Faceless CIT(Appeals) or Mindless CIT(Rejections)? Know what the professionals have to say

Faceless CIT – CIT – Appeal – Appeals – Mindless CIT – Rejections – professionals – Income Tax Faceless Assessments – Faceless Assessments – Assessments – Tax – tax news – taxscan

Faceless CIT – CIT – Appeal – Appeals – Mindless CIT – Rejections – professionals – Income Tax Faceless Assessments – Faceless Assessments – Assessments – Tax – tax news – taxscan

The Income Tax Faceless Assessments and appeals system is facing much criticism from the side of professionals and taxpayers alike, for being mindless about rejection of grounds of appeal and contentions raised in notices post-assessment.

The whole faceless system is now under the radar for being not what it was intended to be, and rejecting ground without application of mind. Allegedly, there are also matters where the first ground of appeal is rejected, after due discussion and the rest of the grounds are left in ignorance.

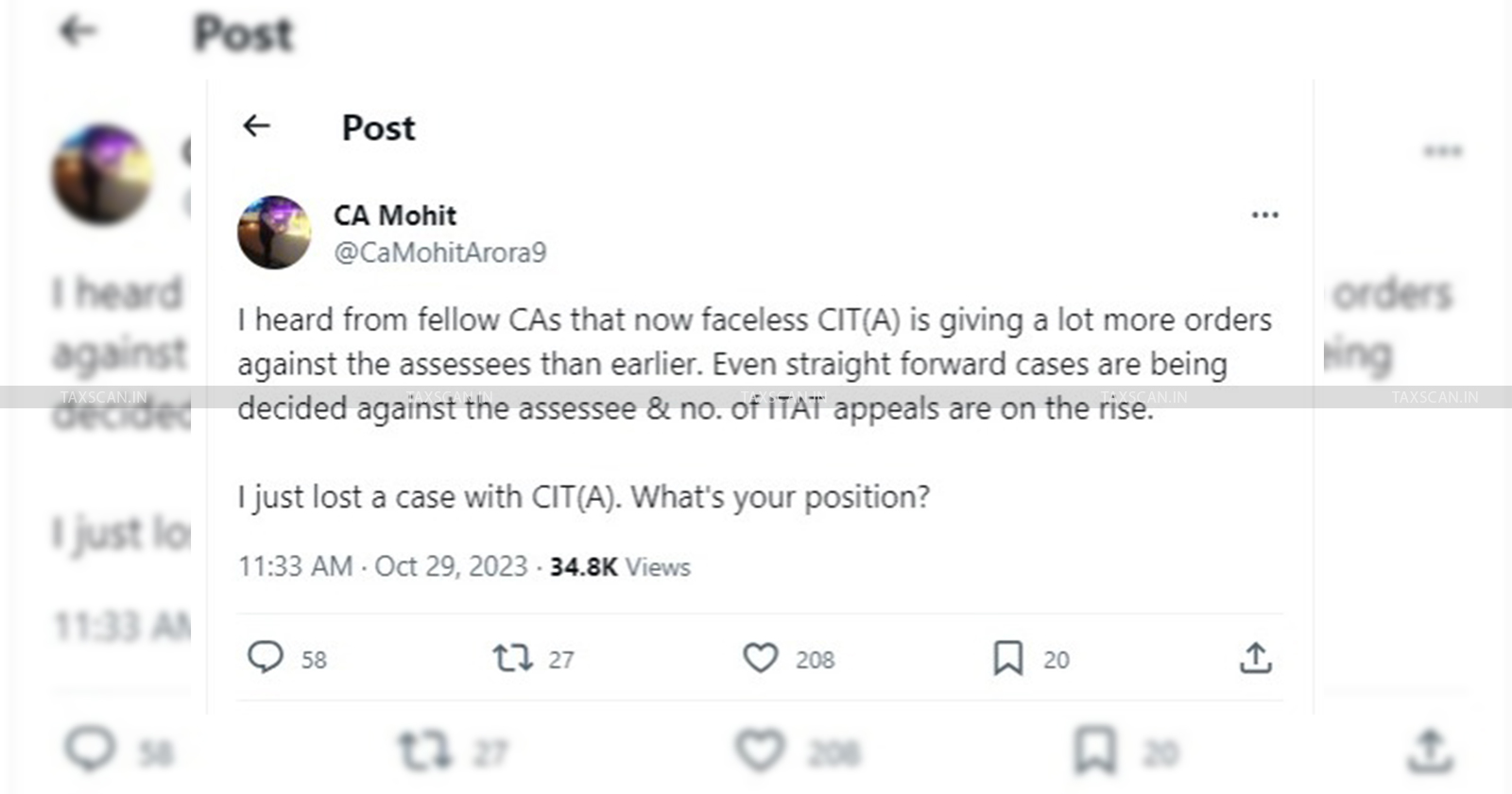

Chartered Accountants like Mohit Arora took to twitter to voice their concerns. The following tweets reveal the gravity and extent of the issue.

“When human has to process the assessments and appeals then he/she prefer traditional approach. Faceless is successful only in case of 100% humanless approach else traditional approach”, CA Vaibhav Garg opined.

Further, the issuance of notices in ignorance of earlier replies are also an alarming issue, giving up the basic natural justice principles.

“Not just faceless, in every appeal that is the case.”, CA Akhil Agrawal tweeted in reply.

These are only a few examples of how the faceless assessment and appeals scheme has turned out to be disastrous for taxpayers, to the extent that CAs are forced to advise clients in advance that they may have to go upto ITAT to get a resolution.

In light of the mounting concerns and experiences shared by professionals, including Chartered Accountants, it is imperative that the authorities take swift and decisive action to address the flaws within the Faceless Assessments and appeals system.

The reported instances of mindless rejections, ignorance of grounds, and issuance of notices without consideration of earlier replies are not only compromising the principles of natural justice but also eroding the intended efficiency of the system.

It is crucial for the concerned authorities to conduct a thorough review and implementation of corrective measures to restore faith in the fairness and effectiveness of the Faceless Assessment and appeals process. Timely action will not only uphold the principles of justice but also contribute to the credibility of the income tax system.

Taxpayers and professionals alike deserve a transparent and just system that aligns with the spirit of the Faceless Assessments initiative. The urgency of this matter cannot be overstated, and immediate intervention is essential to ensure the system operates as intended, providing a fair and impartial resolution for all stakeholders involved.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates