DGFT Proposes Anti-Dumping Duty on Synthetic Grade Zeolite 4A from Iran and Thailand [Read Order]

DGFT Proposes- Anti-Dumping Duty – Synthetic Grade- Zeolite – from Iran – Thailand-TAXSCAN

DGFT Proposes- Anti-Dumping Duty – Synthetic Grade- Zeolite – from Iran – Thailand-TAXSCAN

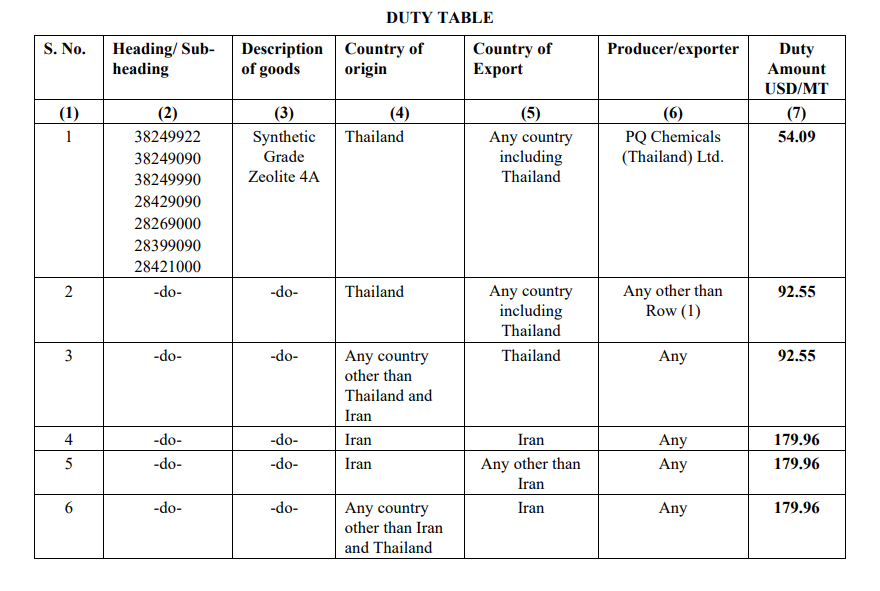

The DGFT, under Case No. CVD(OI) – 04/2024, has issued its final findings, proposing to impose an anti-dumping duty on Synthetic Grade Zeolite 4A from Iran and Thailand. This decision is based on an application submitted by M/s Gujarat Credo Mineral Industries Limited.

The product in question, "Synthetic Grade Zeolite 4A," also referred to as "Zeolite 4A," falls under Chapter 28 of the Customs Tariff Act, 1975, with a sub-heading of 2842 1000.

In adherence to the lesser duty rule, the Authority recommends the imposition of an antidumping duty equal to the lesser of the dumping margin and the injury margin to mitigate harm to the domestic industry. Consequently, the Authority proposes to impose a definitive anti-dumping duty on imports of the subject goods from the specified countries for a duration of five (5) years from the date of notification issued by the Central Government. The duty amount will be determined based on the value of imports as assessed by Customs under the Customs Act, 1962, excluding specific customs duties.

Note: The customs authorities may verify the origin of subject goods in case imports are reported as originating in UAE.

Any challenges to the Designated Authority's determination in this final finding can be appealed before the Customs, Excise, and Service Tax Appellate Tribunal in accordance with the relevant provisions of the Act.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates