DGFT Notifies Revised Registration Fee Structure for SIMS, CIMS, NFMIMS, PIMS: Know Complete Details [Read Notice]

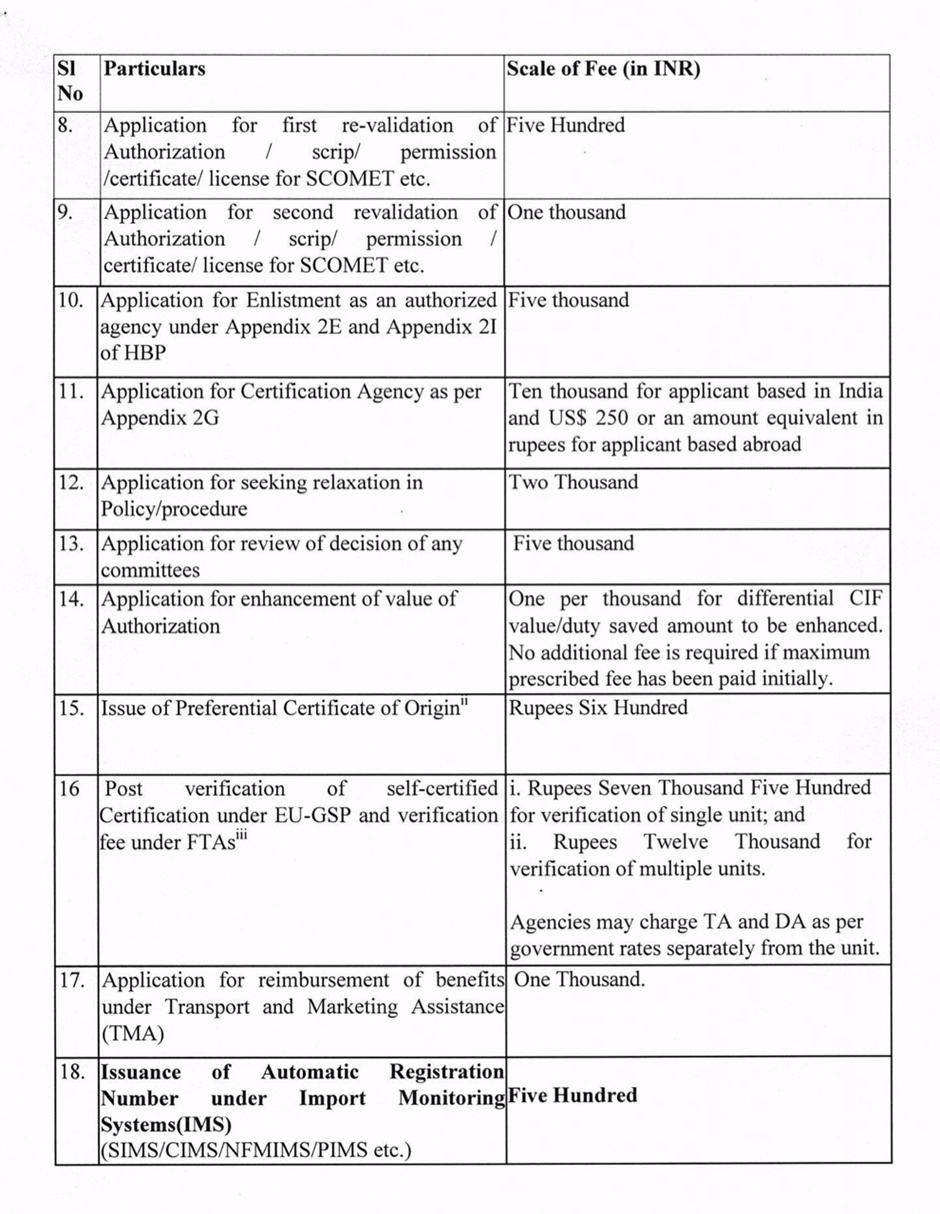

Appendix 2K—which outlines the Scale of User Charges and the Process for Deposit/Refund of Application Fee, Penalty, etc.—has been updated with immediate effect

![DGFT Notifies Revised Registration Fee Structure for SIMS, CIMS, NFMIMS, PIMS: Know Complete Details [Read Notice] DGFT Notifies Revised Registration Fee Structure for SIMS, CIMS, NFMIMS, PIMS: Know Complete Details [Read Notice]](https://www.taxscan.in/wp-content/uploads/2025/04/DGFT-Notifies-DGFT-Registration-Fee-Structure-Registration-Fee-Structure-for-SIMS-taxscan.jpg)

The Director General of Foreign Trade ( DGFT ) has issued a public notice revising the registration fee structure applicable to various Import Monitoring Systems, including SIMS, CIM, NFM-IMS and PIMS. The board has issued a public notice no. 02/2025-26 dated 15th April 2025.

This update has been made in the exercise of powers conferred under Paragraph 1.03 read with Paragraph 2.04 of the Foreign Trade Policy ( FTP ) 2023, as amended from time to time.

Through this amendment, Appendix 2K of Scale of User Charges and Process for Deposit Refund of Application Fee/Penalty, etc) of FTP 2023 of which outlines the Scale of User Charges and the Process for Deposit/Refund of Application Fee, Penalty, etc.—has been updated with immediate effect. The revised Appendix includes a specific provision for levying Registration Fees for various Import Monitoring Systems under implementation.

The fee structure is as follows:

Worried About SME IPO Pitfalls? Gain Clarity with This Advanced Course! Register Now

1. Mode of Payment

Applicants are now required to deposit user charges, penalties, or any other applicable fee through online mode. The payment will be integrated into the online service workflow on the DGFT portal. Upon completion of the service process, users will be redirected to a secure payment gateway to make payments using Internet banking, credit/debit cards, UPI, or other authorized payment modes.

For processes where direct online payment is unavailable, applicants must make payments through the e-Miscellaneous Payment System (eMPS) hosted on the DGFT website.

Worried About SME IPO Pitfalls? Gain Clarity with This Advanced Course! Register Now

2. Exemption from Payment

Certain classes or categories of applicants, as notified under the Foreign Trade (Regulation) Rules, 1993, shall be exempted from the payment of any application fee.

3. Refund Policy

The DGFT has clarified that application fees are charged for processing purposes and are therefore non-refundable, except in specific cases:

- When the fee paid exceeds the prescribed amount;

- When the fee is paid but no application is filed;

- When the fee is paid in error by an exempted applicant.

Importantly, no refund claim will be entertained after one year from the date of payment.

4. Procedure for Claiming Refund

Refund applications must be submitted online via the refund management system. If a file was submitted earlier, the request will be auto-forwarded to the jurisdictional authority. If no file exists, the default recipient shall be DGFT (HQ).

For legacy payments made under the NIC-managed system, the refund process will continue as per the earlier manual procedure using ANF-2G. Jurisdictional licensing authorities shall verify and process refund claims after confirmation from the Pay and Accounts Officer (PAO).

Upon approval, the PAO will authorize payment to the user. Refund sanction orders shall remain valid for three months, with revalidation allowed at the discretion of the issuing authority.

5. Adjustment of Application Fees

In cases where a new Authorization or Duty Credit Scrip is issued in lieu of a cancelled one (e.g., due to non-registration at a Customs Port) or when applicants are directed to apply under the correct scheme, the application fee paid earlier may be adjusted or refunded. The Head of Office of the jurisdictional authority shall assess and sanction such refunds, subject to proper documentation and noting of grounds for the claim.

To Read the full text of the Notice CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Public Notice No: 02/2025-26 , 15 April 2025