GST Returns: Know How to Fetch BoE Missing in your GSTR 2A

The Bill of Entry (BoE) is a declaration form filed by the importer or his/her clearing agent with the Customs. BoE is filed for all imports through air, land and sea and includes supplies from SEZs to DTA. BoE details are transmitted to the GST system by ICEGATE after goods are given out of charge, duty is paid, BoE is amended- whichever is later, called Reference Date.

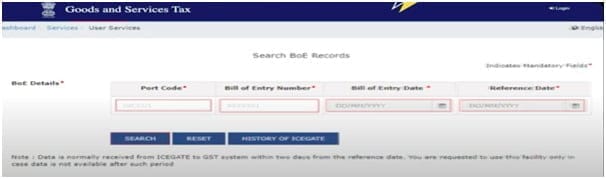

How to search BoE details on the portal?

Step 1: Visit www.gst.gov.in and log in using valid credentials

Step 2: Click the Services, then select User Services and select Search BoE option

Step 3: Enter the Port Code, Bill of Entry Number, Bill of Entry Date and Reference Date. Click the Search button.

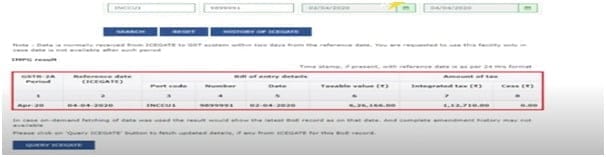

Step 4: Search results are displayed & you’re done!

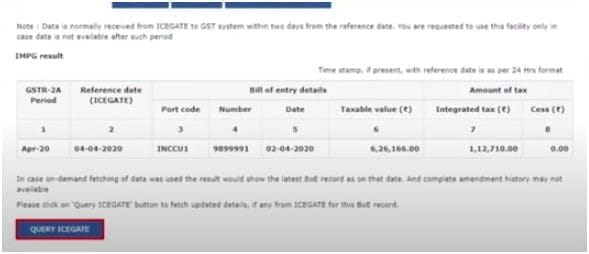

What to do if BoE details are not found in GST Portal – Use Query ICEGATE tab

Step 1: You can click on the QUERY ICEGATE button to initiate an on-demand query for the latest BoE details from ICEGATE.

Step 2: You can click HISTORY OF ICEGATE to view the History of the BoE query made using the on-demand facility.

Support our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.