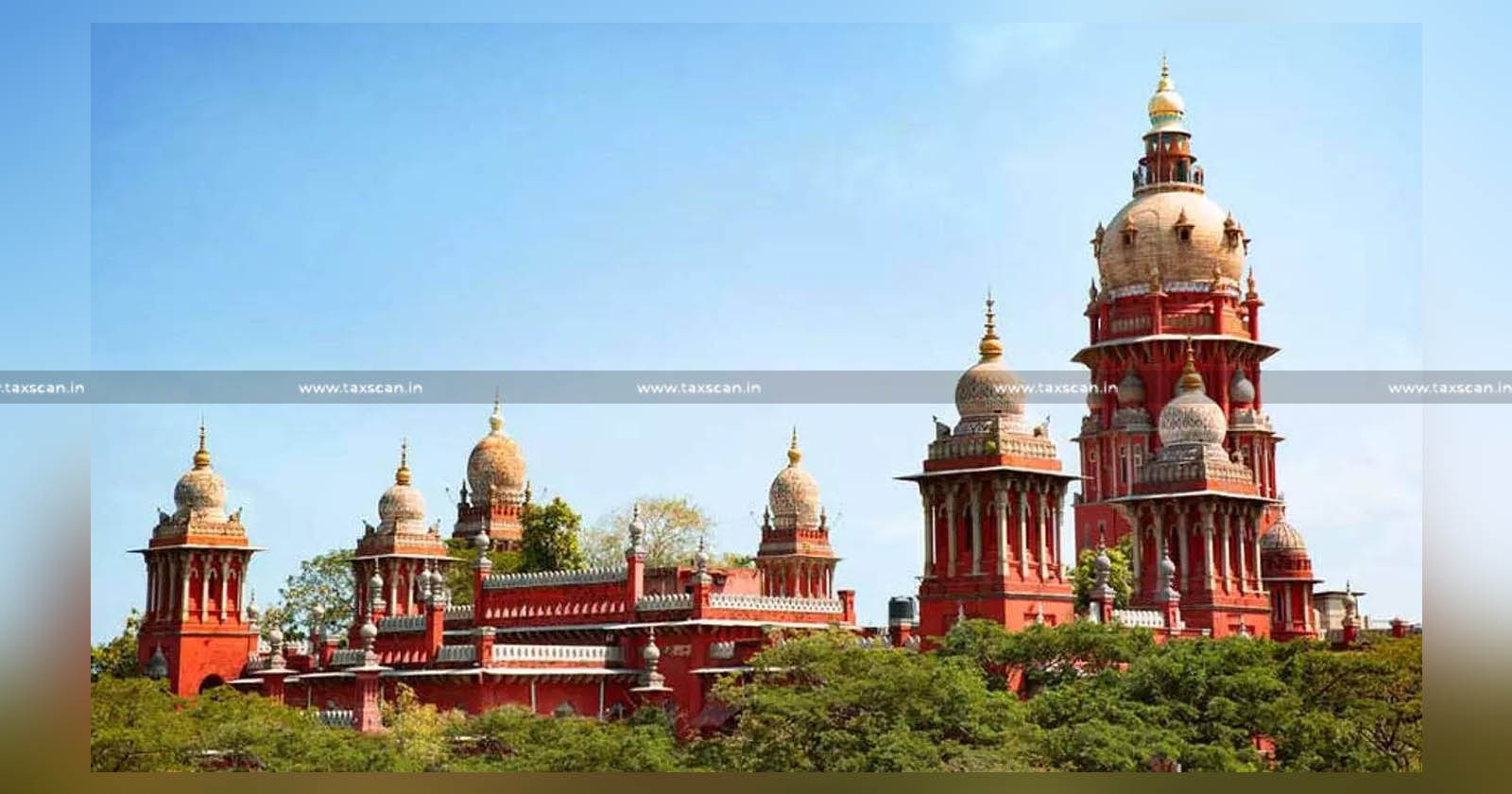

Dept not Object to Condonation of Delay in filing Appeal: Madras HC Grants 3 Weeks Extension for filing Statutory Appeal [Read Order]

Dept not Object to Condonation of Delay in filing Appeal – Madras HC – TAXSCAN

Dept not Object to Condonation of Delay in filing Appeal – Madras HC – TAXSCAN

Madras High Court in a recent case granted 3 week time for filing a statutory appeal, since the department not objected to condone the delay in filing an appeal.

M/s PRM Constructions, the petitioner filed a petition with a prayer to call for the records relating to the Order in Original No.91/202-ST dated 28.09.2022 issued by the 1st respondent with consequential Notices of Demand issued under Section 87(b)(i) of the Finance Act, 1994 addressed to the 2nd and 3rd respondent and to quash the same and further direct the 1st respondent to verify the payments made by Neyveli Lignite Corporation (NLC) under Reverse Charge Mechanism on the contract agreement entered and executed by the petitioner during the year 2015-16 to 2017 up to June 2017.

M A Mudimannan appeared on behalf of the petitioner and Mr Mohana Murali appeared on behalf of the respondent.

The petitioner only asks for an opportunity to file a statutory appeal which, admittedly is beyond the period of statutory limitation under the Finance Act, 1994, under which services tax was levied (since subsumed with Goods and Service Tax).

Mohana Murali, Senior Panel Counsel, who accepted the notice for R1, fairly does not object to the request, therefore the Court condoned the delay.

The Single Bench of Dr Justice Anita Sumanth granted three weeks to file an appeal against the impugned order dated 28.09.2022.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates