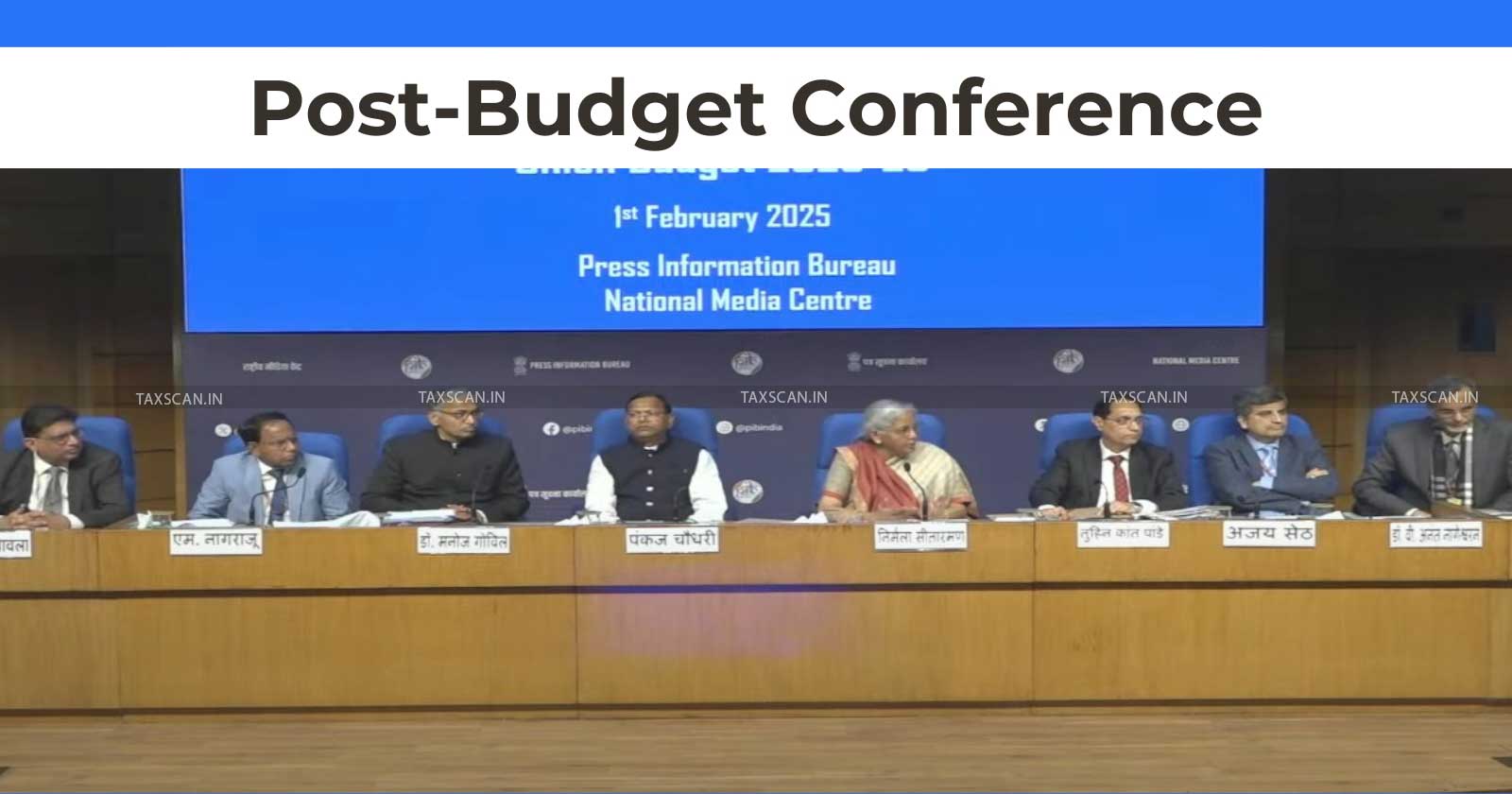

FM Nirmala Sitharaman holds Post-Budget Conference: Key Takeaways

Income Tax Simplification Works Completed within Six Months, says FM

Finance Minister Nirmala Sitharaman – Union Budget 2025 – Budget 2025 Updates – Budget Conference – Taxscan

Finance Minister Nirmala Sitharaman – Union Budget 2025 – Budget 2025 Updates – Budget Conference – Taxscan

The Union Finance Minister Nirmala Sitharaman has addressed the Press through the Post-Budget Conference after tabling the Budget 2025-2026 before both the houses of the parliament. This article attempts to take a look at the noteworthy mentions from the Press Meet.

It was reiterated that Capital Expenditure has an acknowledged multiplier effect on the economy and the same is retained without any reductions. Notable discussions were held on the revised income tax slabs and S. 87A Rebates as well as the revenue expected to be foregone by the same, the figures coming up to around Rs. 1 Lakh Crore. The increased spending is also expected to compensate for the revenue foregone as replied by Ajay Seth, (Secretary) Department of Economic Affairs.

It was also clarified that the New Income Tax Statute/Code will have no bearing on the existing/proposed slabs and tax rates, but will be a simpler and easily understandable version of the existing Income Tax Act, 1961. Given the naming pattern of the laws enacted by the same government in the preceding years, the name of the act can be expected to be Bhartiya Aykar Adhiniyam, 2025.

Get Complete Coverage on Budget 2025-26

Explaining the applicability of the Income Tax rebate under Section 87A on Capital Gains, which are taxed under special rates, it was pointed out by the Finance Minister that calculation of income does not include “Capital Gains”, which was backed by the Finance Secretary Tuhin Kant Pandey.

Commenting towards the question as to whether the victory of Donald Trump in the US Presidential election and the following events had any bearing on the decision to ease out tax burden on the middle class, FM Nirmala Sitharaman replied in the negative and stated that the decision was made under the guidance of the Prime Minister aimed at welfare of the middle class.

75% has already moved to the new income tax regime, stated the finance secretary in response to a question on adoption rate of the new regime.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates