GSTN enables Changes in table 4 of GSTR-3B related to the claim of ITC on Portal

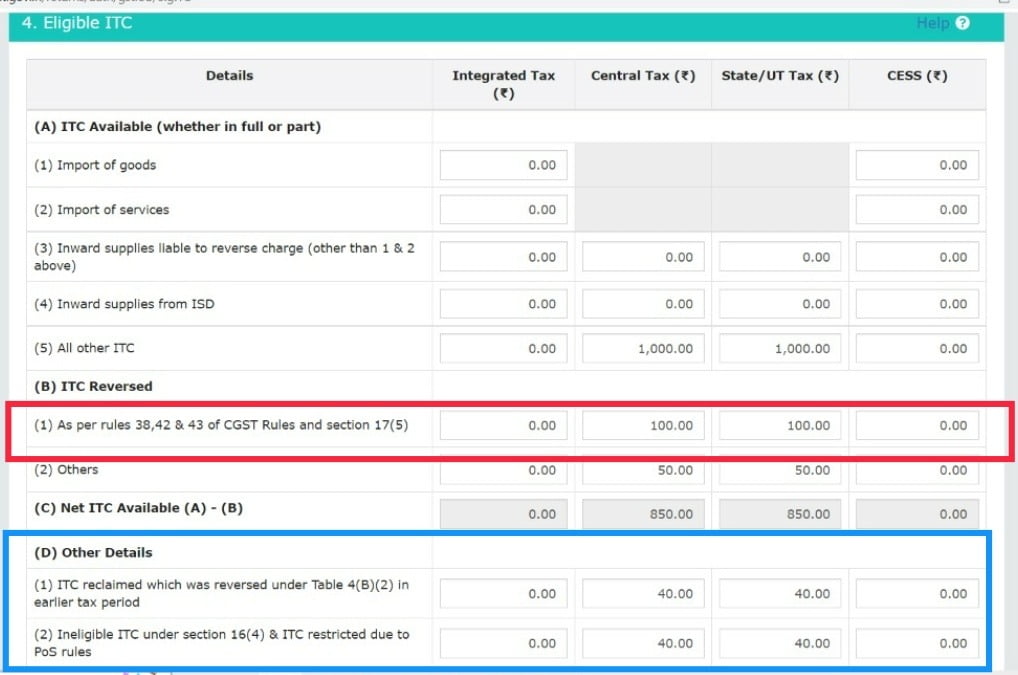

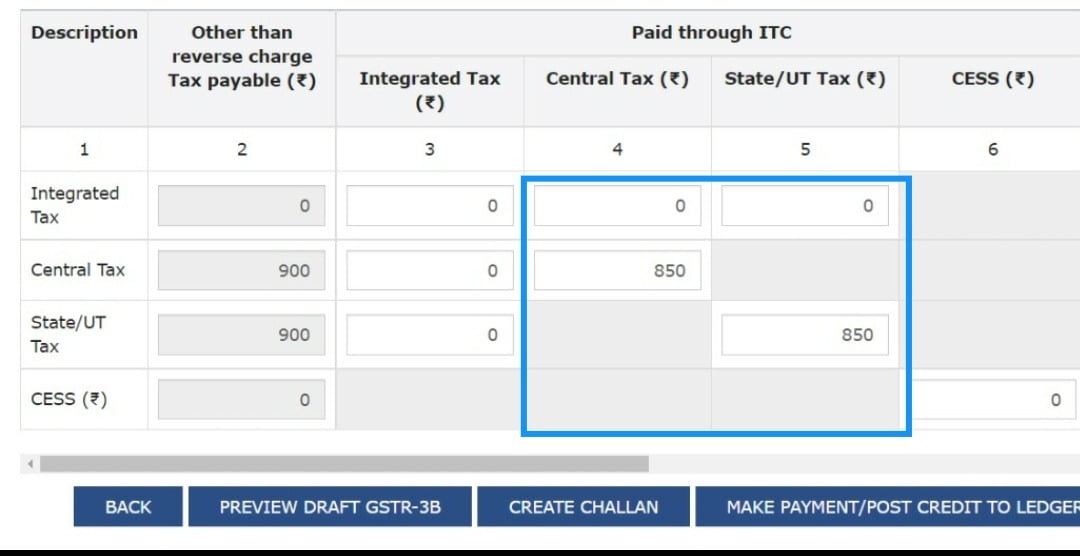

The Goods and Services Tax Network (GSTN) has made changes in Table 4 of GSTR-3B related to the claim of Input Tax credit (ITC) is now live on the GST Portal.

Last month, the portal has enabled Table 3.1.1 in GSTR-3B for reporting supplies under section 9(5) of the Central GST Act, 2017.

In July, the Government introduced a new Table 3.1.1 in GSTR-3B. According to section 9(5) of CGST Act, 2017, an Electronic Commerce Operator (ECO) is required to pay tax on the supply of certain services notified by the government such as Passenger Transport services, Accommodation services, Housekeeping Services & Restaurant Services, if such services are supplied through ECO.

Support our journalism by subscribing to TaxscanAdFree. Follow us on Telegram for quick updates.