[Update] GST Portal Down till 6 PM! GSTN working on Fixes while Due Date Pressure Builds for Tax Professionals

The GST portal has once again gone into hibernation

![[Update] GST Portal Down till 6 PM! GSTN working on Fixes while Due Date Pressure Builds for Tax Professionals [Update] GST Portal Down till 6 PM! GSTN working on Fixes while Due Date Pressure Builds for Tax Professionals](https://www.taxscan.in/wp-content/uploads/2025/01/gst-portal-not-working-gst-portal-not-working-today-gst-portal-gst-portal-issue-Taxscan.jpg)

In a rather disappointing turn of events that has finance professionals on the edge of their seats (and keyboards), the GST portal has once again gone into hibernation. The portal filing returns and generating invoices is down —until 06:00 PM today, as per the official message, which earlier stated that the portal will resume functioning at 03:00 PM IST.

Read Earlier Coverage Here: GST Portal Down for Scheduled Maintenance, Services Unavailable Until Noon Today

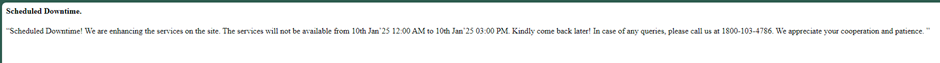

According to the official notification, “Scheduled Downtime! We are enhancing the services on the site. The services will not be available from 10th Jan’25 12:00 AM to 10th Jan’25 03:00 PM. Kindly come back later! In case of any queries, please call us at 1800-103-4786. We appreciate your cooperation and patience.”

Of course, one can only imagine the sigh of relief from the compliance-weary accountants who now have more time to contemplate life’s deeper questions (like whether coffee or tea is the correct fuel for an all-nighter). Meanwhile, tax practitioners who had meticulously scheduled their workload are undoubtedly thrilled to discover that they’ve been gifted bonus hours of anticipation. After all, having your entire compliance schedule hinge on the smooth functioning of a single portal is every professional’s dream come true—what could possibly go wrong?

Complete Draft Replies of GST ITC Related Notices, Click Here

In fairness, the Goods and Services Tax Network (GSTN), which manages the portal, has assured everyone that this downtime is absolutely important for system upgrades and performance improvements. In tandem with the philosophy of the founder, the tech team at Infosys could be working 70 hours a week on various fixes, all in the noble pursuit of making the platform faster, more reliable, and more user-friendly, and in working condition after all.

We respect their dedication—no sarcasm there—because we do recognize that creating a robust online platform for millions of users is no cakewalk.

Still, the frustration of taxpayers who waited until the last minute to file their returns or pay their dues is palpable. Many have urgent deadlines looming, and discovering the “Scheduled Downtime” notice at midnight is just the cherry on top of their compliance sundae. The GSTN, however, stands by its scheduled maintenance plan, pointing out that the downtime was announced in advance—and that if individuals had urgent tasks, they might want to turn back time and plan accordingly.

For those with pressing needs—like that last-minute e-invoice—there’s a helpline: 1800-103-4786. “Those with urgent needs are encouraged to monitor the portal closely for any updates or early restoration of services,” reads the official advisory.

Complete Draft Replies of GST ITC Related Notices, Click Here

In the meantime, tax professionals are advised to enjoy these fleeting hours of forced downtime by compiling documents and performing other offline tasks that inevitably stack up. After all, the moment the portal comes back online, it’s going to be a race to the finish, with thousands of anxious filers all trying to log in at once.

If there’s any silver lining in this cyclical spectacle of portal downtime, it’s that eventually—hopefully—this maintenance will yield a truly seamless user experience (utopian, but it does not hurt to hope). Maybe next time, the portal will run like a gazelle sprinting through a meadow, instead of a snail trudging up a muddy hill.

Until then, accountants, taxpayers, and businesses, brace yourselves: the countdown to 3:00 PM is on. Keep a stash of caffeinated beverages nearby, and may the compliance odds be ever in your favor.

Complete Draft Replies of GST ITC Related Notices, Click Here

On a more serious note, the pain of the professionals who dedicate their time and effort for timely filing should be acknowledged, respected and given due consideration, and a possibility of an extension of the due date must be well pondered upon by the Ministry of Finance in this lose-lose situation.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates