Gone Bananas: Pazhampori set to be doused in 18% GST

The latest tax slap comes following a 2024 Kerala AAR ruling imposing 18% GST on various pre-cooked Kerala-origin food stuff

The Pazhampori is Malayalis’ much adored contribution to the world. A sweet snack made of ripe banana slices immersed in a flour-batter and deep fried in oil, the first bite goes straight to your heart. Often paired with hot ‘Chaaya’, the humble banana fritter has been referred to by numerous monikers – ‘pazhampori’, ‘vazhakkappam’ and ‘ethakkappam’ being some of them.

A cultural icon, the pazhampori is loved equally by people across all spheres of life, the proposed levy of 18% Goods and Services Tax (GST) comes as a major upset towards the connoisseurs of the snack.

GST laws differentiate the levy of GST on products based upon the input materials and preparatory steps used to create the final product as per the classification norms under the Harmonized System of Nomenclature (HSN).

The HSN System formulated by the World Customs Organisation, provides a standardized tax format for items, however the GST Council exercises powers to set requisite GST rates for the different products.

Read More: How Much GST Do You Eat in a Day? Analysis of GST on an Average Indian Diet

The Bakers Association Kerala (Bake), the representative body of Medium and Small Enterprises (MSMEs) bakeries and allied manufacturers in Kerala have expressed that different sweetmeats such as ‘ada’, ‘vada’, ‘unniyappam’ and ‘kozhukatta’ have all been taxed differently under the GST regime owing to variations in ingredients and preparations.

A number of local eateries and bakeries preparing and selling Pazhamporis have recently been issued Notices by the GST Department notifying them of the apparent increase in GST to 18%, while calling upon them to abide by the revised rates.

Read More: Beef Fry, Beef Roast and other Pre-Packaged “Ready to Eat” Food attracts 18% GST: AAR

Ernakulam-based tax jurist Sherry Oommen has referred to the convoluted taxability of foodstuffs and their classification, stating “The GST Department tends to adopt a stance where preparations not specifically covered for reduced levies are taxed at 18%.”

Sherry continued “In my experience, the AAR has been adopting a revenue-friendly stance, undermining its purpose. I believe an external person should be part of the AAR’s constitution to ensure impartiality which is one of the foundations of an independent judiciary.”

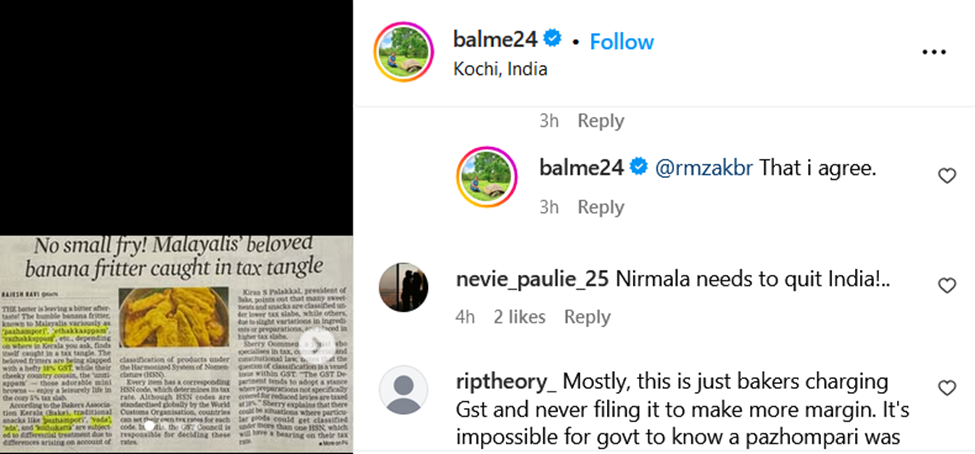

Popular Instagram Food-fluencer Balram Menon (@balme24) called on Malayalees to protest, with aggrieved Keralites flooding the comments arguing for and against the tax levy.

On the flipside, many comment that the levy of GST would lead to increased consumption from road-side tea stalls where GST is unheard of. The changes are poised to affect GST-registered bakeries and restaurants selling Pazhamporis including those paying GST through the composition levy scheme.

Read More: 55th GST Council Extends Concessional 5% GST Rate for Inputs used in Food Preparation

Kiran S Palakkal, president of Bake has expressed discontent in seeking adjudication from the Authority for Advance Ruling (AAR) stating the same to be time-consuming and highly taxing for small-scale businesses.

Palakkal further highlighted that traditional snacks with a short shelf life are usually made by micro units such as Kudumbashree and sold through individual bakeries, with unsold products discarded, resulting in denied input tax claims and heavy financial losses to those involved.

Skeptics argue that the recent trends of levying increased taxation on foods indigenous to the Southern region of India is a form of ‘food fascism’ orchestrated by the Centre. While we await further developments on the subject, I suggest you calm your nerves and treat yourself to the crown jewel of Kerala’s snackventory - the fantabulous Pazhampori!

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates