GST: Council Revises Tax Rates on 66 Items, Movie Tickets, Insulin, Agarbattis to go Cheaper

In its 16th meeting held on New Delhi today, the Goods and Services Tax (GST) Council revised the rates of 66 items from what was originally stated in the four-slab indirect tax structure last month.

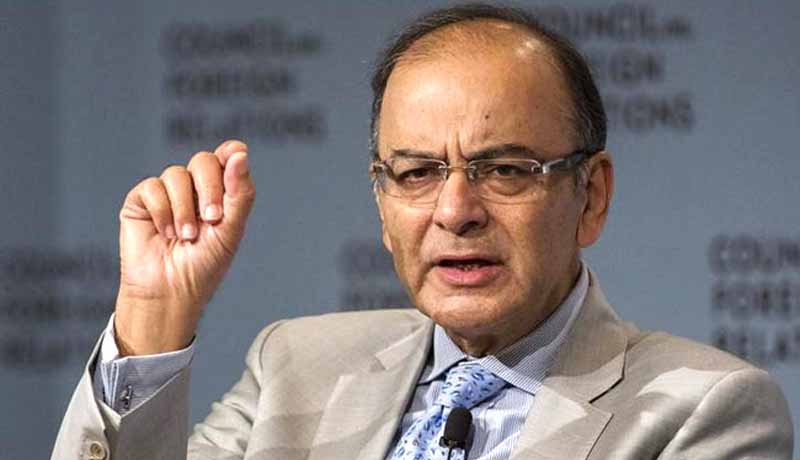

Finance minister Arun Jaitley after the meeting, announced the revised tax rates. Under the revised list, items like insulin, school bags, printers and agarbattis etc. will be cheaper.

"GST Council has reduced tax rates of 66 items+ as against representations received for 133 items. GST on insulin, agarbatti lowered to 5 per cent, school bags to attract tax of 28 per cent," Jaitley said.

Movie tickets below Rs. 100 will be taxed at 18%, while 28% GST would be applicable to tickets above Rs. 100. The Council has also lowered tax rate on computer printers from 28 per cent to 18 per cent and on children's drawing books from nil to 18%. Kitchen use items like pickles, mustard sauce and morabba for which 18% GST was levied will attract 12 per cent GST now. Also, tax rates on cashew nuts have been cut to 5 per cent from 12 per cent.

The tax rate on sanitary napkins remains unchanged, Jaitley said.

The finance minister added that under the GST, traders, manufacturers and restaurants with turnover of up to Rs 75 lakh can avail the composition scheme, against Rs 50 lakh earlier. Following are some of the items for which the rate change is applicable.

Packaged food, including some fruits and vegetables, pickles, toppings, instant food, sauces revised from 18% to 12%

Agarbatti revised from 12% to 5%

Dental wax revised from 28% to 8%

Insulin revised from 12% to 5%

Plastic beads revised from 28% to 18%

Plastic turpolin revised from 28% to 18%

School bags revised from 28% to 18%

Exercise books revised from 18% to 12%

Coloring books revised from 12% to nil

Pre-cast concrete pipes revised from 28% to 18%

Cutlery revised from 18% to 12%

Tractor components revised from 28% to 18%

Computer printers revised from 28% to 18%.

Read the full text of the Revised Rates here.