Fake Alert! Fake Income Tax Notice Claiming Payment Requirement for Audited Balance Sheets makes Rounds, warns Govt

Fake Income Tax Notices asking for payment for audited balance sheets make rounds on Social Media and mails of taxpayers. Beware!

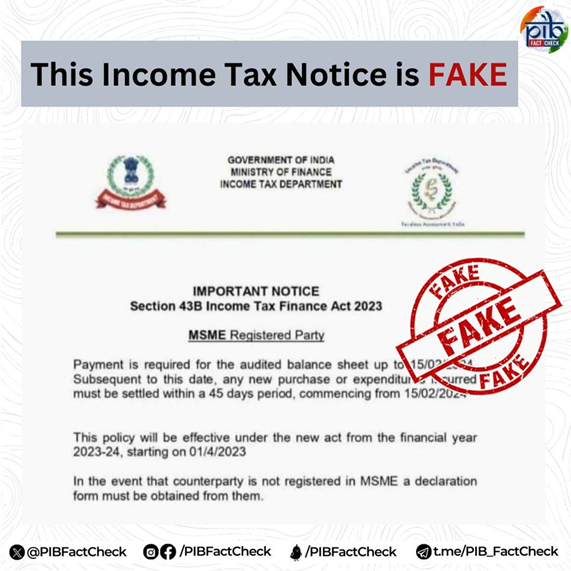

The Indian government has issued a warning about a fake income tax notice circulating online. The notice, which claims to be from the Income Tax Department, demands payment for audited balance sheets up to February 15, 2024.

However, the government has confirmed that the notice is fake and no such payment is required.

What is the fake notice about?

The fake notice claims that all MSME registered businesses must pay for their audited balance sheets by February 15, 2024. The notice also states that any new purchases or expenditures made after this date must be settled within 45 days.

The notice appears to be formatted like an official government document, complete with the logos of the Ministry of Finance and the Income Tax Department. However, there are several red flags that indicate the notice is fake.

Taxpayers are also advised by the IT Department to verify the authenticity of any suspicious notices at the official Government Website: incometax.gov.in.

How to spot the fake notice?

The notice contains grammatical errors and typos.

The notice refers to a non-existent section of the Income Tax Act, Section 43B.

The notice demands payment to be made through unspecified channels, which is not how the Income Tax Department collects taxes.

What to do if you receive a fake/suspicious notice?

Do not make any payments.

Report the notice to the Income Tax Department.

Be aware of other phishing scams that target taxpayers.

The government has advised taxpayers to be vigilant and to verify any suspicious notifications with the Income Tax Department before taking any action.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates