DPIIT notifies Standard Mark Mandatory for Drums and Tins [Read Notification]

DPIIT – Standard Mark Mandatory – Standard Mark – Mandatory – Drums and Tins – taxscan

DPIIT – Standard Mark Mandatory – Standard Mark – Mandatory – Drums and Tins – taxscan

The Department for Promotion of Industry and Internal Trade (DPIIT), vide order no. S.O. 4596(E) issued on 21st October 2023 has notified the standard mark mandatory for Drums and Tins. It shall come into force on the expiry of six months from the date of publication of this notification in the Official Gazette. Any person who contravenes the provisions of this Order shall be punishable under the provisions of the Bureau of Indian Standards Act, 2016.

DPIIT in consultation with Bureau of Indian Standards (BIS) and stakeholders has been identifying key products for notifying Quality Control Order (QCO). This has led to the initiation of development of more than 60 new QCOs covering 318 product standards. It includes 7 standards of Drums and Tins.

Drum is a cylindrical container used for packing powder or semi-solid or liquid. Drums are generally used for the transportation and storage of liquids, semi-solids and powders. A tin is a container of tin-coated sheet metal used especially for packing food items in powder or semi-solid or liquid form. Drums and tins are basically used for storing and transporting several different types of toxic, flammable and hazardous substances.

They are widely used across industries including waste management, healthcare and food services etc. So, it is imperative that Drums and tins need to be of good quality in order to protect any type of leakages, adulteration and fire damage etc.

Conformity to standard and compulsory use of Standard Mark:

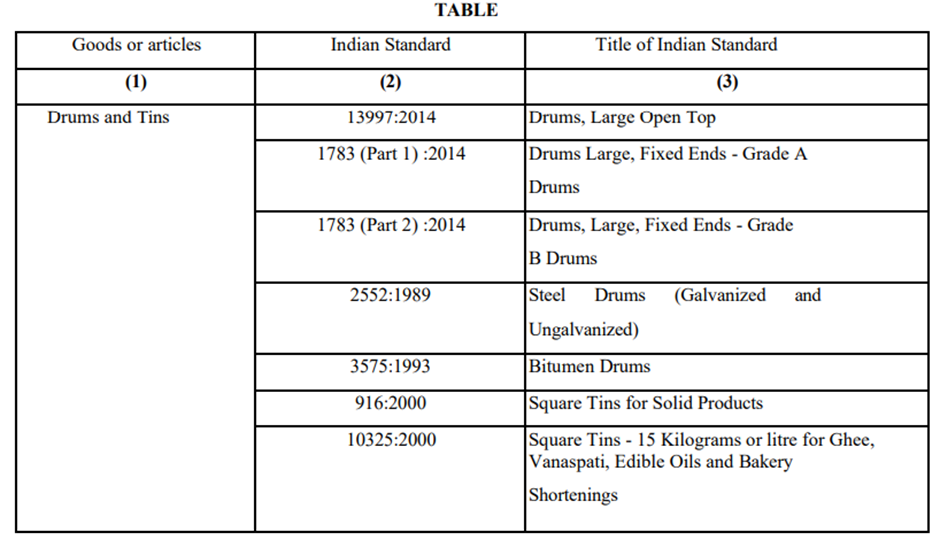

Goods or articles specified in column (1) of the Table shall conform to the corresponding Indian Standard mentioned in column (2) of the Table and shall bear the Standard Mark under a license from the Bureau of Indian Standards as per Scheme-1 of Schedule-II to the Bureau of Indian Standards (Conformity Assessment) Regulations, 2018:

Provided that nothing in this Order shall apply to goods or articles manufactured domestically for export.

Provided further that nothing in this Order shall apply to goods or articles filled with material in powder or semi-solid or liquid form, when imported into India.

Provided also that in relation to micro enterprises, as defined under clauses (h) and (m), respectively of Section 2 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006), it shall come into force on the expiry of twelve months from the date of publication of this notification.

Provided also that in relation to small enterprises, as defined under clauses (h) and (m), respectively of Section 2 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006), it shall come into force on the expiry of nine months from the date of publication of this notification.

To Read the full text of the Notification CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates