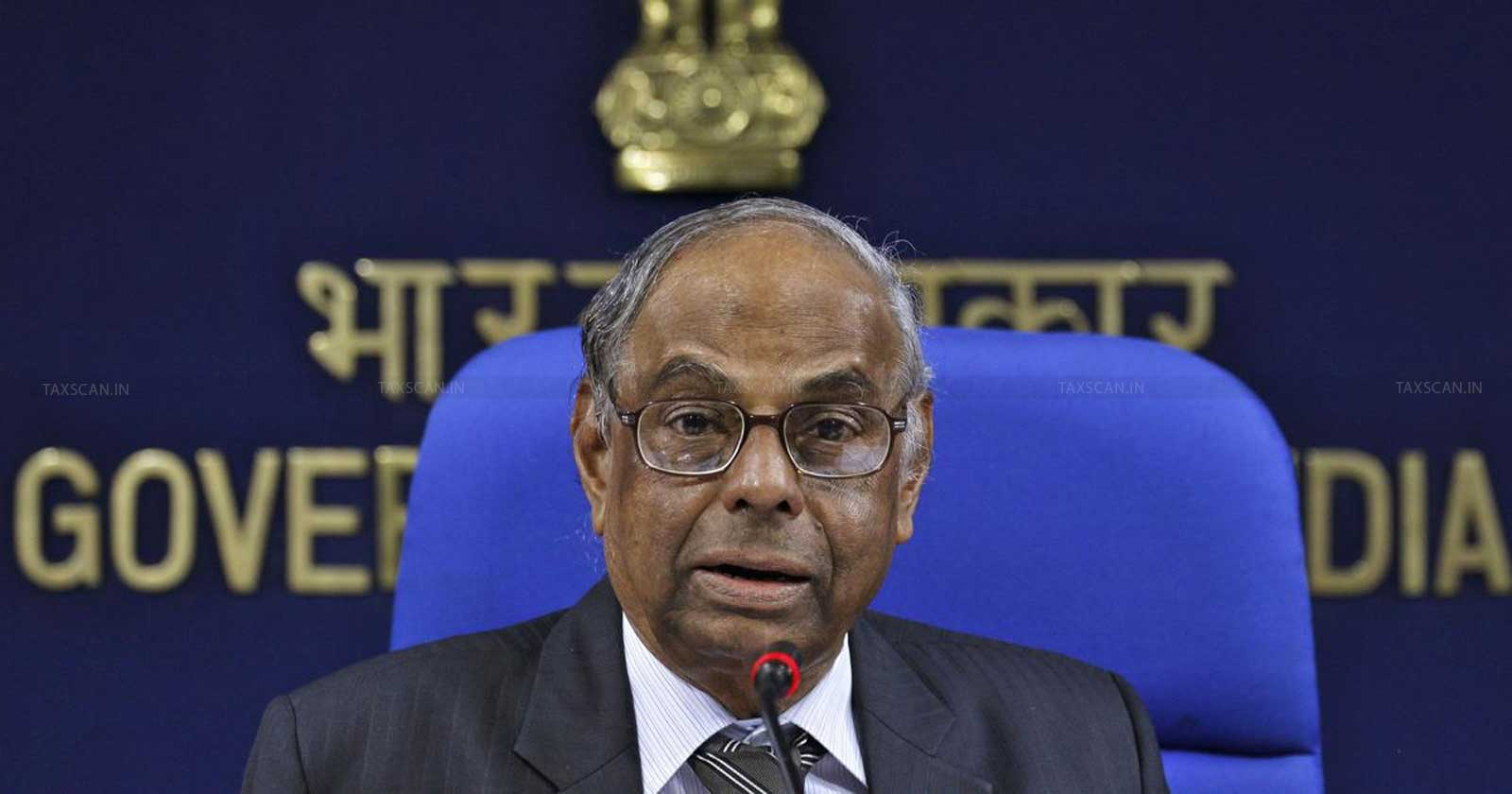

Former RBI Governor C Rangarajan Pushes for State Income Tax to Boost Revenue

The former governor has suggested introducing a state income tax on employees to diversify revenue streams and reduce dependence on volatile indirect taxes

The former Governor of Reserve Bank of India ( RBI ), C. Rangarajan advocates for the levy of state income tax to boost the revenue, where they mainly rely on tobacco products, petroleum and alcohol.

The former RBI governor has suggested a US model of taxation. According to him, the revenue from petroleum will go down, thus affecting the state in their revenue. He said that "Thirty per cent of our import is oil, and therefore energy security becomes a critical issue." He also suggested levying direct tax on expenditure and financial transactions.

"You levy a tax on every financial transaction. I was opposed to it when we wanted the financial system to develop. You will get a huge amount, and you have to keep the tax (Tobin tax) at a very low level," he said to Economic Times.

Affective Ways Of Tax Planning for HUF, Partnership Firm and Will, Click Here

The state governments currently generate revenue from various sources, including SGST, stamp and registration fees, entertainment tax, grants from the central government, and taxes on alcohol, tobacco, and petroleum products.

States with industrial activity or manufacturing plants benefit from additional revenue through these industries. However, states without such economic advantages primarily depend on indirect taxes, stamp duties, and revenue from alcohol and similar sources.

In this context, former RBI Governor C. Rangarajan has suggested introducing a state income tax on employees to diversify revenue streams and reduce dependence on volatile indirect taxes.

While this proposal could boost the state finances, it raises critical concerns. Employees are already burdened by central taxes, and an additional state income tax would further reduce their disposable income. This could negatively impact consumer spending, savings, and overall economic activity, particularly for the salaried class. Balancing fiscal needs with taxpayer welfare remains a huge challenge in implementing such a measure.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates