GST Revenue December crosses 1,03 lakh Crores : Finance Ministry

The gross GST revenue collected in the month of December 2019 is ₹ 1,03,184crore of which CGST is ₹ 19,962crore, SGST is ₹ 26,792crore, IGST is ₹ 48,099crore (including ₹ 21,295crore collected on imports) and Cess is ₹ 8,331crore (including ₹ 847crore collected on imports). The total number of GSTR 3B Returns filed for the month of November up to 31st December 2019 is 81.21lakh.

The GST revenues during the month of December 2019 from domestic transactions have shown an impressive growth of 16% over the revenue during the month of December 2018. If we consider IGST collected from imports, the total revenue during December 2019 has increased by 9% in comparison to the revenue during December, 2018. During this month, the IGST on import of goods has seen a negative growth of (-) 10% but is an improvement over (-) 13% last month and (-) 20% in the month of October.

The government has settled ₹ 21,814crore to CGST and ₹ 15,366crore to SGST from IGST as regular settlement. The total revenue earned by the Central Government and the State Governments after regular settlement in the month of December 2019 is ₹ 41,776 crores for CGST and ₹ 42,158 crores for the SGST.

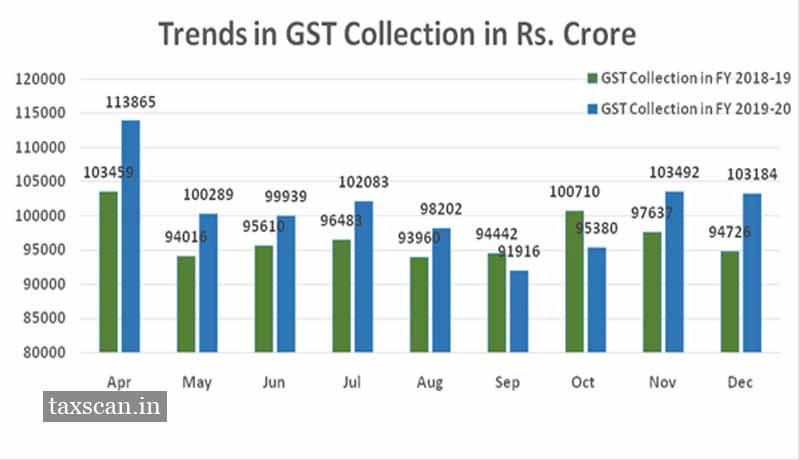

The chart shows trends in revenue during the current year:

Following is the table showing State-wise gross domestic GST Collection and its comparison with that of December 2018:

State-wise Gross Domestic GST Collection for the month of December 2019

Following is the table showing State-wise gross domestic GST Collection and its comparison with that of December 2018: State-wise Gross Domestic GST Collection for the month of December 2019 (Amount Rs. in Cr.)

Following is the table showing State-wise gross domestic GST Collection and its comparison with that of December 2018: State-wise Gross Domestic GST Collection for the month of December 2019 (Amount Rs. in Cr.) | State | Dec-18 | Dec-19 | Growth | |

| 1 | Jammu and Kashmir | 293 | 409 | 40% |

| 2 | Himachal Pradesh | 595 | 699 | 18% |

| 3 | Punjab | 1,162 | 1,290 | 11% |

| 4 | Chandigarh | 143 | 168 | 18% |

| 5 | Uttarakhand | 1,055 | 1,213 | 15% |

| 6 | Haryana | 4,646 | 5,365 | 15% |

| 7 | Delhi | 3,146 | 3,698 | 18% |

| 8 | Rajasthan | 2,456 | 2,713 | 10% |

| 9 | Uttar Pradesh | 4,957 | 5,489 | 11% |

| 10 | Bihar | 909 | 1,016 | 12% |

| 11 | Sikkim | 150 | 214 | 43% |

| 12 | Arunachal Pradesh | 26 | 58 | 124% |

| 13 | Nagaland | 17 | 31 | 88% |

| 14 | Manipur | 27 | 44 | 64% |

| 15 | Mizoram | 13 | 21 | 60% |

| 16 | Tripura | 48 | 59 | 24% |

| 17 | Meghalaya | 108 | 123 | 14% |

| 18 | Assam | 743 | 991 | 33% |

| 19 | West Bengal | 3,230 | 3,748 | 16% |

| 20 | Jharkhand | 1,995 | 1,943 | -3% |

| 21 | Odisha | 2,347 | 2,383 | 2% |

| 22 | Chhattisgarh | 1,852 | 2,136 | 15% |

| 23 | Madhya Pradesh | 2,094 | 2,434 | 16% |

| 24 | Gujrat | 5,619 | 6,621 | 18% |

| 25 | Daman and Diu | 77 | 94 | 22% |

| 26 | Dadra and Nagar Haveli | 129 | 154 | 20% |

| 27 | Maharashtra | 13,524 | 16,530 | 22% |

| 29 | Karnataka | 6,209 | 6,886 | 11% |

| 30 | Goa | 342 | 363 | 6% |

| 31 | Lakshadweep | 4 | 1 | -78% |

| 32 | Kerala | 1,416 | 1,651 | 17% |

| 33 | Tamil Nadu | 5,415 | 6,422 | 19% |

| 34 | Puducherry | 152 | 165 | 9% |

| 35 | Andaman and Nicobar Island | 22 | 30 | 36% |

| 36 | Telangana | 3,014 | 3,420 | 13% |

| 37 | Andhra Pradesh | 2,049 | 2,265 | 11% |

| Grand Total | 69,983 | 80,849 | 16% |