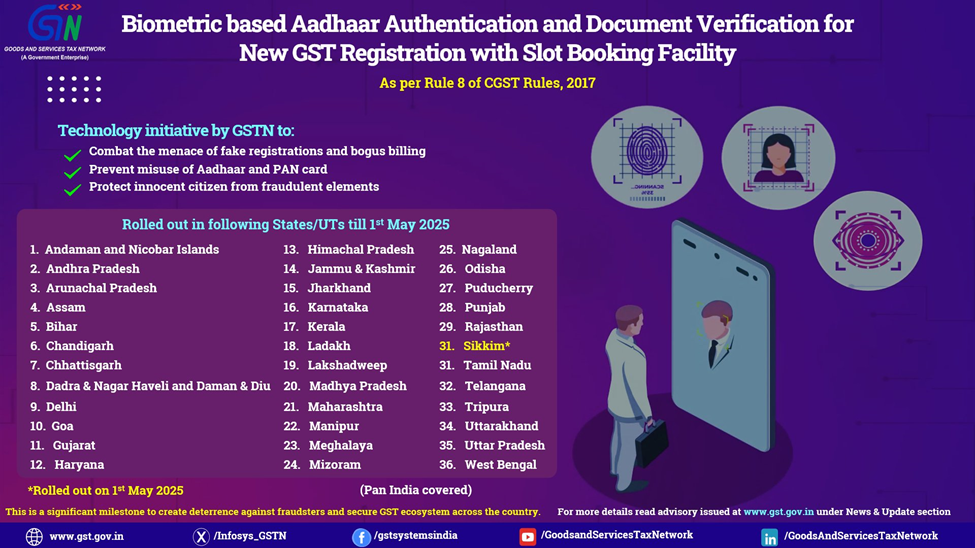

GSTN Enables Biometric-based Aadhaar Authentication & Document Verification with Slot Booking Across India

Sikkim is the latest entrant to a revised list of 36 States and Union Territories that support the function

The Goods and Services Tax Network (GSTN) has now enabled Biometric-based Aadhaar Authentication and Document Verification with Slot Booking for new GST registrations across all States and Union Territories, following the system’s rollout in Sikkim on May 1, 2025. This marks the completion of nationwide coverage under the mechanism, which has been implemented in line with Rule 8 of the CGST Rules, 2017.

As part of the process, GSTN uses data analysis and risk parameters to identify applicants who are required to undergo biometric Aadhaar authentication and in-person verification of documents submitted during the GST registration process.

Phase-3 of reporting of HSN codes in Table 12 of GSTR-1 & 1A from May 2025 Onwards: GSTN issues Advisory Read More

Upon submission of Form GST REG-01, applicants receive an intimation email which contains either:

- A link for OTP-based Aadhaar authentication, or

- A link for booking an appointment at a designated GST Suvidha Kendra (GSK) for biometric authentication and document verification, along with details of the GSK and jurisdiction.

Recent GST Rulings You Can’t Ignore! Are you updated? Click here

Applicants who receive the slot booking link must use it to select a suitable date and time for visiting the GSK. Once booked, they receive an appointment confirmation email.

ICAI Releases Updated Handbook on Exempted Supplies under GST Read More

During the GSK visit, the applicant must carry:

- A copy (hard or soft) of the appointment confirmation email

- The jurisdiction details as mentioned in the intimation email

- Original Aadhaar and PAN cards

- Original documents that were uploaded with the application

GST Basics You Can’t Afford to Miss! Get clarity today! Click here

Biometric authentication and verification will be carried out at the GSK for all individuals listed in the application. The applicant must complete this process within the maximum permissible period specified in the email. Upon successful completion, the system will generate an Application Reference Number (ARN).

The slot booking feature for applicants in Sikkim went live on May 1, 2025, making the functionality available pan-India, across all 36 States and Union Territories—including Delhi, Gujarat, Maharashtra, Kerala, Tamil Nadu, West Bengal, and the Union Territories of Ladakh, Lakshadweep, and the Andaman & Nicobar Islands.

GSTN enhances Biometric Authentication: Promoters/Directors Can Now Verify at Any GSK in Their Home State Read More

The working hours and operational days of each GSK are determined by the administrative authorities of the respective states.

This technology initiative by GSTN aims to curb fake registrations, prevent misuse of Aadhaar and PAN, and protect genuine taxpayers from fraud, reinforcing the integrity of India’s GST ecosystem.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates