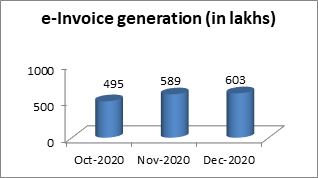

GST E-Invoice System completed 3 months; Enabled more than 37000 Taxpayers to Generate more than 1680 Lakh IRNs

GST e-invoice system, the game-changer in the GST system, has completed a journey of three months and has facilitated the smooth transition of the taxpayers to the new platform. It has enabled more than 37000 taxpayers to generate more than 1680 Lakh Invoice Reference Numbers (IRNs), during the last three months from the NIC developed e-Invoice system.

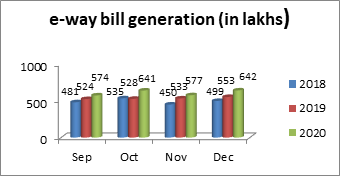

Starting with 495 lakhs during October 2020, the generation of e-Invoice has increased to 589 lakhs in November 2020 and 603 Lakhs in December 2020. Interestingly the e-way bill generation from the NIC (National Informatics Centre) developed e-way bill system is also highest from September to December 2020 compared to the same months of previous years.

The response of the system is good and the generation of IRNs is hassle-free during this period. However, there have been common errors such as repeated requests on the same document number, simultaneous requests on the same document number, requests with validation or calculation errors, etc. Proactive measures are taken by the NIC Help desk, including communication with taxpayers about the issues through mails and telephonic calls and suggestion of corrective measures, has facilitated in bringing the errors down. NIC has also started sending daily updates to the generators of IRN about the number and value of the IRN generated by him/her.

The Government has reduced the aggregate turnover cut off to Rs. 100 Crores per annum for the generation of IRN by the taxpayers from 1st January 2021. NIC has already enabled the API and offline tool based sites for these taxpayers. NIC is also geared up with adequate infrastructure to handle the generation of e-invoices from these taxpayers from 1st January 2021. NIC portal facilitates the big taxpayers, whose turnover is more than Rs. 500 Crores, to enable direct API access to their suppliers and clients from their systems.

Keeping the requirements of small taxpayers in view, NIC has developed the offline Excel-based IRN preparation and printing tool, called a NIC-GePP tool for the small taxpayers. This application will allow the taxpayers to enter the invoice details, prepare the file to upload on the NIC IRN portal, download the IRN with QR code, and print the e-invoice with QR code.

Support our journalism by subscribing to Taxscan AdFree. We welcome your comments at info@taxscan.in