Govt. notifies New TRQ Applications under India-UAE CEPA for FY 2023-24 [Read Notification]

TRQ Applications – TRQ – DGFT – Government – TRQ – FY 2023-24 – India-UAE CEPA – CEPA – India-UAE CEPA for FY 2023-24 – taxscan

TRQ Applications – TRQ – DGFT – Government – TRQ – FY 2023-24 – India-UAE CEPA – CEPA – India-UAE CEPA for FY 2023-24 – taxscan

The Directorate General of Foreign Trade (DGFT) issued a new TRQ application under the Tariff head under India-UAE CEPA for Financial Year 2023-24.

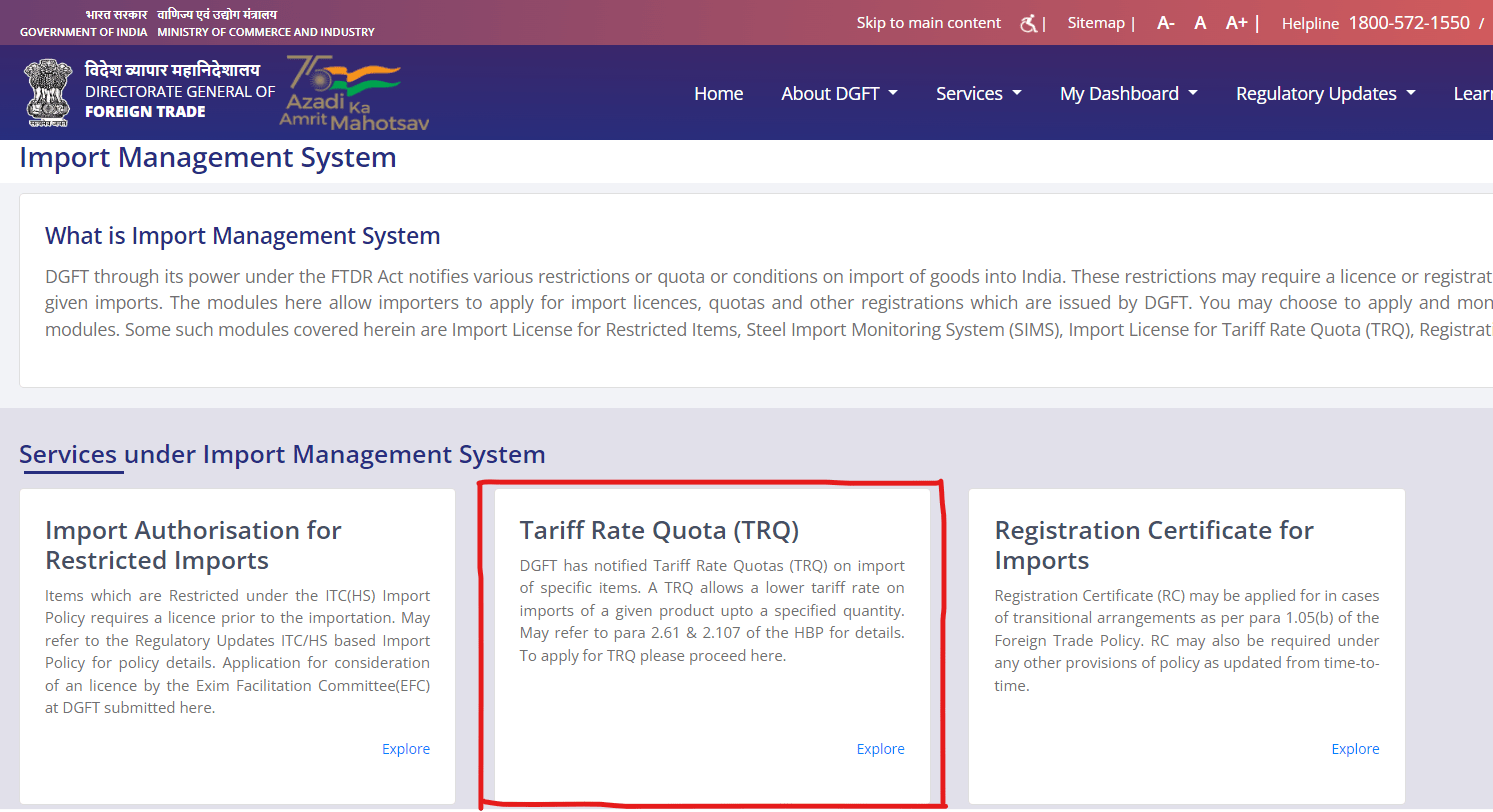

The process of requesting a quota allocation to import a specified quantity of a certain product into a country at a reduced tariff rate is known as a TRQ (Tariff Rate Quota) application. Governments employ tariff rate quotas to control imports of particular goods while also giving indigenous industries a chance to compete with imports from overseas.

