Difficulty to Resolve Table 8 Error in GSTR-1? Check here to Generate Smooth Summary

Difficulty to Resolve Table 8 Error in GSTR-1 – Check here to Generate Smooth Summary – TAXSCAN

Difficulty to Resolve Table 8 Error in GSTR-1 – Check here to Generate Smooth Summary – TAXSCAN

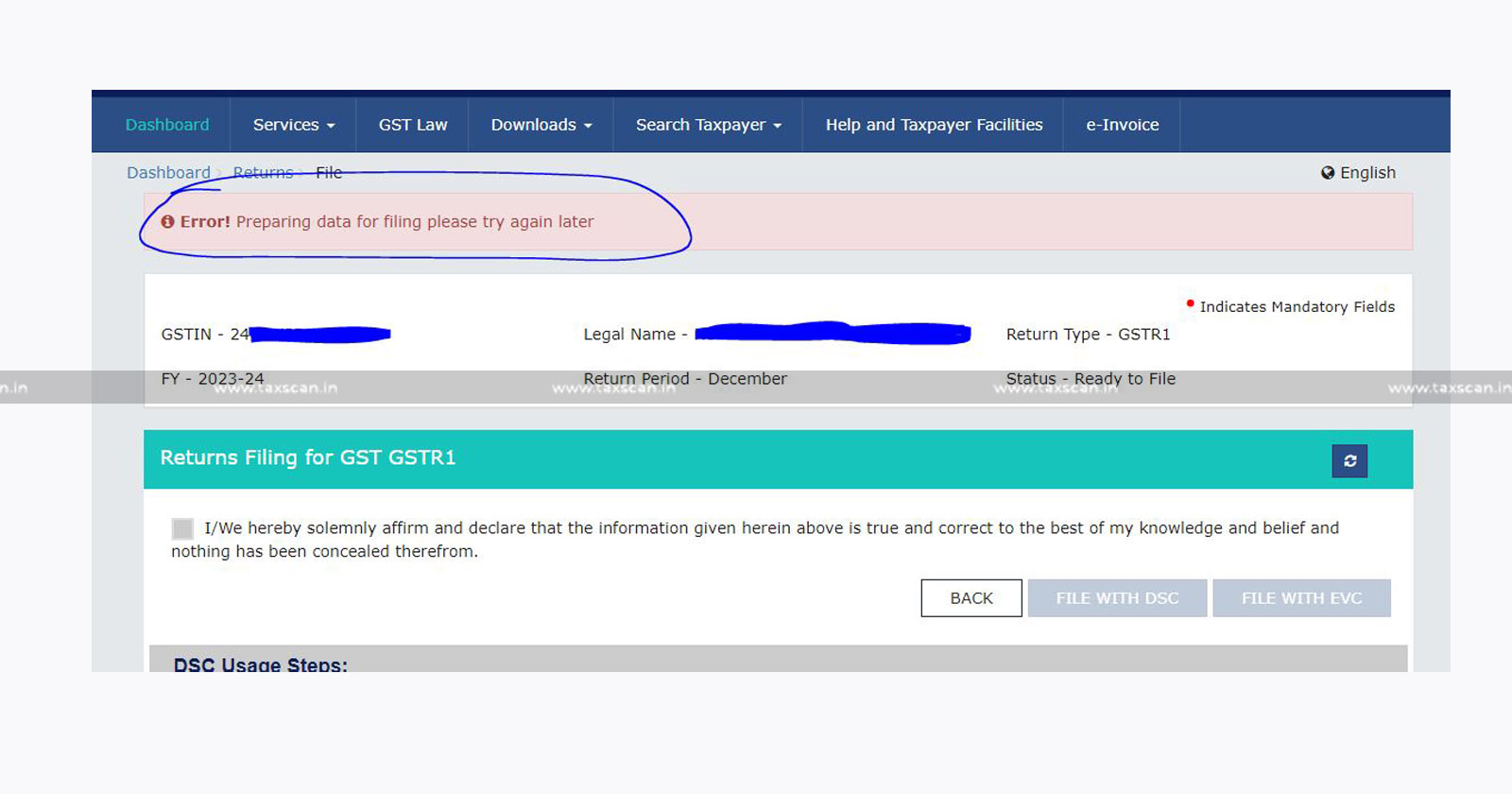

Navigating through the complexities of GSTR-1 can be a challenging task, especially when faced with errors in Table 8. If you find yourself grappling with difficulties in resolving Table 8 errors, you're not alone. However, fret not – we've got you covered.

In this comprehensive guide, we will walk you through the steps to generate a smooth and accurate summary, helping you efficiently tackle and resolve Table 8 errors in your GSTR-1 filing. Let's simplify the process and ensure a hassle-free experience in rectifying these issues.

GSTR - 1

Form GSTR-1 is a monthly/quarterly Statement of Outward Supplies to be furnished by all normal and casual registered taxpayers making outward supplies of goods and services or both and contains details of outward supplies of goods and services.

Every registered taxable person, other than an input service distributor/composition taxpayer/persons liable to deduct tax under Section 51 /persons liable to collect tax under Section 52 is required to file Form GSTR-1, the details of outward supplies of goods and/or services during a tax period, electronically on the GST Portal.

Form GSTR-1 needs to be filed even if there is no business activity (Nil Return) in the tax period. You can opt for Quarterly filing of Form GSTR-1 under following condition:

- If your turnover during the preceding financial year was up to Rs. 5 Crore or

- If you are registered during the current financial year and expect your aggregate turnover to be up to Rs. 5 Crores

Note: In case you have chosen Opt-in for Quarterly Return option, you need to file both Form GSTR-1 and Form GSTR-3B quarterly only.

Table 8 Error Resolving

There is a difficulty faced by the taxpayers in preparing the summary in Table 8. Now, Table 8 has been freshly designed this time to bring in changes of declaration of e-commerce data. Open Table 8 of GSTR 1 and save it. After saving, then generate the summary. The error will be resolved.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates