GST Portal Removes Tweet Informing New Facility regarding Dropping of Proceedings for Suspension of GST Registration, Creates Confusion among Taxpayers

The GST Portal has removed its new tweet informing the taxpayers about the new facility to drop the proceedings for suspension of registration at the GST portal and revoke the suspension of registration, has now creating confusion among the taxpayers and the tax professionals.

Yesterday, the GST portal has introduced a new facility to drop the proceedings for suspension of registration at the GST portal and revoke the suspension of registration. The new facility was accepted amongst the taxpayers amidst difficulties to restore the registration.

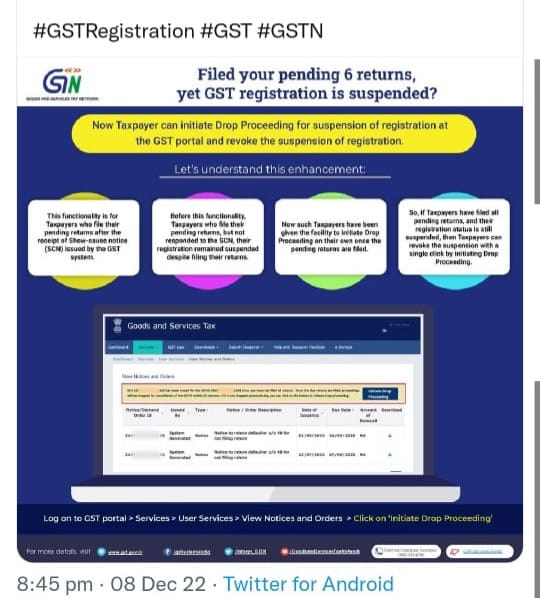

A recent tweet by the GST Tech (@Infosys_GSTN) stated that Now taxpayers can initiate Drop the GST Registration cancellation proceedings.

This functionality is for Taxpayers who file their pending returns after the receipt of the Show cause notice (SCN) issued by the GST system.

Currently, the Taxpayers who file their pending returns, but have not responded to the SCN, their registration remained suspended despite filing their returns.

The facility could be a great relief to the Taxpayers who can initiate Drop Proceedings on their own once the pending returns are filed.

So, if Taxpayers have filed all pending returns, and their registration status is still suspended, then Taxpayers can revoke the suspension with a single click by initiating Drop Proceeding.

The move could reduce the litigations before the Courts. However, the deletion of the post without any clarification from the side of GSTN or the Government implied that the taxpayers have to wait some more time to resolve the issues.

Recently, various writ petitions were filed before the High Courts as the taxpayers were aggrieved by the action of GST department suspending the registration and the statutory remedy was unavailable due to the absence of the GST Tribunal till date.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates