GST: Maharashtra Govt. issues Guidelines for issuance of FORM GST DRC-07 in case of Vehicles Detained under E-Way Bill provisions [Read Circular]

![GST: Maharashtra Govt. issues Guidelines for issuance of FORM GST DRC-07 in case of Vehicles Detained under E-Way Bill provisions [Read Circular] GST: Maharashtra Govt. issues Guidelines for issuance of FORM GST DRC-07 in case of Vehicles Detained under E-Way Bill provisions [Read Circular]](https://www.taxscan.in/wp-content/uploads/2022/03/E-Way-Bill-Proper-Officer-GST-Maharashtra-Government-Guidelines-issuance-FORM-GST-DRC-07-Vehicles-Vehicles-Detained-E-way-Bill-provisions-E-way-Bills-Taxscan.jpg)

The Maharashtra State Government has issued Guidelines for issuance of FORM GST DRC-07 in case of Vehicles Detained under E-way Bill provisions.

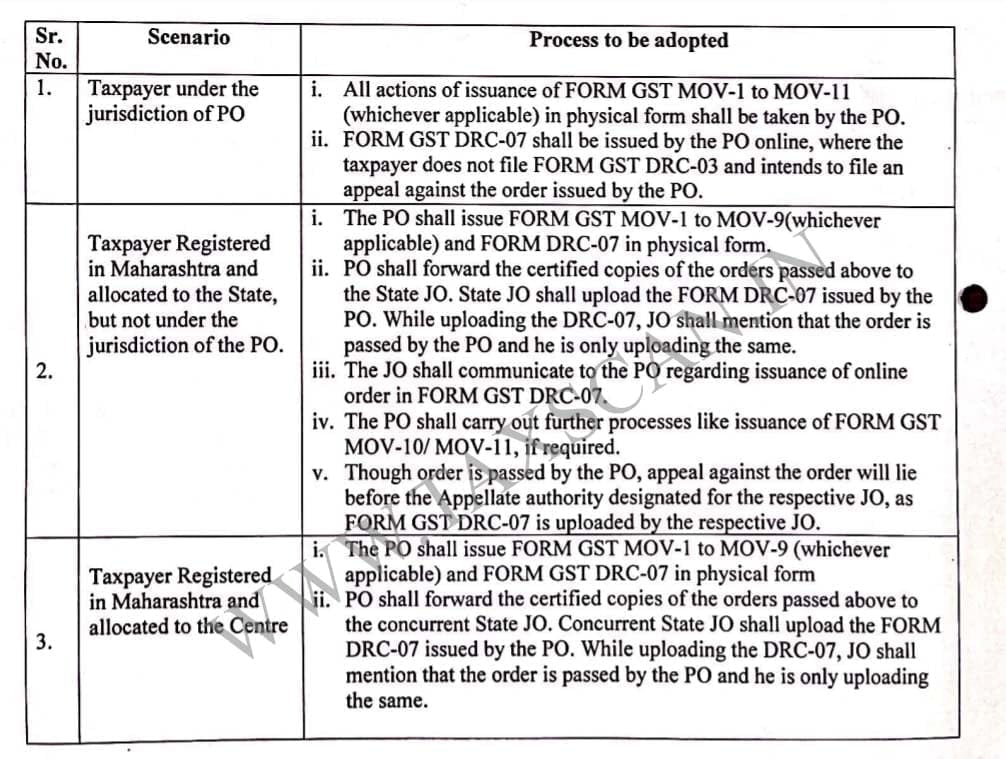

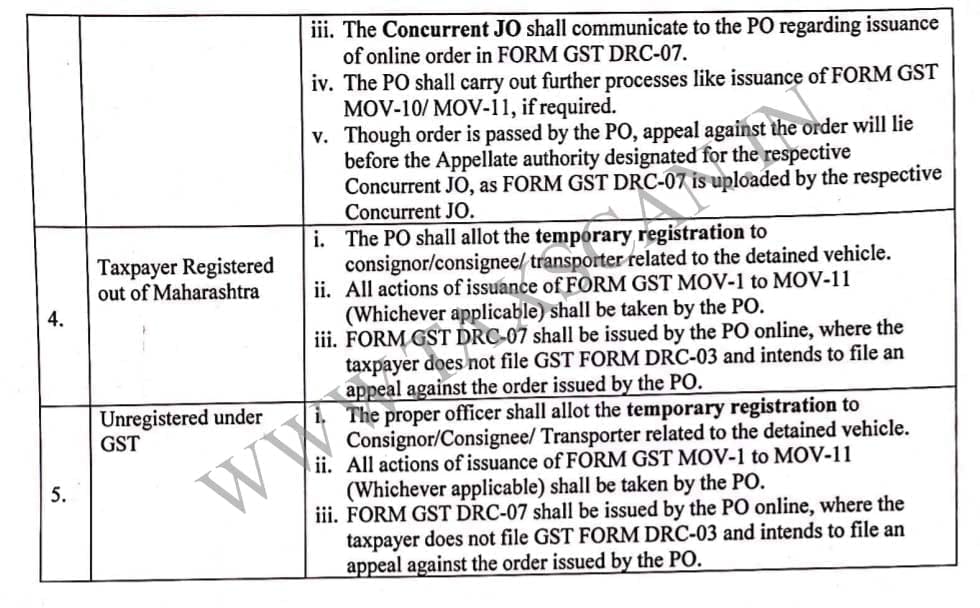

In the Maharashtra Goods and Services Tax Department (MGSTD), the activity of interception of conveyances for verification of E-way bill is carried out by Enforcement officers as well as Non-enforcement (Nodal) officers. All the proper officers in the Maharashtra State from the rank of State Tax Officers (STOs) to Deputy Commissioners of State Tax are deployed for the interception of the vehicle for E-way bill verifications. During the interception, the proper officer is required to take various statutory actions in case of violation of E-way bill provisions.

The proper officer releases the detained vehicle upon payment of applicable tax and penalty in FORM GST DRC-03 (Voluntary Tax Payment Form) or submission of security in the form of Bank guarantee by the tax payer. If the taxpayer does not file the FORM GST DRC-03 and intends to file an appeal against the findings of the proper officer, then the proper officer is required to issue FORM GST DRC-07 (Digital Summary of the Demand Order). The proper officer used to issue various orders in physical forms, till the time the appeal procedure was not made online on the GSTN Back Office (BO). During this period the consignor/consignee/transporter used to file an appeal before the jurisdictional appellate authority of the proper officer who had passed such order.

With the appeal procedure becoming online, it has become mandatory for the proper officer to pass the various orders online on the BO. In the present scenario, the proper officer (other than investigation/enforcement officer) is not able to pass the online orders in E-way bill MOV forms as MOV forms/orders are currently bundled with Enforcement Module and FORM GST DRC-07 can only be issued either by the investigation officer or the jurisdictional officer.

In a Circular issued by State Government said that, Many queries are received from the proper officers deployed for interception work regarding their inability to issue FORM GST-DRC-07 in cases where they don't have territorial jurisdiction over the taxpayers related to detained vehicle. Due to inability of the proper officer to issue FORM GST DRC-07 online, the tax payer is not in a position to exercise his right to appeal on the system.

Guidelines for issuance of FORM GST DRC-07

CIRCULAR NO: 04A of 2022

DATE: 02/03/2022

To Read the full text of the Circular CLICK HERE

Support our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.