GST: Delhi Govt. issues Guidelines on Unblocking of ITC on expiry of One Year from the date of Blocking [Read Circular]

![GST: Delhi Govt. issues Guidelines on Unblocking of ITC on expiry of One Year from the date of Blocking [Read Circular] GST: Delhi Govt. issues Guidelines on Unblocking of ITC on expiry of One Year from the date of Blocking [Read Circular]](https://www.taxscan.in/wp-content/uploads/2022/03/GST-Delhi-Government-Guidelines-Unblocking-of-ITC-ITC-expiry-of-One-Year-date-of-Blocking-Blocking-Taxscan.jpeg)

The Delhi Government has issued the Guidelines on Unblocking of ITC under GST on expiry of One Year from the date of Blocking.

Rule 86A of the GST Rules, 2017 empowers the officers to block the Input Tax Credit (ITC) availed by the taxpayers wrongly or fraudulently. Sub-rule (3) of the said Rule stipulates that the ITC so blocked shall cease to have effect after the expiry of a period of one year from the date of blocking in case no action has been taken by the officers. It has been brought to notice by GSTN that in about 6414 GSTINs pertaining to Delhi State jurisdiction, ITC amounting to Rs.2037.31 crores has been blocked by the Delhi State GST officers which is lying blocked beyond a period of one year. In this regard, GSTN has already informed that they are contemplating introducing the functionality of automatically unblocking of such ITCs, in view of the provision of sub-rule (3) of Rule 86A, as mentioned above, which may result in such ITC becoming available to the taxpayers for utilisation.

The Circular said that, Most of these taxpayers' ITCs would have been blocked by the Proper Officers on account of some mismatches/investigation/non-existence or receipt of alert notices, etc. from other states/central jurisdiction authorities, regarding the taxpayers. Hence, it is important that all such cases are taken to their logical conclusion in a time-bound manner. The matter has been examined and the Proper Officers may immediately take steps to finalise the investigation/proceedings in all these cases. Subsequent to which the proper officer should either utilize these blocked credits against the demands (DRC 07) issued against these taxpayers following the legal provisions or if during the investigation/proceedings it is found that conditions for blocking the ITC no longer exist, the ITCs should be unblocked.

Following indicative steps may be taken by the Proper Officer on an immediate basis In case of taxpayers whose registration is active

- An immediate field visit of all such GSTINs whose credit have been blocked, be conducted and in case the firm is found non-existing, suspension and cancellation of registration of the firm may be carried out. Further, a show cause notice (DRC-01) should be issued proposing to create a demand by disallowing the ITC availed and thereafter demand should be created (DRC-07 ) in case of no reply or no satisfactory reply is received from the registered person, as per law. If considered appropriate, summary assessment under Section 64 may also be considered. Finally, the blocked ITC should be unblocked and utilised towards payment of the demand created.

- In case, during the field visit the taxpayer is found existing, then a show cause notice (DRC-01) should be issued proposing to create a demand by disallowing the ITC to the extent, fraudulently availed or for which the taxpayer is not eligible, keeping in view the provisions of clause (a) to (d) of sub rule ( I) of rule 86A. Thereafter, DRC 07 should be issued, if no response or non satisfactory response is received, as per the law and finally, the blocked ITC should be unblocked and utilised towards payment of the demand created through DRC-07.

- c. Here, it should also be kept in mind that earlier when the ITCs were blocked, some or all of these steps might have already been taken, so only the remaining steps should be taken now and the matter should be taken to the logical conclusion as mentioned above.

- d. In the above said cases, proper officer should also search whether the said firm exists in the name of some other firm (same PAN), and if such cases are found then intimation of those firms, claiming the wrong ITC, shall also be sent to the concerned jurisdictional authority (other fin-n).

II. In case of taxpayer registration has already been canceled

- In case of taxpayer, whose ITC had been blocked, and whose registration has already been cancelled, first of all the reason of cancellation should be ascertained. In case the taxpayer was cancelled for being non-existing/non-functioning, then the ITC availed should be disallowed and blocked ITC be utilised after following the procedure mentioned in I (a) above.

- In case the taxpayer was cancelled for the reasons other than the reason of non-existing/non-functioning, then the ITC, to the extent it is believed to be availed fraudulently/ineligibly, should be disallowed and demand (DRC-07) should be created and finally the blocked ITC should be unblocked and utilised towards payment of the demand created through DRC 07, after following the procedure given in 1(b) above.

- As mentioned in 1(c) above, only the remaining steps should be taken now and the matter should be taken to the logical conclusion.

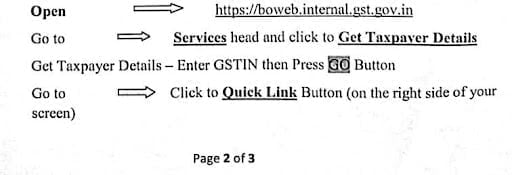

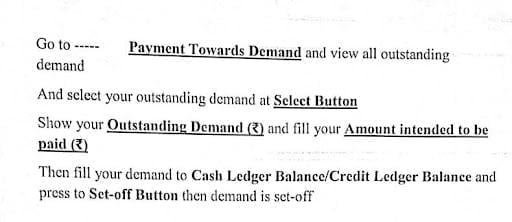

The steps to be followed for utilising the blocked ITC, after unblocking the same, against the demand created through DRC-07 are as under:

if the taxpayer has already responded to the notices issued earlier by the Proper Officer and the Proper Officer after examining the responses, has come to the conclusion that the unblocking may no longer be required then such blocked credit should be unblocked forthwith.

CIRCULAR NO: F.3(429)GST/Policy/2022/1067-1072

DATE: 08/03/2022

To Read the full text of the Circular CLICK HERE

Support our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.