Document Identification Number (DIN): Structure, Legality and Relevance in GST Laws

Before the introduction of the DIN, there were instances where fraudulent notices were issued by unauthorized individuals claiming to be from the tax department

The Goods and Services Tax (GST) regime in India, which was implemented in July 2017, has brought about significant changes to the country's taxation system. One of the key features of the GST system is the introduction of the Document Identification Number ( DIN ), which serves as an important tool in the administration and enforcement of GST-related processes.

The DIN system is designed to enhance transparency, ensure accountability, and mitigate fraudulent activities, particularly in the context of notices and communications sent to taxpayers by the tax authorities.

In this article, we will explore the structure, legality, and relevance of the Document Identification Number in the context of GST laws.

What is the Document Identification Number (DIN)?

The Document Identification Number (DIN) is a unique number assigned to every communication issued by the GST authorities to a taxpayer. This number is designed to identify the specific document or notice issued, ensuring its authenticity, traceability, and accountability. The concept of the DIN was introduced to prevent the issuance of fraudulent or unauthorized communications from the tax authorities.

The DIN system has been implemented under the Goods and Services Tax Act, which mandates that all communications issued by tax authorities must carry a valid DIN. This includes notices, orders, and any other official documents sent by GST officials.

Structure of DIN

The structure of the Document Identification Number (DIN) follows a specific format, which is critical for maintaining uniformity and easy reference. Typically, a DIN consists of the following elements:

- Prefix: The DIN starts with a unique code that represents the office or department from which the document is being issued.

- Date of Issue: The next segment includes the date on which the document was issued. This helps in tracking the timeline of the communication.

- Serial Number: A unique serial number is generated for each document issued by the tax authorities. This ensures that no two documents issued by the same authority will have the same number.

- Suffix: A suffix may be added, typically to indicate the type of document or communication, such as an order, notice, or letter.

The combination of these elements creates a unique and traceable identifier for each communication, which can be easily verified by both the taxpayer and the tax authorities.

Legality of DIN

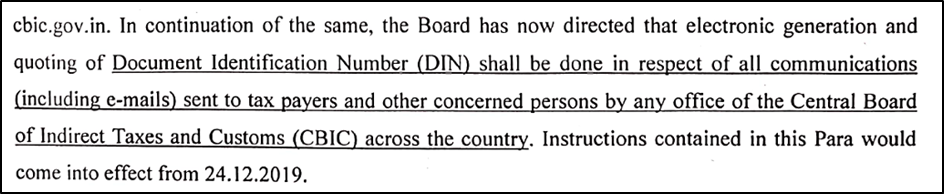

Generation and quoting of Document Identification Number (DIN), was introduced in GST vide the circular no. 122/41/2019-GST dated 5th November 2019. Notably, DIN is to be generated and quoted on all the communication sent by the departmental officers to the taxpayers and/ or any other concerned person.

The introduction of the Document Identification Number (DIN) has legal backing under the provisions of the Goods and Services Tax Act, 2017. The GST Act empowers tax authorities to issue notices, orders, and other official communications to taxpayers for various reasons, such as assessments, audits, and compliance checks.

The use of DIN in these communications is mandatory and is intended to enhance the legitimacy and transparency of the tax administration system. Any communication sent by the tax authorities that does not have a valid DIN is considered to be invalid. This provision aims to prevent the issuance of fake notices, orders, or other documents, which could otherwise be used for fraudulent purposes.

The circular can be accessed at: circular-cgst-128.pdf

Affixing DIN on all the communication issued to taxpayers was made mandatory with effect from 24th December 2019 as per the above circular.

It is important to note that the DIN system was introduced and enforced by the Central Government, applying to all Central Departmental Officers. However, it was up to each State Government to implement the system within their jurisdiction. Despite the Central Government's efforts, most State Governments have not issued any notifications or circulars to adopt the DIN system.

Know When to Say No to Cash Transactions, Click Here

Interestingly, only Karnataka and Kerala have implemented the generation and quoting of DIN on all communications sent by state tax officers to taxpayers. Unfortunately, the other states have not followed this practice, which has compromised the intended purpose of the DIN system.

The legality of the DIN is further reinforced by the fact that it is integrated with the GSTN (Goods and Services Tax Network), which is the IT backbone of the GST system in India. The DIN is linked to the centralized database of GST records, which ensures that every document issued by the authorities is registered and can be cross-verified.

Relevance of DIN in GST Laws

The introduction of the Document Identification Number in the GST regime holds several important advantages and has significant relevance in the smooth functioning of the tax system:

Prevention of Fraudulent Practices

One of the primary purposes of the DIN system is to eliminate the possibility of fake notices or orders being issued to taxpayers. Before the introduction of the DIN, there were instances where fraudulent notices were issued by unauthorized individuals claiming to be from the tax department. The DIN system ensures that all official communications are traceable and can be easily verified as legitimate.

By making it mandatory for all communications to have a DIN, the government has made it more difficult for fraudsters to deceive taxpayers into making payments or complying with non-existent orders.

Increased Transparency

The DIN system enhances transparency in the GST framework by providing a unique identifier for each document. Taxpayers can easily verify the authenticity of any communication they receive by checking the DIN against the records in the GST database. This increases trust in the tax system, as taxpayers can be confident that the documents they are receiving are official and genuine.

Accountability of Tax Authorities

The inclusion of a DIN in all communications holds tax authorities accountable for the notices and orders they issue. If a document lacks a valid DIN, it can be immediately flagged as invalid or unauthorized. This ensures that tax officers cannot act arbitrarily or issue communications without due process.

Additionally, DINs help track the specific office and personnel responsible for issuing a particular communication, promoting further accountability and reducing the possibility of corruption or mistakes within the tax administration, by having a proper paper trail.

Efficient Recordkeeping and Retrieval

Since all communications from the tax department are assigned a unique DIN, it becomes easier to organize, store, and retrieve records. Taxpayers, tax professionals, and the authorities themselves can use the DIN to track documents across the system, making it easier to resolve disputes, check the status of cases, and retrieve relevant information.

Legal Certainty

The DIN system provides legal certainty in the GST framework. Since all notices, orders, and communications issued by the tax department must have a valid DIN, there is a clear and reliable mechanism for determining the authenticity of documents. This legal framework minimizes the potential for disputes and litigation arising from fake notices or procedural errors.

Conclusion

The Document Identification Number (DIN) is an essential component of the GST system that serves to enhance transparency, accountability, and efficiency. It provides a clear structure for identifying official communications issued by tax authorities, helping to prevent fraudulent activities and ensuring that taxpayers receive only legitimate notices and orders.

The legal backing for the DIN system ensures its enforceability, and its relevance within the r GST framework cannot be overstated.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates