GST Bangalore Zone issues Grievance Redressal Mechanism for Processing of application for GST Registration [Read Notification]

The office has outlined specific documentation requirements based on the nature of ownership or occupancy of the business premises.

![GST Bangalore Zone issues Grievance Redressal Mechanism for Processing of application for GST Registration [Read Notification] GST Bangalore Zone issues Grievance Redressal Mechanism for Processing of application for GST Registration [Read Notification]](https://www.taxscan.in/wp-content/uploads/2025/05/GST-registration-GST-Bangalore-taxscan.jpg)

The Office of the Principal Chief Commissioner of Central Tax, Bengaluru Zone, has launched a specific Grievance Redressal Mechanism to simplify the process of new GST registrations. It has issued a public notice 01/2025 dated 9th may 2025.

The step has been taken due to several problems faced by applicants while undergoing GST registration under the jurisdiction of Central Tax in Bengaluru Zone. The newly formed mechanism is to promote the timely and efficient redressal of grievances, particularly those caused due to undue or ambiguous document demands throughout the registration process.

Complete Ready to Use PDFs of 200+ Agreements Click here

It has been observed that applicants often face challenges due to the nature of clarifications sought by officers in connection with the information submitted through FORM GST REG-01. This particularly pertains to documents related to the ownership of the principal place of business, the constitution of the business, and the identity details of the authorised signatory or owner.

In several cases, additional documents not prescribed in the standard list appended to the form were being demanded, causing unnecessary delays. To resolve these concerns, the Bengaluru Zone has issued specific guidelines detailing the documents that need to be uploaded during the registration process.

For proof of the Principal Place of Business (PPOB), the notice outlines several acceptable documents. For owned premises, any one of the following will suffice: latest property tax receipt, municipal khata copy, electricity bill, or other similar documents such as water bills that clearly establish ownership.

In the case of rented premises, a valid rent or lease agreement must be submitted along with proof of the lessor’s ownership, such as a property tax receipt or electricity bill. If the agreement is unregistered, the applicant must also upload the lessor’s identity proof. However, if the utility connection is in the name of the applicant tenant, it is considered valid proof, and no additional documents from the lessor are required.

Also read: Wаrtime Tахаtiоn: How Governments Raise Revenue During Соnflict

Know the complete aspects of tax implications of succession, Click here

For premises owned by a relative or spouse, a consent letter along with identity proof of the owner and ownership document (such as a property tax receipt or electricity bill) must be submitted. In shared premises, similar principles apply, with flexibility depending on whether a rent agreement exists or not.

In absence of such agreements, an affidavit along with proof of possession such as an electricity bill in the applicant’s name will be accepted, provided the affidavit is notarized or certified by a magistrate. For applicants located in a Special Economic Zone (SEZ), relevant SEZ certificates issued by the Government of India are required.

With regard to the constitution of business, if the applicant is a partner in a firm, the Partnership Deed alone is sufficient proof and additional documents such as Udyam Registration, MSME certificate, shop establishment certificate, or trade license are not required. Similarly, for applicants such as societies, trusts, clubs, government departments, statutory bodies, or local authorities, only the registration certificate or a similar proof of constitution is mandated.

GST READY RECKONER: Complete Topic wise Circulars, Instructions & Guidelines Click here

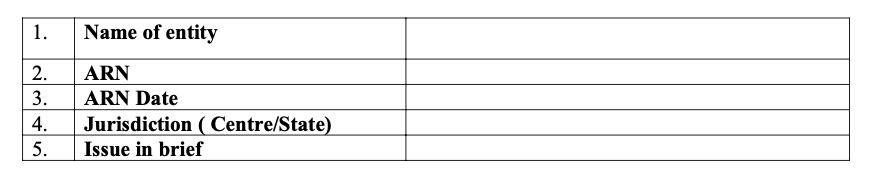

Any GST Registration applicant in the State of Karnataka whose Application Reference Number (ARN) has been assigned to Central jurisdiction and who has a grievance with respect to any query raised in contravention of the above instructions, regarding grounds of rejection of application etc. may approach this office, for resolution of the grievance, as given below:(i) The applicant may send the complaint/grievance on email, to cgst-blr@gov.in, in the following format:

(ii) The applicants may if they wish, visit/contact the GST Seva Kendra, Bengaluru Zone situated on 3rd Floor, C.R.Building Annex, Queens Road, Bangalore 560001. Phone: 080-22866812.

To Read the full text of the Notification CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Notification No: 01/2025 , 9 May 2025