GST: Know the Solution for Import ITC not getting reflected GSTR 2A or 2B

The Goods and Service Tax Networks (GSTN) has rolled out functionality to drag the data of Import ITC (from Custom website) which is not reflected on the GST Portal.

Many taxpayers are facing technical issues on the GST Portal that Import ITC of some Bill of Entries is not getting reflected in GSTR 2A/2B. Due to this many taxpayers are receiving notices from the department for excess claims of ITC.

How to view BoE (Bill of Entry) on the GST Portal?

To view the details of BoE (Bill of Entry) on the GST Portal, perform the following steps:

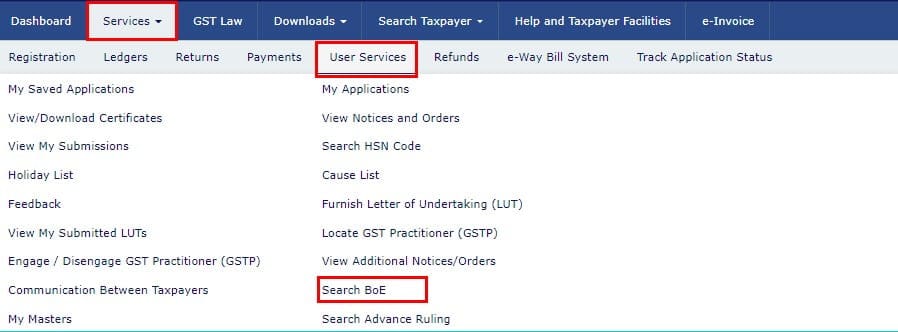

Step 1: Access the www.gst.gov.in URL. The GST Home page is displayed. Click the Services > User Services > Search BoE option.

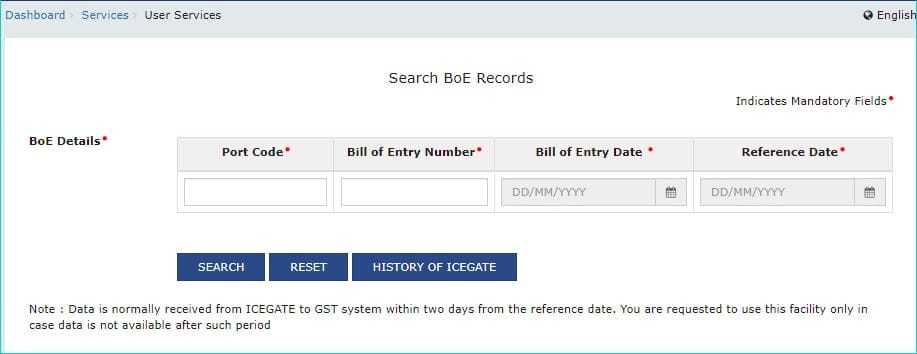

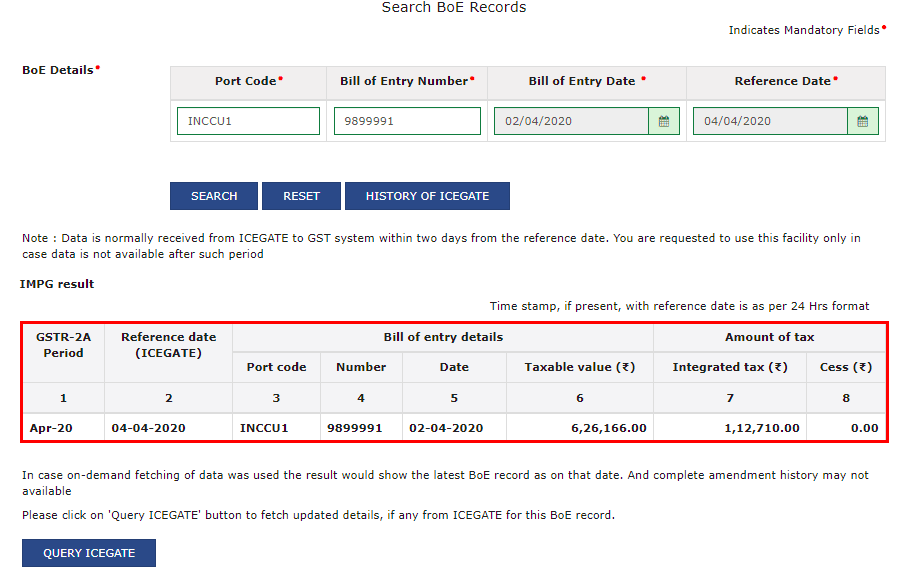

Step 2: Search BoE Records page is displayed.

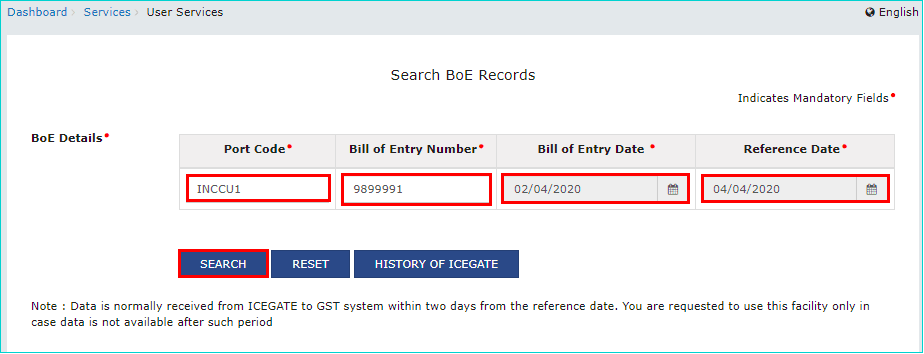

Step 3: Enter the Port Code, Bill of Entry Number, Bill of Entry Date, and Reference Date. Click the SEARCH button.

It is noteworthy that the reference date is the date when the goods have been cleared from Customs (Passed out of Customs charge). The reference date will either be Out of charge date, Duty payment date, or amendment date - whichever is later.

Step 4: The search results are displayed. You can click on the QUERY ICEGATE button to initiate on-demand fetching of the latest BoE record from ICEGATE, in case, most recent record is not available with the GST Portal. You can click the RESET button to reset the data entered in the fields.

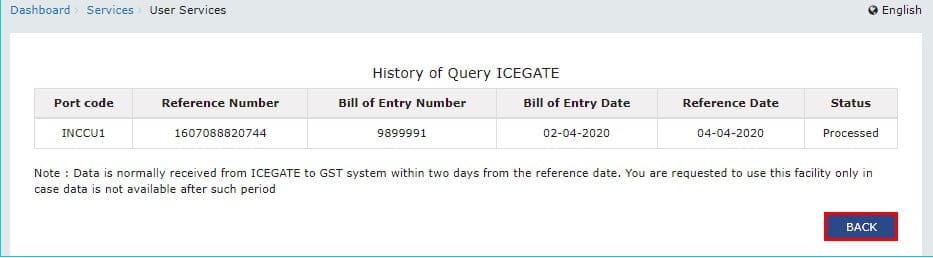

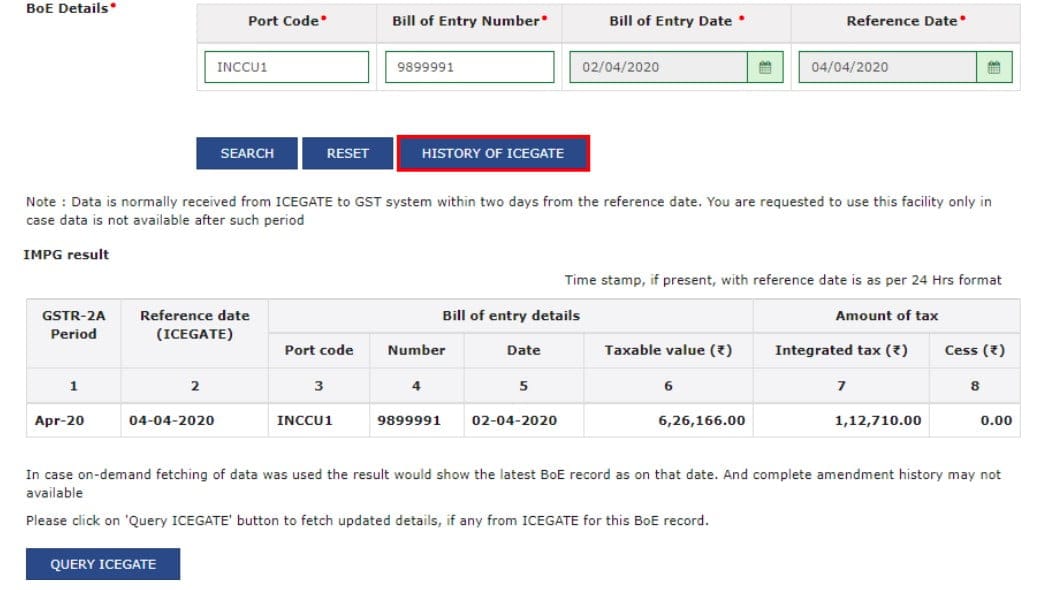

You can click HISTORY OF ICEGATE to view the History of query ICEGATE.

History of fetched BOE details from ICEGATE along with the status of the query is displayed. You can click the BACK button to go back to the Search BoE Records page.