DGTR imposes Anti-Dumping Duty on ‘Trichloro Isocyanuric Acid’ from China PR and Japan [Read Notification]

The investigation established that the quality of domestically produced TCCA matched imported goods, and the imposition of anti-dumping duties would not adversely affect product availability in India

DGTR imposes – DGTR – Anti-Dumping Duty – Trichloro Isocyanuric Acid – China PR and Japan – taxscan

DGTR imposes – DGTR – Anti-Dumping Duty – Trichloro Isocyanuric Acid – China PR and Japan – taxscan

India's Directorate General of Trade Remedies ( DGTR ) has announced the imposition of anti-dumping duties on imports of Trichloro Isocyanuric Acid (TCCA) imports originating in or exported from China and Japan. It has recommended imposing ADD for 5 years.

The decision follows a detailed investigation under the Customs Tariff Act, 1975, and related rules, which concluded that these imports were causing material injury to the domestic industry.

The investigation began after Bodal Chemicals Limited, the sole domestic producer of TCCA, filed a petition citing dumping concerns. TCCA is widely used as a disinfectant, bleaching agent, and water treatment chemical.

Transform GST Compliance with Expert Drafting Skills - Click here to Register

The preliminary findings issued in May 2024 revealed that imports of TCCA from China and Japan were being sold in India at prices below their normal value. This dumping had notably undercut the prices of the domestic industry, leading to reduced market share, financial losses, and underutilization of production capacity.

The DGTR’s investigation highlighted several critical points:

- Imports of TCCA surged by 236% during the investigation period, dominating the Indian market despite sufficient domestic production capacity.

- The domestic industry was forced to suspend operations in January 2023 due to the adverse impact of dumped imports.

- Price undercutting by imports prevented the domestic industry from increasing prices to offset rising raw material costs, exacerbating financial losses.

The authority’s final findings reaffirmed the preliminary conclusions. The dumping margin was found to be important, and the injury caused to the domestic industry was directly linked to the dumped imports.

Transform GST Compliance with Expert Drafting Skills - Click here to Register

The investigation also established that the quality of domestically produced TCCA matched imported goods, and the imposition of anti-dumping duties would not adversely affect product availability in India. The authority has recommended the imposition of anti-dumping duties for five years, calculated based on the lesser of the dumping margin or injury margin.

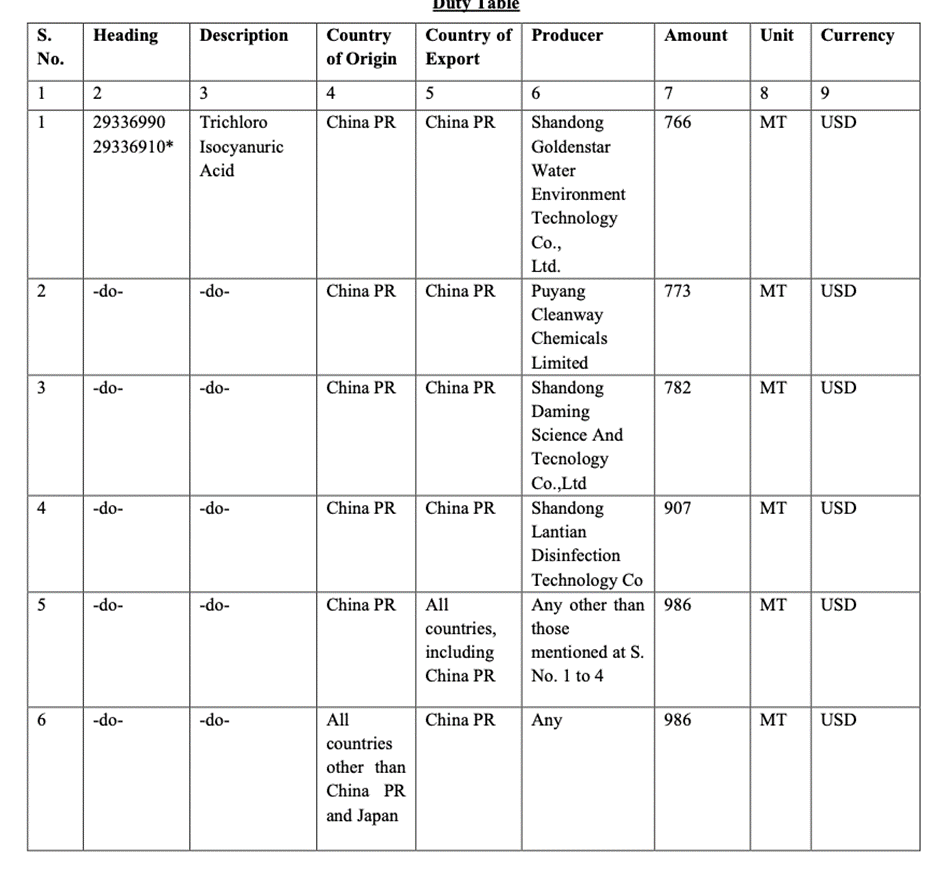

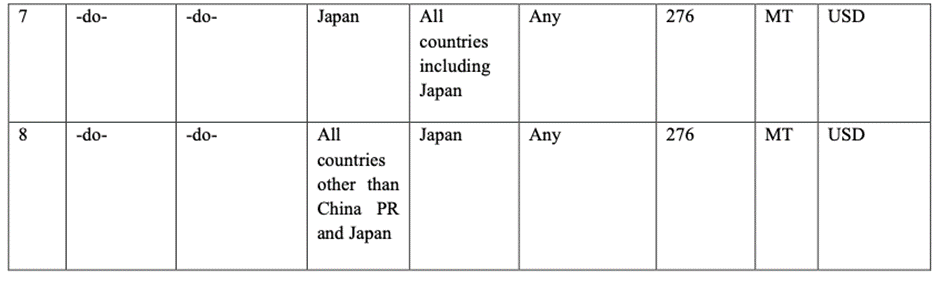

The duty table is as follows:

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates