DGFT revises Unwrought Silver, Gold and Platinum Import Conditions [Read Notification]

These changes, with effect from the date of issue, harmonize the import regulatory regime with the revised provisions of the Finance Act, 2025, dated 29.03.2025.

DGFT import policy – Unwrought silver import- Foreign Trade Act – Taxscan

DGFT import policy – Unwrought silver import- Foreign Trade Act – Taxscan

The Directorate General of Foreign Trade ( DGFT ) has revised the import policy conditions for unwrought silver, gold and platinum concurring with the Finance Act, 2025. The updated policy, notified through a notification, vide no. 08/2025-26 dated 19th May 2025.

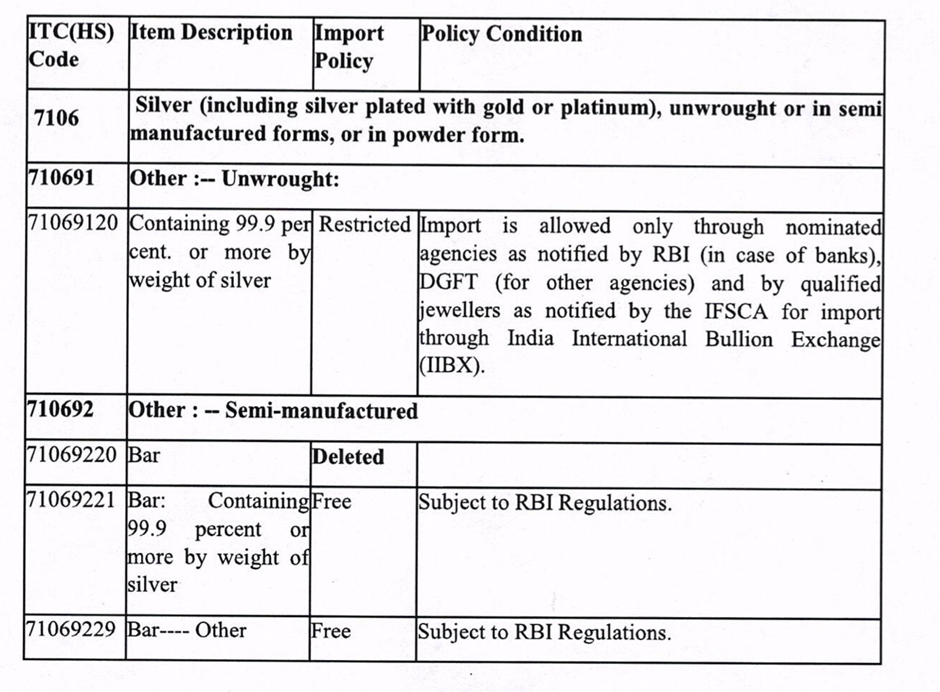

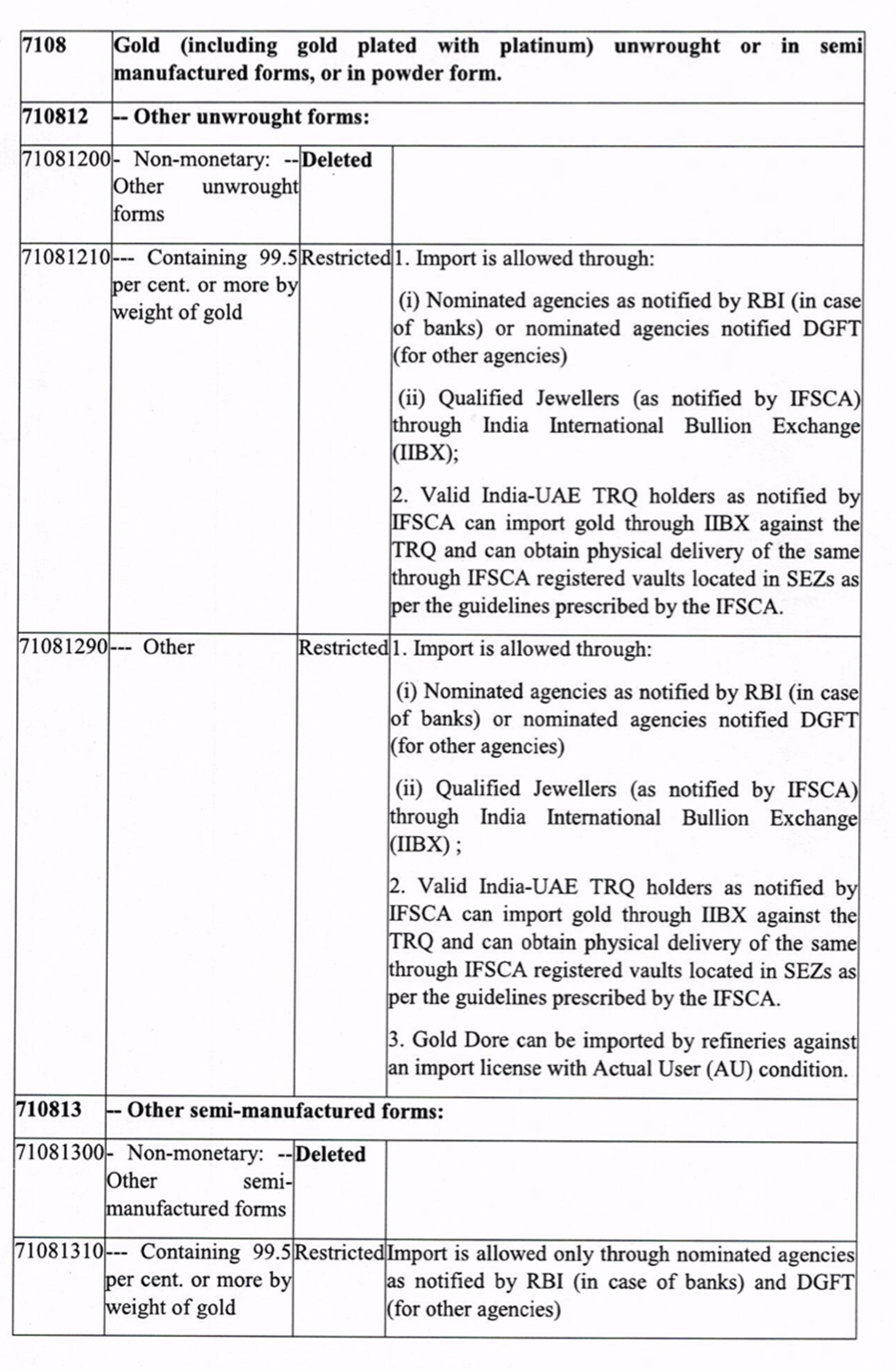

The government, by virtue of powers granted under Section 3 read with Section 5 of the Foreign Trade (Development & Regulation) Act, 1992, and as per Paragraphs 1.02 and 2.01 of the Foreign Trade Policy (FTP) 2023 as amended, has amended Import Policy and Policy Conditions for certain ITC (HS) codes under Chapter 71 of Schedule-I (Import Policy) of ITC (HS) 2022.

Step by Step Guide of Preparing Company Balance Sheet and Profit & Loss Account Click Here

These changes, with effect from the date of issue, harmonize the import regulatory regime with the revised provisions of the Finance Act, 2025, dated 29.03.2025. The notification also specifies the deletion of some ITC (HS) codes and the revised policy conditions relevant to newly established codes under Chapter 71.

Unwrought means something which is not worked into finished condition. Thus, such imports will be made through proper channels as fixed by the government. Under different HS codes, the government has restricted silver including silver plated with gold and platinum, under unwrought, which contains 99.9% or more of weight of silver, the same is restricted.

These cannot be imported freely. However, it can be imported on condition that “it is allowed through nominated agencies as notified by the RBI (in case of banks) and by qualified jewellers as notified by the IFSCA for Import through India International Bullion Exchange (IIBX)”

To Read the full text of the Notification CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates