Govt introduces The Taxation Laws (Second Amendment) Bill in Parliament: Tax, Penalty & Surcharge on Black Money

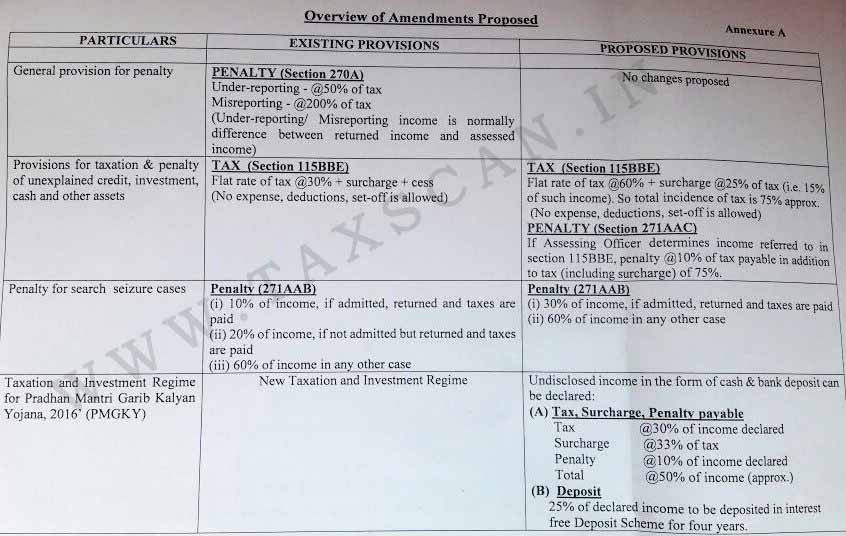

The Taxation Laws (Second Amendment) Bill, 2016 has been introduced by the Finance Minister Arun Jaitley before the Parliament on Monday. The Bill proposes 30 per cent tax on undisclosed income plus 10 per cent penalty beside a 33 per cent surcharge without allowing expense, deductions and set-off.

The Bill further proposes to amend section 270A to impose 50 and 200% penalty on under-reported and misreported income.75% tax and 10 per cent penalty will be levied on the assessee in case of undisclosed wealth detected by the Income Tax authorities post demonetisation. Section 270AAB will be inserted to this effect.

The Bill also proposes to deposit 25 per cent of undisclosed income in the Pradhan Mantri Garib Kalyan Deposit Scheme post demonetisation. The declarant under this regime shall be required to pay tax @ 30% of the undisclosed income, and penalty @10% of the undisclosed income. Further, a proposal for the levy of surcharge called ‘Pradhan Mantri Garib Kalyan Cess’ @33% of tax is also included in the Bill. In addition to tax, surcharge and penalty (totaling to approximately 50%), the declarant shall have to deposit 25% of undisclosed income in a Deposit Scheme to be notified by the RBI under the ‘Pradhan Mantri Garib Kalyan Deposit Scheme, 2016’. This amount is proposed to be utilised for the schemes of irrigation, housing, toilets, infrastructure, primary education, primary health, livelihood, etc.

Reportedly, the cabinet meeting headed by PM Narendra Modi on Friday proposed to amend income tax act by imposing 50% tax on the black money deposited with bank during the 50 days window period.