GST Portal “Last Date” Glitch: GSTR-1 Filers and Professionals under Undue Distress, GST ITC claims to be unfit for Non-filing of Return

Due Date extension could be thought about, to alleviate taxpayer concerns

“And we are back to 2017. Thank you”, tweeted a stakeholder, as the Goods and Services Tax ( GST ) Portal chose to shut itself down and prevent professionals and honest taxpayers from accessing it for filing the GST Return Form GSTR-1 on the last date for submission, due to a server overload.

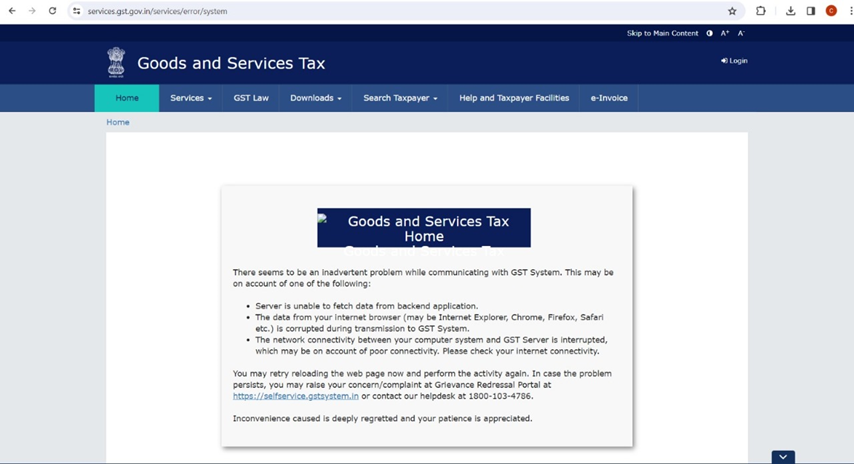

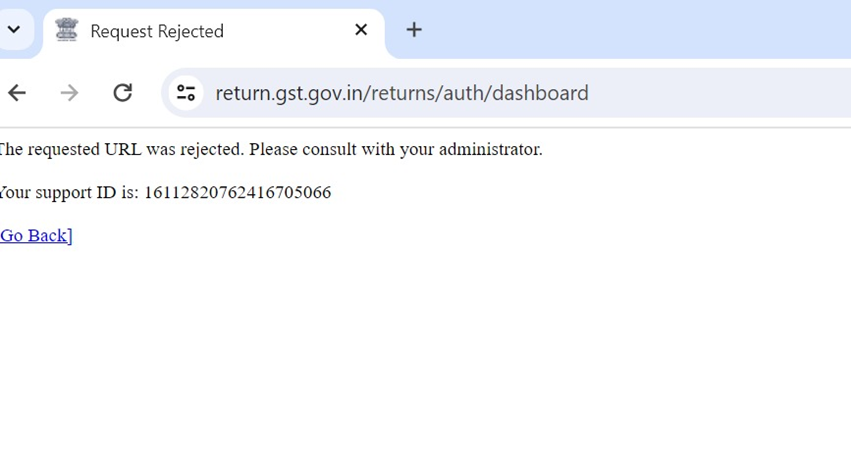

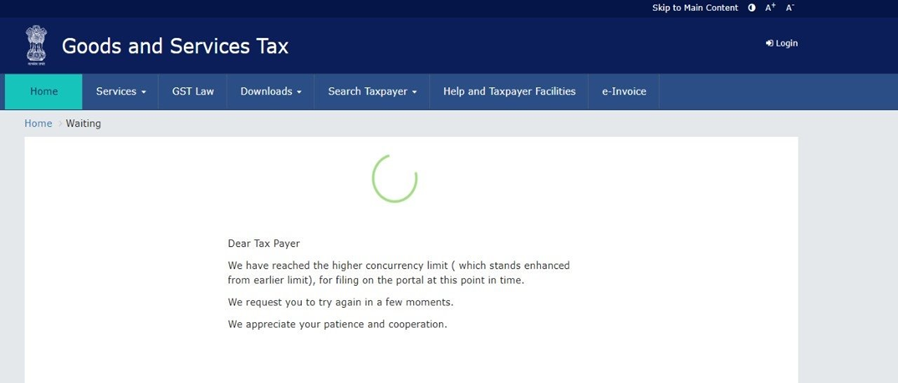

3 Different Portal Glitches on Due Date of Filing GSTR-1

X, (Formerly Twitter) has been flooded with the grievances and complaints of the Taxpayers and Professionals trying to complete their filings on time.

The stakeholders urge an extension of the Goods and Services Tax Return -1: GSTR-1 due date to avoid inability of suppliers to transfer the Input Tax Credit to the respected traders.

“As the volume and no of registered GST users increase, @cbic_india should invest in good servers and hardware capacity for the smooth functioning of the GST portal during due dates!” opined CA Chirag Chauhan on X.

As expected, the Infosys - GSTN is yet to respond to the stakeholder concerns, as is the Finance Minister and Ministry of Finance.

For nearly seven years, the Goods and Services Tax ( GST ) portal has grappled with significant technical challenges, causing frustration among taxpayers seeking to file their returns. The recent series of glitches, stemming from the portal's inability to handle high demand, has led to login issues, malfunctioning return modules, and overall site disruptions.

Despite ongoing complaints from taxpayers, the government has yet to address these persistent issues, prompting calls for immediate action to streamline the filing process. Many taxpayers have expressed dissatisfaction with the GST portal's performance, highlighting their concerns through social media platforms such as Twitter.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates