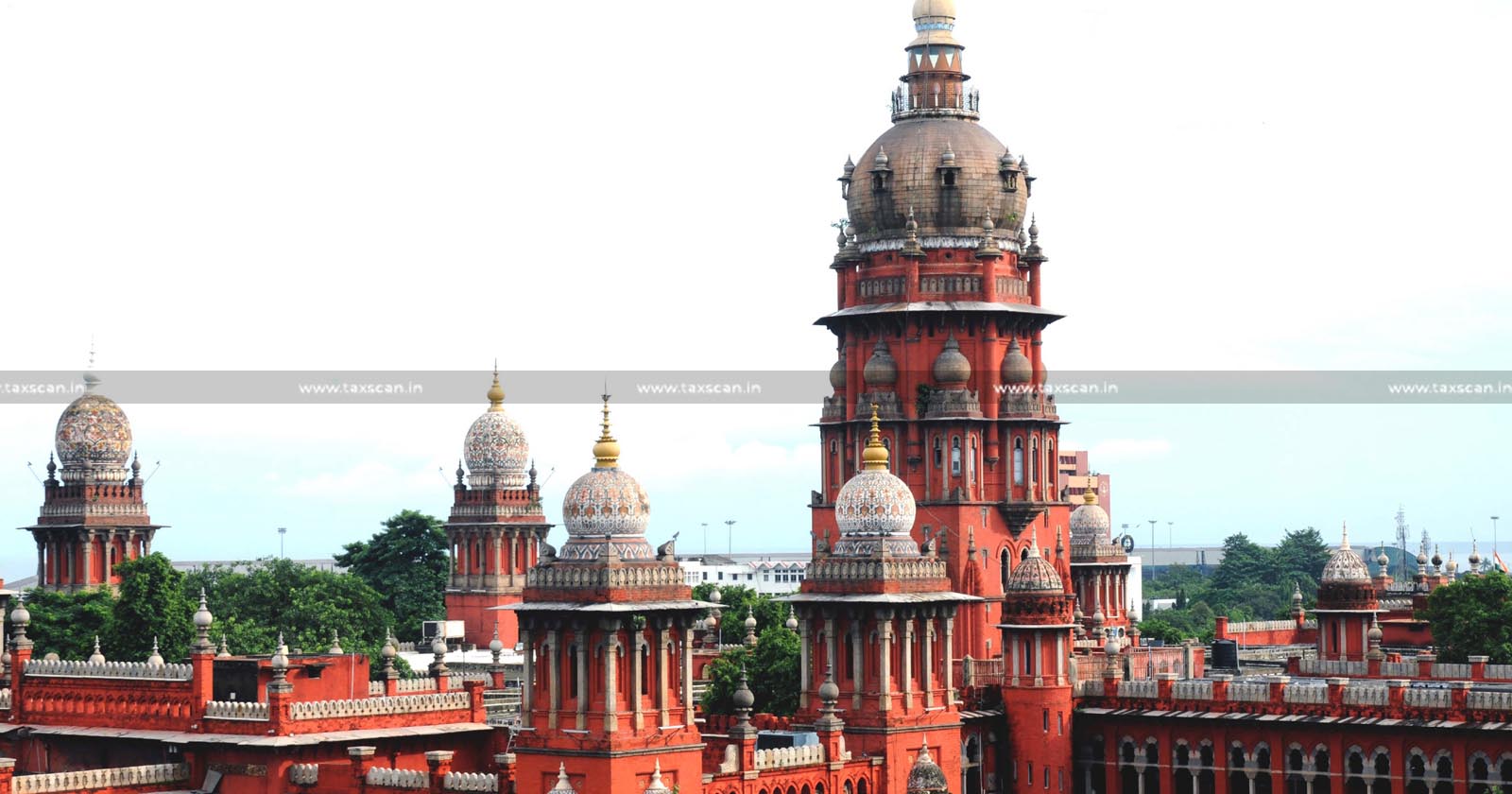

Discharge of Tax Liability: Madras HC Stays Proceedings

Madras HC stays proceedings on discharge of tax liability

Discharge – Tax Liability – Madras HC – Proceedings – taxscan

Discharge – Tax Liability – Madras HC – Proceedings – taxscan

The Madras High Court stayed proceedings in an interim manner as there was discharge of tax liability. The notifications issued under Section 168A of applicable GST enactments are challenged in the writ petition.

The counsel for the petitioner referred to paragraph 4.7 of the impugned order and pointed out that it is recorded therein that the petitioner had discharged the tax liability, albeit under the wrong head of tax. M. Santhanaraman, senior standing counsel, accepted notice for respondents 1 & 3 and V. Prashanth Kiran, Government Advocate, accepted notice for the second respondent.

Section 168A of the Central Goods and Services Tax ( CGST ) Act, 2017 empowers the government to extend the time limit specified, prescribed, or notified under the Act in special circumstances. The primary purpose of Section 168A is to allow the government to provide relief in situations where compliance with the specified time limits becomes impossible due to force majeure events. Section 168A begins with a non-obstante clause, which means that it takes precedence over other provisions of the Act. This clause allows the government to override any conflicting provisions and extend the time limit as needed.

A Single Bench of Justice Senthilkumar Ramamoorthy observed that “Upon examining the order in original, especially paragraph 4.7 thereof, and noticing that the admitted position is that the tax liability was discharged, there shall be an interim stay of further proceedings pursuant to the order in original until the matters are heard next. List these matters on 10.06.2024.”

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates