Govt Revises GSTAT Principal and State Benches’ Constitution Notification, Constitutes Circuit Benches [Read Notification]

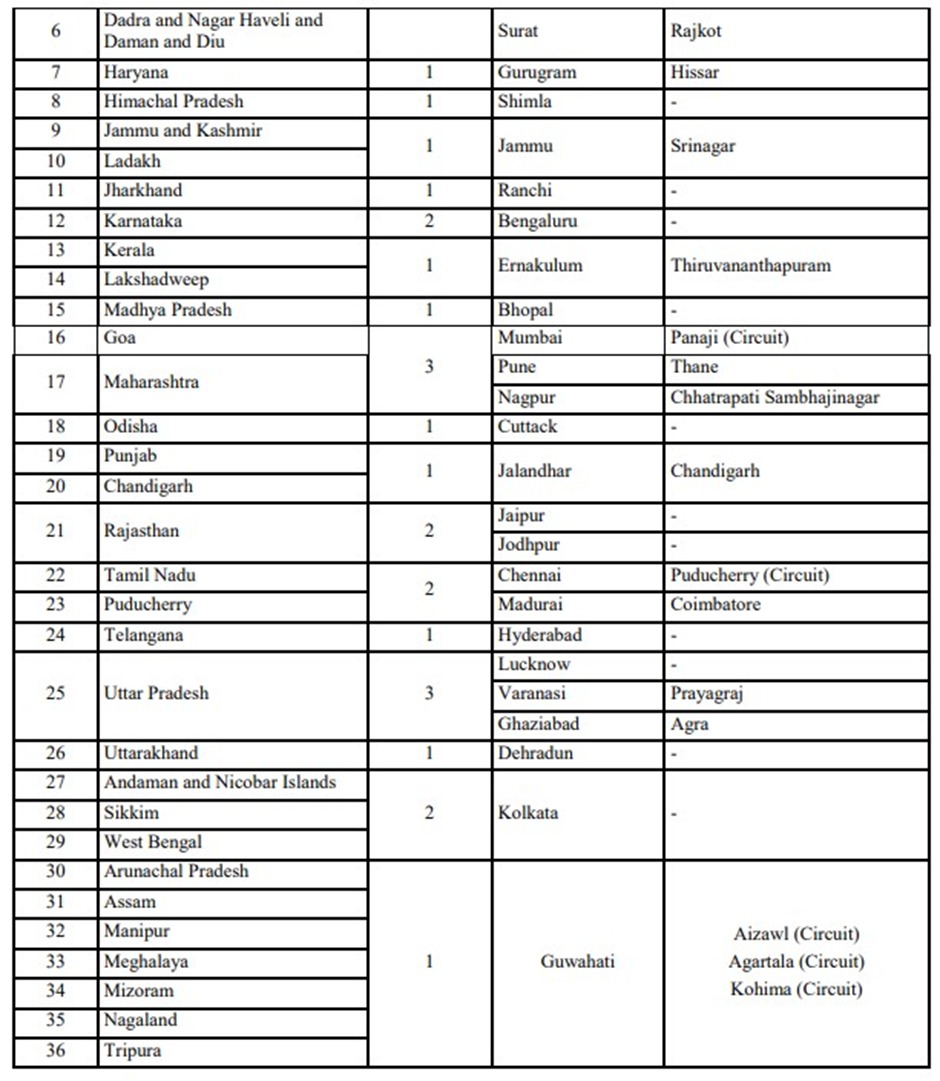

It is explained that Locations shown as 'Circuit' shall be operational in such manner as the President may order, depending upon the number of appeals filed by suppliers in the respective States/jurisdiction

![Govt Revises GSTAT Principal and State Benches’ Constitution Notification, Constitutes Circuit Benches [Read Notification] Govt Revises GSTAT Principal and State Benches’ Constitution Notification, Constitutes Circuit Benches [Read Notification]](https://www.taxscan.in/wp-content/uploads/2024/07/GSTAT-Principal-State-Benches-Constitution-Notification-Constitutes-Circuit-Benches-taxscan.jpg)

The Government has updated the notification regarding the GST ( Goods and Services Tax ) Appellate Tribunal ( GSTAT ), specifically concerning the establishment of principal and state benches. It constituted circuit benches to all states. The ministry of Finance, vide notification no. S.O. 3048(E) dated 31st July 2024 has issued the same.

According to the notification, it has suppressed the previous notifications S.O.1(E) dated 29th December 2023 and S.O.4073(E) dated 14th September 2023 on the constitution of GSTAT benches. The government has established the Goods and Services Tax Appellate Tribunal (GSTAT), with effect from the 1st day of September, 2023. The principal bench is constituted in New Delhi.

Get the Complete GST Case Digest of Supreme Court, Click here.

The new notification added the Sitting or Circuit Bench in all the state benches, which was absent in the original notification. In the original notification, there were only three circuit benches, however, through this new notification the government expanded the circuit benches to each state.

The notification explained that Locations shown as 'Circuit' shall be operational in such manner as the President may order, depending upon the number of appeals filed by suppliers in the respective States/jurisdiction.

Further it has explained that the additional sitting associated with the Bench shall be operated by one Judicial Member and one Technical Member. There are 31 benches in total which spreaded across the nation.

Get the Complete GST Case Digest of Supreme Court, Click here.

The GSTAT benches are as follows:

In February, it was anticipated that the GSTAT would commence operations in August 2024. However, this timeline has been revised. The tribunal is now expected to become operational by October 2024 or early next year.

Recently, the Government has notified the GSTAT Appointing, Disciplinary and Appellate Authorities for Group B and C. Thus, it is expected that the tribunal will function as soon as possible.

Read More: Govt Notifies GSTAT Appointing, Disciplinary and Appellate Authorities for Group B and C

To Read the full text of the Notification CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Notification No: F. No. A-50050/150/2018 , 31st July, 2024