DGFT notifies Realignment of Ro DTEP Schedule w.e.f. 1st May 2023 consequent to amendments made under Finance Bill, 2023 [Read Notification]

DGFT – DGFT notifies Realignment of Ro DTEP Schedule – DGFT notifies – Ro DTEP Schedule – amendments – Finance Bill 2023 – Finance Bill – Taxscan

DGFT – DGFT notifies Realignment of Ro DTEP Schedule – DGFT notifies – Ro DTEP Schedule – amendments – Finance Bill 2023 – Finance Bill – Taxscan

The Directorate General of Foreign Trade (DGFT) via Notification No: 04 /2023 issued on 1st May 2023 notified the realignment of Remission of Duties and Taxes on Exported Products (RoDTEP) schedule (Appendix 4R) with the First Schedule of the Custom Tariff Act with effect from 1st May 2023 consequent to the amendments made under Finance Bill, 2023.

Any exporter of the goods is qualified to use the RoDTEP scheme benefits. Such an exporter could be a manufacturer or a retailer.

The Central Government introduced new additions/amendments to Appendix 4R in accordance with the authority granted by Section 5 of the Foreign Trade (Development and Regulation) Act, 1992, read in conjunction with Paragraph 1.02 of the Foreign Trade Policy 2023.

The amendments made are:

- 149 tariff lines at 8 Digit level are added in the RoDTEP schedule

- 52 tariff lines at 8 Digit level are deleted from the RoDTEP Schedule

It was also notified that the details of the HSS codes as in Para above along with RoDTEP rates/value caps are available at the DGFT portal.

Steps to get Details:

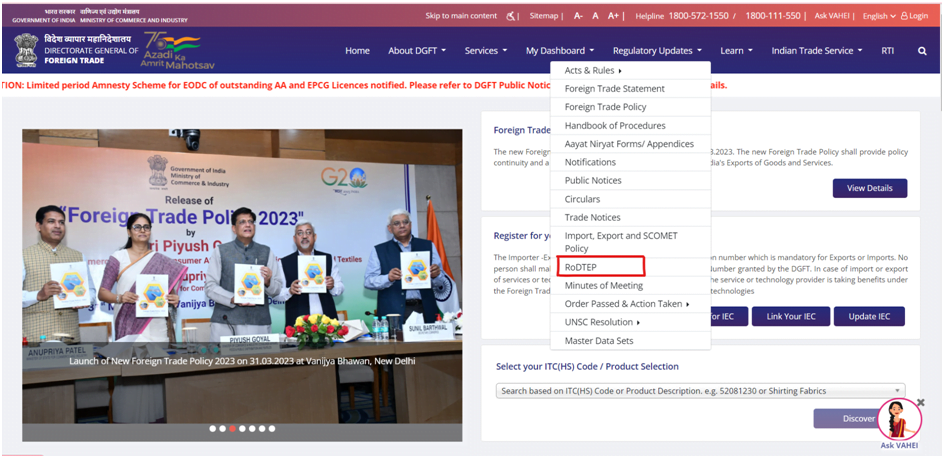

Go to www.dgft.gov.in

Click on Regulatory Updates > RoDTEP

A refund of the taxes and duties paid on inputs used in the production of exported goods, such as state and federal taxes, power tariffs, and fuel used for transportation, is available to exporters under the RoDTEP system. Exporters can receive this reimbursement in the form of transferable duty credit stamps, which can be applied to a variety of duties, taxes, and fees.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates