DGFT notifies Regularization of Remission of Duties or Taxes on Export Products (RoDTEP) for 18 Products [Read Notification]

DGFT – DGFT notifies Regularization of Remission of Duties or Taxes on Export Products – Remission of Duties or Taxes on Export Products – Taxscan

DGFT – DGFT notifies Regularization of Remission of Duties or Taxes on Export Products – Remission of Duties or Taxes on Export Products – Taxscan

The Directorate General of Foreign Trade (DGFT) vide notification no. 24/2023 issued on 3rd August 2023 has notified the regularisation of Remission of Duties or Taxes on Export Products (RoDTEP) for 18 HS Codes under Heading 5208.

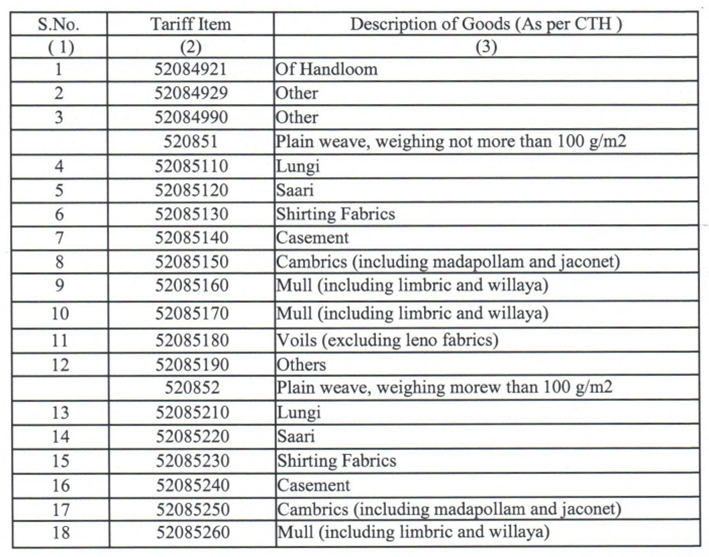

The following is considered regarding 18 HS Codes under Heading 5208 which were added in Appendix 4R vide Notification No. 63 dated 25.03.2023:

2. (i) Whereas, customs EDI directory in ICES had an error inasmuch as it did not contain above-mentioned 18 HS Codes of heading 5208 which form part of the legal text of the first schedule to Customs Tariff Act, 1975 and exporters claimed and availed RoDTEP wherein export goods were classified in tariff lines with in headings of 5208 other than the said 1 8 HS Codes,

(ii) Whereas, above-mentioned 18 HS Codes of heading 5208 have been enabled in

customs EDI directory in ICES for filing shipping bills w.e.f. 28.01.2023 and however, exporters could claim RoDTEP benefit from 28.03.2023 onwards after RoDTEP rates were notified vide said DGFT Notification no. 63 dated 25.03.2023,

(iii) Whereas, on account of noticing inconsonance in classification vis-å-vis first schedule to Customs Tariff Act, 1975, show cause notices have been issued or RoDTEP benefit disallowed at the time of export relating to the period 01.01.2021 to 27.01.2023, and also, for the period 28.01.2023 to 27.03.2023 claiming the RoDTEP

could not be enabled,

(iv) whereas, taking in account the sequence of measures taken in connection to correcting this said omission, allowing RoDTEP since 01.01.2021 as well as the regularisation of the RoDTEP as claimed as such, as long as it was claimed against one of the HS Codes under heading 5208 in the case of exports under shipping bills filed from 01.01.2021 to 27.01.2023 would obviate any changes required in any of the relevant shipping bills under which exports stand made, that the claims would simply get finalized and show cause notices, if any, already issued would get decided accordingly,

(v) whereas, in the case of exports under shipping bills filed from 28.01.2023 to 27.03.2023, by allowing RoDTEP since 01.01.2021, enablement from DG Systems in CBIC is required so as to update the RoDTEP directory and to make other changes, including in ICES/ICEGATE, as are necessary, so as to allow exporters, who claimed the said 18 HS Codes in their export declaration in shipping bill, to make a supplementary claim in respect of RoDTEP amount. For this, the DG Systems in CBIC shall be issuing a Systems Advisory allowing exporters (who claimed the 18 eight-digit tariff lines in their export declaration in shipping bill) to make a supplementary claim within 180 days of the date of the said Systems Advisory.

3. Therefore, in exercise of the powers conferred by Section 3 and Section 5 of the Foreign Trade (Development and Regulation) Act, 1992 read with Para 1.02 of the Foreign Trade Policy 2023, the Central Government hereby -

i) allows RoDTEP for these 18 HS codes mentioned in Table in Para 1 above w.e.f. 01.01.2021 in supersession of DGFT Notification no. 63 dated 25.03.2023 to that extent.

ii) regularizes the RoDTEP availed by the exporters w.e.f. 01.01.2021, in the manner as outlined in sub-para (iv) or (v) Of Para 2 above, as the case may be.

The effect of the notification is that the RoDTEP benefit relating to 18 HS codes under heading 5208 notified vide Notification no. 63/2015-20 dated 25.03.2023 is being regularized w.e.f. 01.01.2021, in consultation with the Department of Revenue.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates