82,000.

Not Claiming ITC: If the taxpayer does not claim ITC, the full cost of ₹1,00,000 will be available for depreciation.

Click the link to read about Availment of Both GST ITC and Depreciation on Capital Goods: Here’s How to Draft Reply to GST Notice along with Draft Format

- Deferred Tax Liabilities and Deferred Tax Assets

A Deferred Tax Liability (DTL) occurs when tax expenses recorded in financial books are lower than the tax due as per tax laws, creating a future tax obligation. This often happens when depreciation in accounting records is lower than tax depreciation, meaning the tax due will be higher in the future.

On the other hand, a Deferred Tax Asset (DTA) arises when tax paid exceeds tax owed per financial statements, leading to absolution of future tax liabilities. This typically occurs when an expense is recognized in financial records before it’s allowed for tax purposes.

Both DTL and DTA reflect temporary differences and help in matching income tax expense with reported accounting income, providing a more accurate financial picture for long-term planning.

Become a PF & ESIC expert with our comprehensive course - Enroll Now

7. Impact of New Tax Options: Sections 115BAA and 115BAB

Section 115BAA offers companies an option to pay a lower tax rate of 22%, provided they forgo certain exemptions and deductions, including additional depreciation under Section 32.

Section 115BAB provides a reduced tax rate of 15% for new manufacturing companies that meet specific criteria. Similar to Section 115BAA, companies opting for this section must also forgo various deductions, including depreciation incentives.

These sections offer lower tax rates but reduce the depreciation benefits available to taxpayers under Section 32 of the Act. Taxpayers need to carefully evaluate the merits and demerits of both Options and choose a method that complements their overall tax strategy.

- Depreciation Rates for Financial Year 2023-24

The Depreciation Rates for F.Y. 2023-24 have been annexed under Appendix I and Appendix IA of the Income Tax Rules.

Become a PF & ESIC expert with our comprehensive course - Enroll Now

Appendix I of the Income Tax Rules provides for the Depreciation of Tangible and Intangible Assets as follows.

Depreciation Rates for Tangible Assets:

| Sl. No | Asset Class | Asset Type | Rate of Depreciation |

| 1 | Building | Residential buildings not including boarding houses and hotels | 5% |

| 2 | Building | Boarding houses and hotels | 10% |

| 3 | Building | Purely temporary constructions like wooden structures | 40% |

| 4 | Furniture | Any fittings / furniture including electrical fittings | 10% |

| 5 | Plant and machinery | Motor cars excluding those used in a business of running them on hire | 15% |

| 6 | Plant and machinery | Motor cars excluding those used in a business of running them on hire purchased on or after 23 August 2019 but before the 1 April 2020 and is put to use before 1 April 2020 | 30% |

| 7 | Plant and machinery | Lorries/taxis/motor buses used in a business of running them on hire | 30% |

| 8 | Plant and machinery | Lorries/taxis/motor buses used in a business of running them on hire purchased on or after 23 August 2019 but before the 1 April 2020 and is put to use before 1 April 2020 | 45% |

| 9 | Plant and machinery | Computers and computer software | 40% |

| 10 | Plant and machinery | Books owned by assessee carrying on a profession being annual publications | 100% |

| 11 | Plant and machinery | Books owned by assessee carrying on profession not being annual publications | 60% |

| 12 | Plant and machinery | Books owned by assessee carrying on business in running lending libraries | 100% |

| 13 | Intangible assets | Franchise, trademark, patents, license, copyright, know-how or other commercial or business rights of similar nature | 25% |

Depreciation Rates for Intangible Assets:

| Sl. No | Asset Class | Asset Type | Rate of Depreciation |

| 1 | Patents, Copyrights, Trademarks | Intellectual Property Rights | 25% |

| 2 | Know-how, Franchise Rights | Commercial Rights, Technical know-how | 25% |

Special Depreciation Rates for Certain Assets under Appendix IA:

| Sl. No | Asset Class | Asset Type | Rate of Depreciation |

| 1 | Power Generation Machinery | Machinery used in Power Generation and Distribution | 40% |

| 2 | Pollution Control Equipment | Air and Water Pollution Control Devices | 40% |

| 3 | Renewable Energy Devices | Windmills, Solar Energy Systems | 40% |

- Conclusion

Depreciation plays a vital role in reducing taxable income and managing tax liabilities under the Income Tax Act, 1961. Understanding depreciation rules, especially under Section 32, and keeping abreast of relevant changes such as the introduction of Sections 115BAA and 115BAB can help taxpayers make informed decisions regarding asset management and tax planning. Opting for the right method of depreciation and evaluating which tax rates are beneficial is crucial for maximizing tax savings.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates