Form 12BB: Things to know about Investment Declaration tool for Tax Saving

Form 12BB – Things – investment declaration tool – tax saving – taxscan

Form 12BB – Things – investment declaration tool – tax saving – taxscan

Investment declaration guide: With the onset of tax season, employees are required to declare their investments and expenses to their employers for hassle-free financial management and seeking tax benefits.

The employees who fall under the taxable income bracket are eligible to submit a key document - Form 12BB - to their employees for tax deduction purposes under section 192 of the Income Tax Act of 1961.

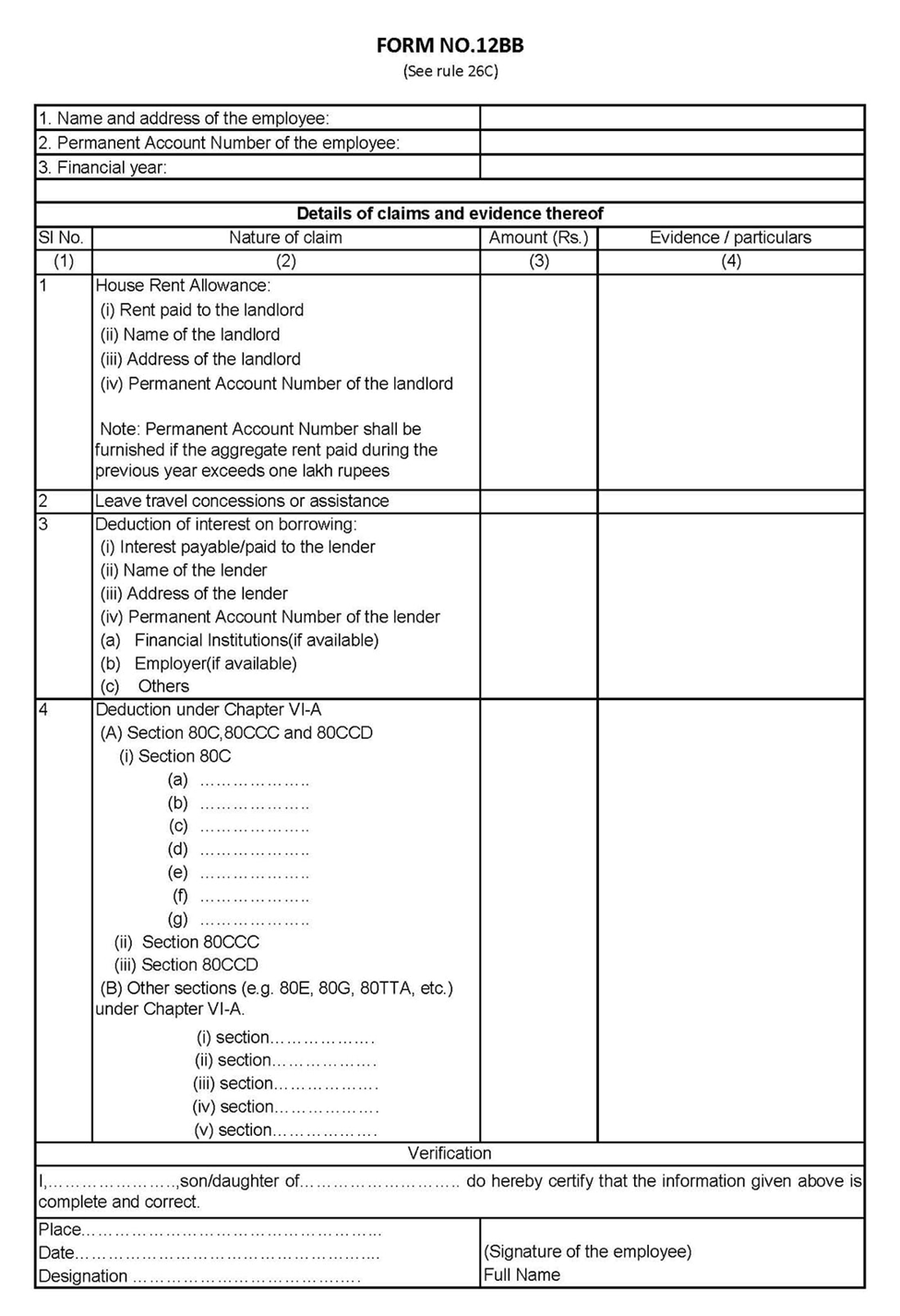

Form 12BB is a statement of claims by an employee for deduction of tax. With effect from 1st June 2016, a salaried employee is required to submit Form 12BB to his or her employee to claim tax benefits or rebates on investments and expenses. Form 12BB has to be submitted at the end of the financial year. Form 12BB applies to all salaried taxpayers.

Using Form 12BB, an employee has to declare the investments that they have made during the year. Documentary evidence of these investments and expenses has to be provided at the end of the financial year as well.

The Form 12BB is used to fill out information of an employee's particular claims on their salary package to claim tax deductions. These claims include various allowances such as house rent allowance, food and conveyance, and leave travel concessions, among other things, which are part of one's salary package.

Is Form 12BB applicable to the new tax regime?

The new tax regime, implemented in 2020, is a simplified version of the older system. In this optional system, the Centre has eliminated most of the exemptions that were otherwise offered. Consequently, the employees opting for this system cannot claim any exemptions in Form 12BB but are required to submit it anyway.

Notably, they can still seek benefits such as standard deduction of Rs 50,000 and rebate under Section 87A up to Rs 25,000 under the new system. To be specific, the effective tax-free income under the old tax regime stands at Rs 5.5 lakh, and at Rs 7.5 lakh under the new tax regime.

A sample Form 12BB may be downloaded from the online portal of the income tax department. The document copy can also be sought from the respective employer organisation.

What claims can be made in Form 12BB?

According to Indian tax laws, employees can submit particular claims related to various allowances in Form 12BB. The document is divided into four main sections, including house rent allowance, leave travel concessions or assistance, deduction of interest on borrowing and other deductions under Sections 80C, 80CCC and 80CCD.

Other than claims for rental dues and travel allowances, employees can claim deductions on life insurance premiums, Public Provident Fund, Equity Linked Savings Scheme or ELSS funds, school tuition fees for children, etc.

These Sections also allow one to claim benefits on the National Pension Scheme and health insurance plans, among other things.

Form 12BB: Purpose, Sample, How to Download and Fill Form 12BB

The investments declaration must be made at the start of each fiscal year. In order to properly deduct taxes from your monthly salary, your employer requests that you submit all of your tax-saving investments for the year. You should declare your investments because doing so could increase your take-home pay.

At the beginning of the financial year, you have to just make an estimate of the investments that you intend to make. You don’t need to submit actual proofs until the end of the financial year. You can actually invest less or more. The eventual investments don’t have to be exactly as declared.

Filling out Form 12BB isn't as daunting as it seems. This guide will walk you through each section, explaining what information to include and how to claim maximum tax benefits.

Part I: Personal Details

● Full Name

● Address

● PAN (Permanent Account Number)

● Financial Year (Current year: 2023-24)

Part II: Details of claims and evidence

1. House rent allowance

If you live in a rented accommodation and have HRA as a part of your CTC, you can claim HRA exemption by submitting the following details -

● Amount of Rent paid to landlord

● Name of your landlord

● Address of your landlord

● PAN No. of your landlord if the total rent paid during the year is more than Rs.1 lakh.

● Submit proof: Monthly rent receipts or rental agreement

Find out the HRA tax exempt amount with our free HRA calculator.

● If HRA is not a part of your CTC, and you live in a rented house, you can claim a similar tax deduction under section 80GG.

● You only need a rent receipt if your monthly rent is more than Rs. 3,000.

● You can’t claim HRA exemption if you are living in your own house.

● If you're paying rent to your parents, it's advisable for them to report it as part of their income when filing their Income Tax Return.

● Avoid submitting fake rent receipts; doing so could land you in trouble with tax authorities.

● It is advisable to print a formal rent agreement on stamp paper.

Know more about how to claim a house rent allowance.

2. Leave travel concessions or Leave Travel Allowance (LTA)

To claim LTA benefit, you will have to submit travel documents like boarding passes, flight tickets, or travel agent invoices to your employer.

● Eligibility: LTA is only available if it's part of your CTC.

● Who Can Benefit: You, your spouse, children, dependent parents, and dependent siblings.

● Frequency: You can claim LTA twice within a four-year block (current block: 2022-2025).

● Carry-Forward Option: If you claimed only one LTA in the previous block, you can carry it forward and use it in the next block's first calendar year.

● Domestic Travel Only: LTA applies only to domestic travel, not international trips. No exemption for accommodation expenses.

You're eligible to deduct the interest on your home loan as per Section 24 of the Income Tax Act. This deduction applies to the interest paid on a loan taken for building, rebuilding, repairing, buying, or renovating your home.

When filling out Form 12BB, you need to provide the following details:

● The interest you paid or payable to the lender during the financial year along with name, address and PAN/Aadhaar number of the lender

There are various other tax saving benefits of a home loan:

● Interest Payment: Deduct interest paid on loans for purchase, construction, renovation, or repair (up to Rs. 2 lakh for self-occupied property, entire amount for rented property).

● Principal Repayment: Deduct up to Rs. 1.5 lakh under Section 80C (valid for both self-occupied and rented property).

● Deduction for First-Time Buyers:

● Section 80EE: Up to Rs. 50,000 additional deduction for loans below Rs. 35 lakh on properties under Rs. 50 lakh (valid for loans sanctioned till March 31st, 2017).

● Section 80EEA: Up to Rs. 1.5 lakh additional deduction for loans on properties with stamp duty value below Rs. 45 lakh (valid for loans sanctioned between April 1st, 2019, to March 31st, 2022).

Evidence required to be submitted:

● Interest Certificate: From your lender, showing interest paid and loan type.

● Possession/Completion Certificate: For new or renovated properties.

● Self-Declaration: Whether the property is self-occupied or rented.

Form 12BB: Purpose, Sample, How to Download and Fill Form 12BB

The investments declaration must be made at the start of each fiscal year. In order to properly deduct taxes from your monthly salary, your employer requests that you submit all of your tax-saving investments for the year. You should declare your investments because doing so could increase your take-home pay.

At the beginning of the financial year, you have to just make an estimate of the investments that you intend to make. You don’t need to submit actual proofs until the end of the financial year. You can actually invest less or more. The eventual investments don’t have to be exactly as declared.

Form 12BB Sample

4. Deductions under Section 80C, 80CCC, 80CCD

Chapter VI-A of the income tax act covers deductions under various sections like 80C (investments), 80D (medical insurance), and 80G (donations). To claim these deductions, you can submit following proof of your investments or expenses:

| Deduction Type | Investment Proof |

| Public Provident Fund | - Copy of the stamped deposit receipt paid during the current financial year, or, - Copy of passbook clearly mentioning the PPF account. |

| ELSS mutual fund | Copy of investment certificate in your name with date of investment, investment amount, type of investment, etc. If you are submitting the proofs in Jan and plan to continue the SIP for FEB and March, you can declare it for those months as well. |

| Life insurance policy | Premiums paid towards life insurance for self, spouse and/or children |

| Tax-saving FDs | Copy of the deposit receipt, or passbook |

| NSC | Copy of NSC Certificate in the name of the employee |

| Tuition Fees of children | Copy of tuition fees receipt paid to educational institutions along with the nature of payment (donation fees, capitation fees, sports fees, transport fees, uniform and stationery fees, etc. |

| Post Office Term Deposit | Copy of deposit receipt (qualifying deposits are deposits over 5 years) |

| Preventive Health check-ups under section 80D | Copy of premium receipt paid during the year. Copy of the bills of preventive health check-ups in the name of employee or family |

| Medical expenses under section 80DD (for handicapped dependent) | Proof of amount spent for medical treatment, training and rehabilitation of handicapped dependent, or, Amount paid towards or deposited in any scheme of LIC, UTI or any other Board approved insurer for maintenance of handicapped dependent. Form 10-1A |

| Interest paid on higher education loan | Copy of the bank certificate mentioning the principal and the interest amount paid and the amount payable |

| Deduction under section 80U | Deduction for disability up to Rs. 75,000 (Rs. 1,25,000 for severe disability) can be availed after providing a medical certificate from any Government Hospital. A copy of certificate in Form 10-1A issued by a competent medical authority stating the percentage of disability should be submitted as proof |

| Donations under section 80G | Valid receipts for the donations made that qualify for deduction under this section. Receipts should be in the name of the employee. |

Part III: Verification

The final step in Form 12BB is verifying the details you've provided. Simply fill in your name, your parent's name, city, and the date along with your signature.

What is the purpose of an investment declaration?

Employees have to submit a declaration of deductions and exemptions that they want to claim. The employer will deduct TDS from the employee’s salary on the basis of these declarations. These investments are generally required to be made on the employer’s HR portal.

What is an Investment Declaration?

If you are a salaried person, you must know that a portion of your salary is deducted against Income Tax (Tax Deducted at Source, TDS) and remitted to the government. For this, an employer asks you to submit details of your tax-saving instruments and deductions to compute the TDS correctly.

So, investment declaration is a self-declaration form of estimated tax liability submitted by you to your employer at the start of the financial year, aka the tax season. But don’t worry if you don’t remember the date, as many organizations send communications to their employees regarding their investment declaration form submission. Sharing the details with the employer from the very start will help the company compute the correct TDS. This will make you eligible for tax savings.

However, the declaration is not just restricted to investments. It can be extended to other deductions such as loss from the home property due to interest repayment of home loan, housing loan repayment, tuition fees, first-time home buyers, and more.

What happens if you skip investment declaration?

Employees are required to submit their proof of investments in Form 12BB to claim any benefits. Insufficient proof or missing the investment declaration deadline will result in the deduction of TDS (tax deducted at source) from every employee's net income by their employers.

Can an employee claim a refund on TDS?

While it is advised to be up-to-date on submitting investment declarations as per the respective company deadlines, in the event an employee fails to do so and faces a TDS deduction, they can claim a refund on the same while filing their income tax return.

Investment declaration can be made for the following investments:

1. Home loan interest:

Your home loan might be incurring a significant amount of interest every year. Apart from declaring in Form 12BB the name, address and PAN of the lender, you may be required to submit the provisional interest certificate that specifies the principal amount for the year and break-up of interest on provisional basis. This provisional interest certificate has to be obtained from the lending bank or financial institution.

2. House rent allowance:

You can claim the house rent payable to the landlord. The only details required are the owner's name, address and PAN.

3. Leave travel concession or allowance:

You can claim this amount only if it is included in your salary package.

4. Medical claim premium:

The premium you pay towards health insurance qualifies for tax benefits under section 80 D of the Income Tax Act. Make sure you declare the premium amount in your tax declaration.

5. Deductions under:

● Section 80C- Premiums paid towards a life insurance policy or investments made in tax saving mutual funds may be claimed as a deduction.

● Section 80CCD- It includes the amounts paid towards NPS.

● Section 80E - Interest paid on education loan.

● Section80G: Donations made to Government/specified organizations (mostly NGOs).

Tax saving options under Section 80C

Let’s look at the best tax-saving plans under Section 80C:

1. Equity Linked Saving Scheme (ELSS)

2. Unit Linked Insurance Plan (ULIP)

3. National System (NPS)

4. Public Provident Fund (PPF)

5. Fixed Deposit (FD)

6. National Savings Certificate (NSC)

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates