DGFT releases Final Finding of Investigation on Anti-Dumping Duty on Flax Yarn Imports of below 70 lea count from China PR [Read Notification]

DGFT – Final Finding of Investigation – Investigation – Anti-Dumping Duty – Flax Yarn Imports – Flax Yarn – Imports – China PR – taxscan

DGFT – Final Finding of Investigation – Investigation – Anti-Dumping Duty – Flax Yarn Imports – Flax Yarn – Imports – China PR – taxscan

The Directorate General of Foreign Trade (DGFT) notified the final findings of the Investigation of anti-dumping duty on import of flax yarns below 70 lea count originating or exported from China PR.

The Designated Authority received an application filed by M/s Grasim Industries Limited (Jaya Shree Textiles) and Sintex Industries Ltd (Applicants or domestic industry) in accordance with Customs Tariff Act, 1975 and Customs Tariff (Identification, Assessment and Collection of AntiDumping Duty on Dumped Articles and for Determination of Injury) Rules for sunset review investigation of anti dumping duty on imports of Flax Yarn of below 70 Lea Count (subject goods or PUC) originating in or exported from China PR (subject country).

In terms of Section 9A(5) of the Customs Tariff Act the anti-dumping duty imposed shall, unless revoked earlier, cease to have effect on the expiry of five years from the date of such imposition. The Authority is required to review whether the expiry of anti-dumping duty is likely to lead to the continuation or recurrence of dumping and injury.

It was clarified that the scope of the PUC is limited to ―flax yarn of below 70 lea count (equivalent to 42 Nm). 13. The product under consideration is generally classified under Chapter 53 of the Customs Tariff Act under head 5306 and subheadings 53061010, 53061090, 53062010 and 53062090. The HS codes are considered only indicative, and the product description is decisive for the purpose of the present investigation.

The Authority notes that the products under consideration produced by the domestic industry and imported from the subject country are comparable in terms of physical & chemical characteristics, functions & uses, product specifications, pricing, distribution & marketing, and tariff classification of the goods. The goods produced by the domestic industry and imported from the subject country are like articles in terms of the Rules. The two are technically and commercially substitutable.

It was further submitted by the authority that the present investigation is a sunset review investigation, and the purpose of this investigation is to examine the continuation or recurrence of dumping and consequent injury if anti-dumping duty is allowed to expire even if there is no current injury. This also requires a consideration of whether the duty imposed is serving the intended purpose of eliminating injurious dumping.

The Authority noted that the investigation was initiated and notified to all the interested parties and adequate opportunity was given to the domestic industry, the exporters, the importers, the users and the other interested parties to provide information on the aspects of dumping, injury and the causal link and also on likelihood of dumping and injury to the domestic industry.

Having concluded that there is positive evidence of likelihood of dumping and injury if the existing antidumping duties are allowed to cease, the Authority is of the view that the anti-dumping duty in force on the imports of the product under consideration from the subject country is required to be continued further.

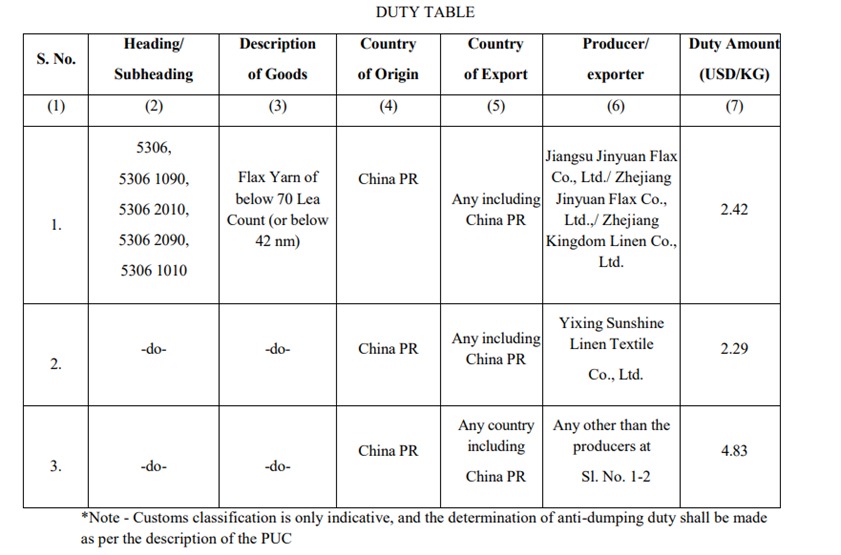

Considering the facts and circumstances of the case, the Designated Authority considers it appropriate to recommend extension of the anti-dumping duties on the imports of the subject goods from the subject country. Accordingly, the anti-dumping duties for producers from China is recommended as per the duty table below.

Thus, in terms of provision contained in Rule 4(d) and Rule l7(l) (b) of the AD Rules, the Authority recommends the continued imposition of the existing anti-dumping duties, so as to remove the likelihood of dumping and injury to the domestic industry.

Accordingly, definitive anti-dumping duty equal to the amount mentioned in column 7 of the duty table below is recommended for the imposition for five (5) years from the date of the Notification to be issued by the Central Government, on all imports of the subject goods originating in or exported from the subject country.

If there is a need to challenge the order of the Central Government resulting from this recommendation, an appeal can be made before the Customs, Excise and Service Tax Appellate Tribunal, following the applicable provisions of the Act.

To Read the full text of the Notiication CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates