GST Portal Alert: File Form CMP-02 to opt for Composition Levy Scheme by March 31, 2024

Submit Form CMP-02 to choose the Composition Levy Scheme before March 31, 2024 in the GST Portal

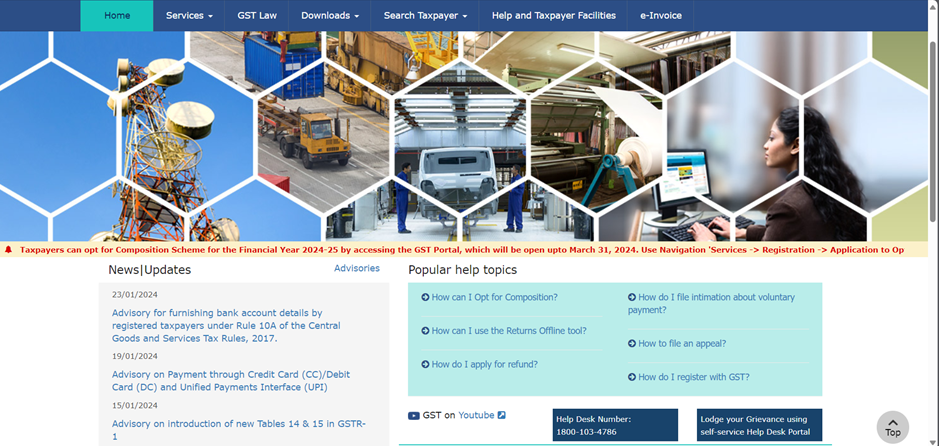

The Goods and Services Tax Network ( GSTN ) has issued an announcement, stating that taxpayers can opt for the GST Composition Levy Scheme by filing Form CMP-02 in the Goods and Services Tax Portal by March 31, 2024.

The Goods and Services Tax composition levy is an alternative method of levy of tax designed for small taxpayers whose turnover is up to Rs. 75 lakhs ( Rs. 50 lakhs in case of few States ). The objective of the GST composition scheme is to bring simplicity and to reduce the compliance cost for the small taxpayers.

Read Also: Case Digest: GST Cases on Composition Levy

Moreover, it is optional and the eligible person opting to pay tax under this scheme can pay tax at a prescribed percentage of his turnover every quarter, instead of paying tax at normal rate.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates