Govt. notifies Due Dates for Filing GST Returns [Read Notifications]

![Govt. notifies Due Dates for Filing GST Returns [Read Notifications] Govt. notifies Due Dates for Filing GST Returns [Read Notifications]](https://www.taxscan.in/wp-content/uploads/2017/11/GST-Month-Returns-Taxscan.jpg)

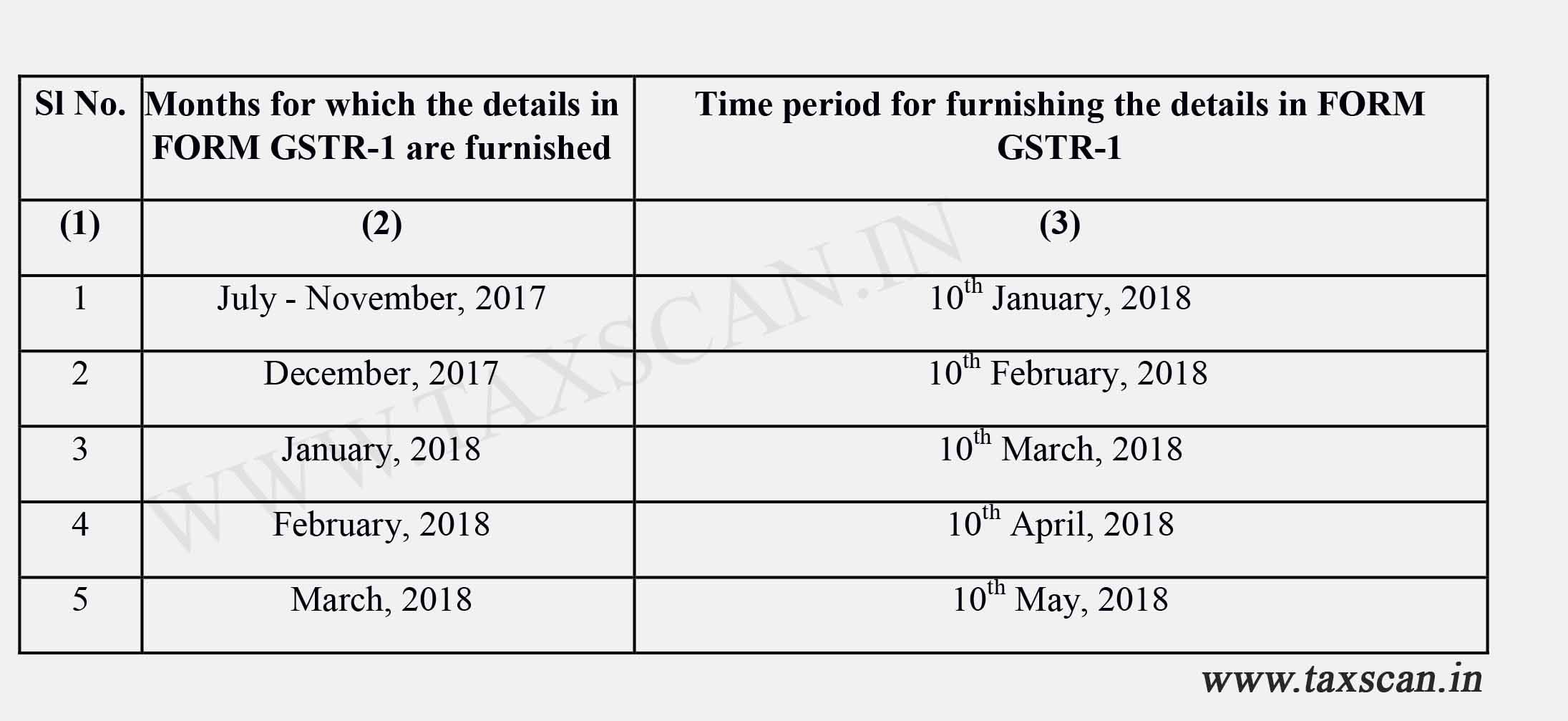

As per the Notification, registered persons with aggregate turnover of more than Rs. 1.50 crores shall file monthly return in form GSTR-1 for the period July to October on or before 31st December 2017. Such person shall file their November Return within 10th January.

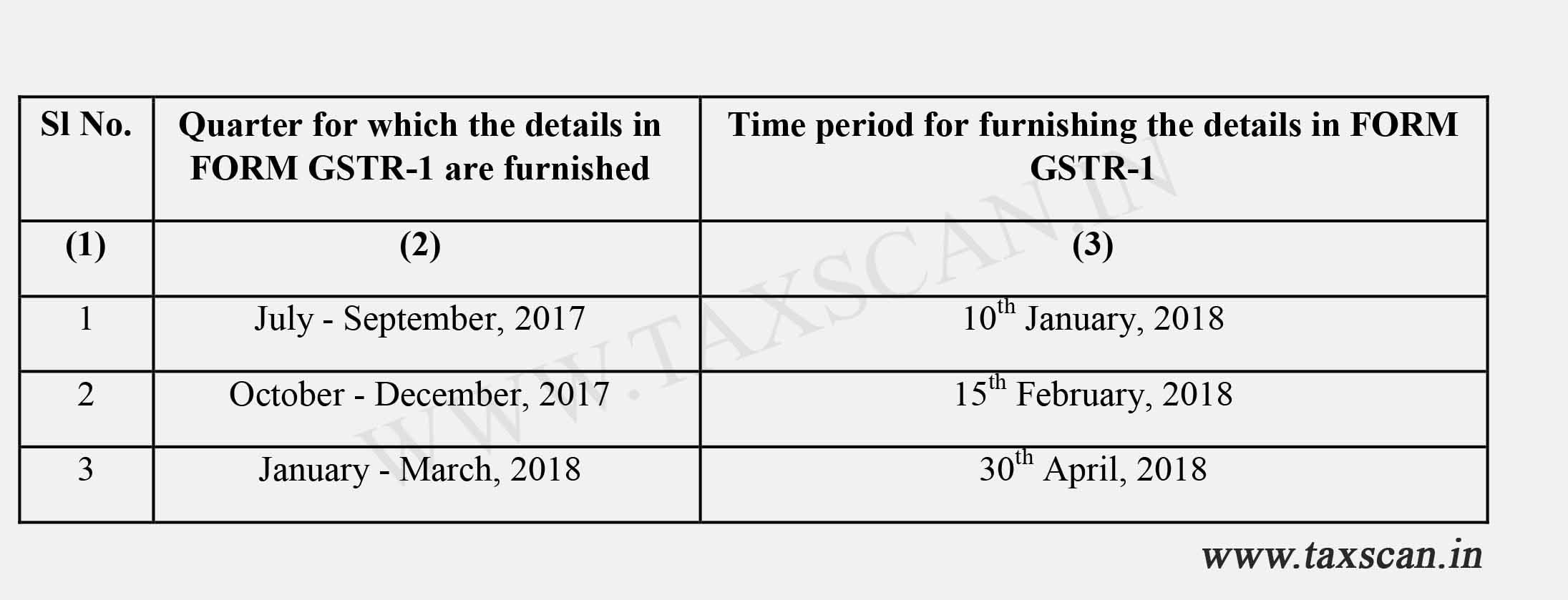

Quarterly return for registered persons with aggregate turnover up to Rs. 1.50 crores shall file GSTR1 for July to September on or before 31st December 2017. Further, GSTR1 for October to December can be filed till February 15th and January to March 2018 can be filed till 30th April, 2018.

Also, the GST portal has displayed the due dates for filing various returns under the current tax regime. The due dates for filing various other returns are as follows;

FORM GST REG-26 (Application for enrolment of Existing Taxpayer): 31st Dec, 2017

FORM GST ITC-04 (Details of Goods/Capital Goods sent to Job-worker and received back) during the quarter July to September: 31st Dec, 2017

FORM GSTR-5 (Return for Non-Resident Taxable person) for the months of July, August, September, November, and December, 2017: 31st Jan, 2018

FORM GSTR-5A (Details of Supplies of Online Information and Database Access or Retrieval Services by a person located outside India made to Non-Taxable persons in India) for the months of July, August, September, November, and December, 2017: 31st Jan, 2018

FORM GST ITC-01 (Declaration for claim of Input Tax credit under Sub-section(1) of Section 18 ) by the registered persons, who have become eligible during the months of July, August, September, October, and November, 2017: 31st Jan, 2018

FORM GST CMP-03 (Intimation of details of stock on date of opting for composition levy) :31st Jan, 2018.

To Read the full text of the Order CLICK HERE