Gauhati HC directs CIT to refund Income tax deducted from the salary of BSF officer

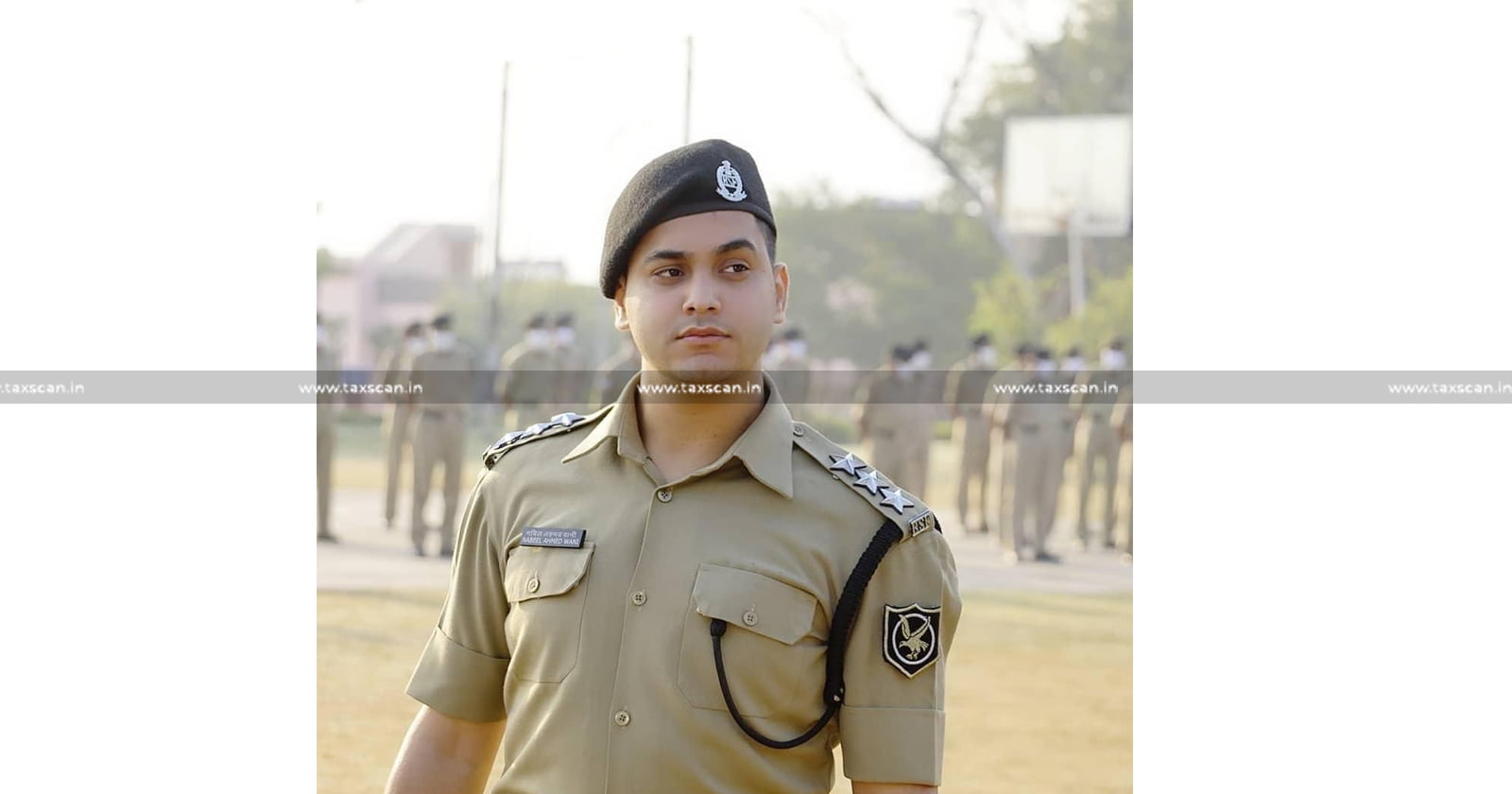

The Gauhati High Court (HC)has directed the Commissioner of Income Tax (TDS) to expeditiously process the request for a refund of income tax deducted from the salary of the DIG (Ops) of the Border Security Force (BSF), who is a member of the scheduled tribe.

Chyawan Prakash Meena, the petitioner is serving as a DIG (Ops) of the Border Security Force and is posted in Masimpur, Silchar, Assam. The petitioner contended that he is a member of a recognized Schedule Tribe from the State of Rajasthan under Article 342 of the Constitution of India and is therefore entitled to Income Tax Exemption as provided under Section 10(26) of the Income Tax Act, 1961.

In Pradip Kr. Taye and Ors. Vs. Union of India and Ors reported in (2010) it was held that persons belonging to Schedule Tribe will be eligible to the benefit of Section 10(26) of the IT Act, 1961 irrespective of their places of posting.

In terms of the provisions of this Section, any member of a Scheduled Tribe as defined in Clause (25) of Article 366 of the Constitution, residing in any of the areas prescribed under Section 10(26), is exempted from payment of income tax.

It was contended that the petitioner belongs to the "Meena" community, which is considered a Schedule Tribe under the Constitutional Scheduled Tribe State Order 1951 in theState of Rajasthan.Further stated that since he is certified to be a member of the Schedule Tribe "Meena" in the State of Rajasthan and, by that,he is exempt from payment of income tax under the provisions of Section 10(26) of the Income Tax Act, 1961, income tax has been deducted from his salary in the form of Taxes Deducted at Source (TDS).

The single bench of Justice Soumitra Saikia has observed that the petitioner is indeed entitled to the benefits accrued under Section 10(26) of the Income Tax Act, 1961 and directed the respondent department to refund the amount within a period of three (3) weeks from the date of receipt of a certified copy of this order.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to TaxscanAdFree. Follow us on Telegram for quick updates.

CHYAWAN PRAKASH MEENA vs THE UNION OF INDIA AND 3 ORS , 2023 TAXSCAN (HC) 535 , MR. A GOYAL , DY.S.G.I