GST: Govt Asks Traders to Issue Correct Invoices

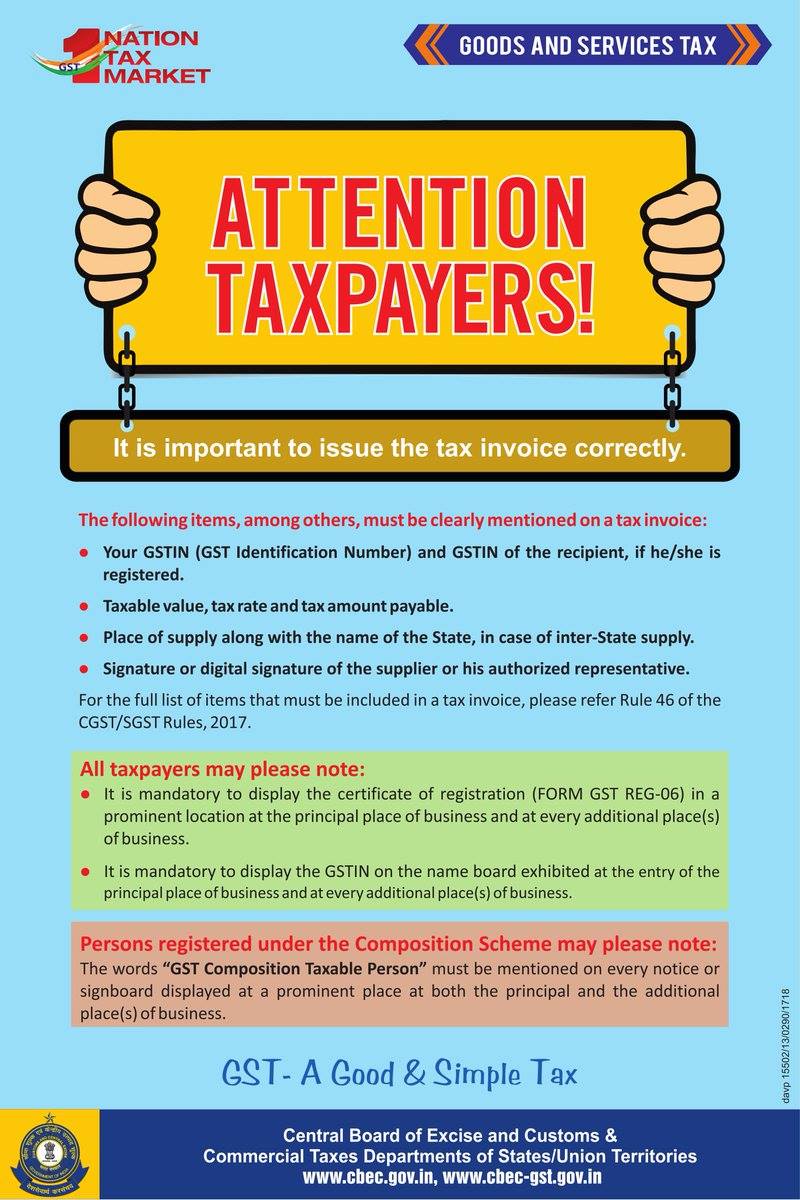

The Government recently asked the tax payers to issue invoices in correct form as mandated under Rule 46 of Central Goods and Services Tax (CGST) Rules and the State Goods and Services Tax (SGST) Rules.

It was said that the GST Identification number of the supplier and the recipient must be mentioned in the tax invoice, if both are registered under the GST Acts.

Along with this, the taxable value, the tax rate and the tax amount payable etc. must be specified.

In case of inter-State supply, the place of supply must be mentioned along with the name of the state. Signature or Digital Signature of the supplier must also be affixed in the invoice properly.

Every taxable person is required to display his GSTIN number on name board or sign board of business and is also required to display his registration certificate in business premises so that a citizen can easily find out whether a person is registered or not. It must be placed on the Principal and the additional places of business.

The composition dealer should use the words “GST Composition Taxable Person” on every notice or signboard displayed at a prominent place at both the Principal and the additional places of business.