From the publication date of this public notice through May 7, 2023, new applications for TRQ under tariff head 7108 for FY 2023–24 are being accepted. The Applications are invited online through the DGFT website:

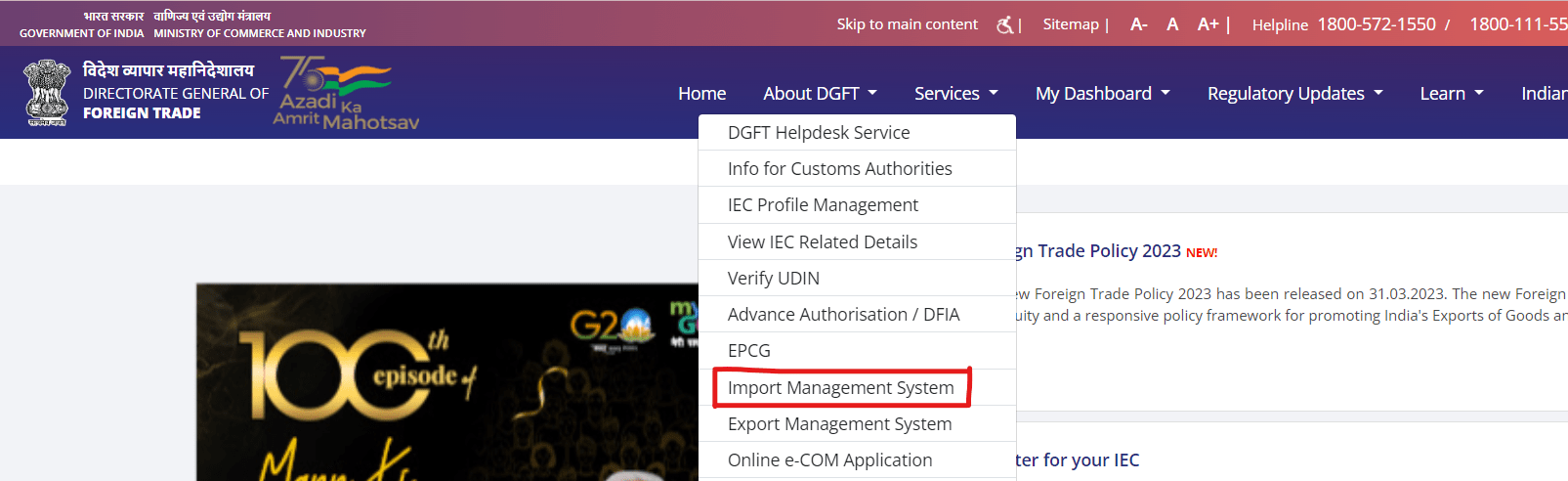

www.dgft.gov.in > ‘Services’ > Import Management System >Tariff Rate Quota (TRQ)

All requests for a TRQ under tariff head 7108 for the fiscal years 2023–2024 must follow the procedures outlined in Public Notice 06/2023, dated April 17,2023.

Further, for the TRQ allocation of a total of 140 MTs under tariff head 7108 for the fiscal years 2023–2024, all applications—new and old—that may be submitted in response to this public notice must be taken into consideration together with the earlier applications already submitted.

In general, the minimum lot size for allocation is 5 Kg; however, this minimum lot size may be reduced if there are more qualifying applicants. The applicant's requested amount for allocation must be less than or equal to multiples of the minimum lot size.

Additionally, a six-monthly evaluation of the allocation will be conducted. When the TRQ utilisation is less than 25% during the aforementioned review procedure, 50% of the remaining amounts are regarded to have been surrendered and are subject to being redistributed to other allottees.

To Read the full text of the Notification CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates